10 Retirement Tools You Really Need!

Category: Retirement Planning

November 18, 2017 — Anybody who has spent any time preparing for their retirement quickly realizes that it isn’t that easy. Sure, you can retire one day and just float along, but it probably won’t work out too well. For one thing, you might not realize until too late that you can’t afford to retire. Or you retire somewhere, not knowing that there is actually a much better place for you to retire. And even if you are wealthy, you might retire unhappily, woefully unprepared for how to stay busy and fulfilled.

In this article we have assembled our top 10 retirement tools for your consideration. They are tools we have used and know to be helpful. We have grouped them into categories for your convenience. As always, please share

your thoughts as well as the ones you find useful in the Comments section at the end!

Social Security

1. SocialSecurity.gov. There is so much good and useful information at the Social Security site. You can find out all about what your benefits will be, when you can sign up, what your options are, etc. Of course you can always visit a Social Security office or call them, but start at the website and you will be amazed with what you can find out

Healthcare

2. Medicare.gov. The types of comments we made about Social Security also apply here. Find out the facts about Part A, B, C, and D – and sign up for the option that fits you. Learn your options about Medigap (supplemental) insurance and get started on that too.

Retirement Calculators

There are multiple calculators (almost all free) that will help you predict if your retirement plans are going to pan out. For example, will your asset match up with your spending plans, or will you run out of money before you die – definitely not a good situation! With these calculators you plug in your age, retirement assets, and spending plans – then you get a prediction. One website we’ve seen, Caniretireyet.com, provides a short list and descriptions of their favorite calculators; it includes links to a good one from Fidelity as well as the Vanguard Nest Egg calculator discussed below. You might want to check it out. But here are our two favorite calculators:

3. SocialSecurity’s Retirement Estimator The Retirement Estimator gives estimates based on your actual Social Security earnings record. This is the place to start, as it will tell you with considerable certainty how much your monthly Social Security payment will be. Knowing that, you can go through the rest of the equation, adding in pensions and income from your retirement savings and possible employment, how long you want the money to last, and then deducting what you think your expenses will be.

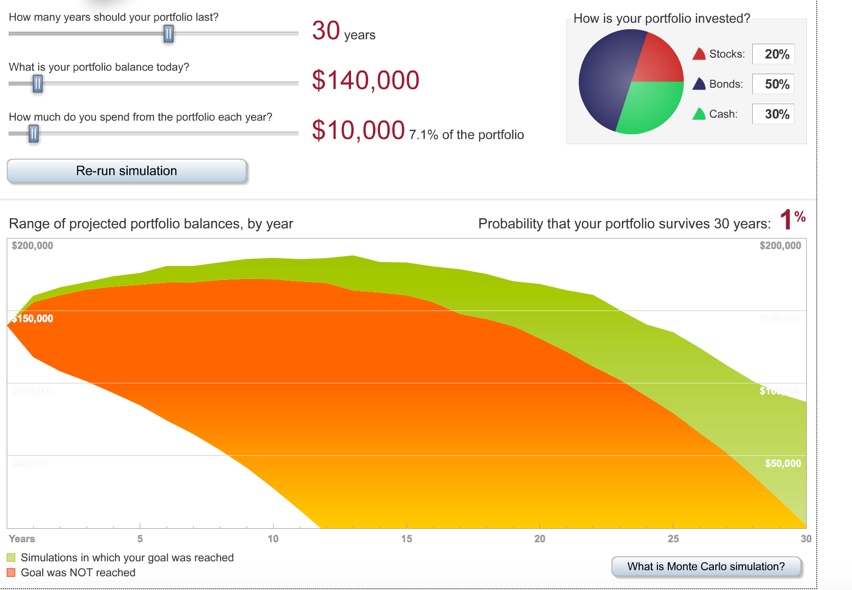

4. We like the Vanguard Nest Egg Calculator , which automatically does all of the calculations we just mentioned above. We used it with a couple of hypothetical assumptions to see what it said. The typical baby boomer couple has saved $135,000 for retirement, a nest egg that would provide $400/month ($4800/year) forever assuming a constant 3% return. But if our example couple needed to take out $10,000/year to maintain their lifestyle and bolster their Social Security income, the Monte Carlo simulations predict what would happen. In this case our hypothetical couple would have a 1% chance of having their money last 30 years. More likely, they would be living on Social Security alone in after 15 or so years.

Where to Live

Here at Topretirements we have two tools to help you figure out where to live, in addition to our main website and our free weekly newsletter.

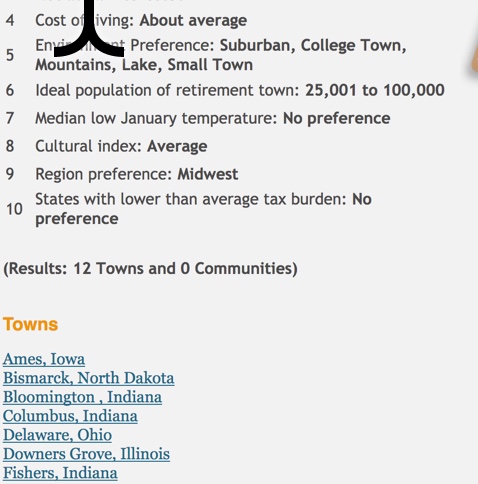

5. The RetirementRanger is the first. This online tool asks you 10 simple questions about where you want to retire, then instantly emails you a list of the towns and communities that fit your profile.

6. Best Cities for Successful Aging from the Milken Institute. As opposed to most “Best of…” lists, this one is based on lots of data and covers multiple categories. There is some great information here – the lists show the 381 best cities for successful aging for both large metros and smaller metros.

7. Kiplingers State by State Guide to Taxes for Retirees. There are a variety of places you can learn about taxes affecting retirees by state (including the State Guides at Topretirements.com). But the Kiplinger tool is unusually good. For example you can click on a state in its map and get a detailed summary of taxes on retirement income, property and purchases, as well as special tax breaks for seniors.

Helpful information about retirement

8. NextAvenue.org

Next Avenue is part of the PBS system, and it “invites readers to consider what is next, what lies just ahead and what will be revealed in their lives by exploring questions big and small”. Their articles, like “5 Social Security Gotchas” are short but practical. Their articles spark a lot of ideas which you later read about at Topretirements. We recommend NextAvenue and offer refer to them, even though they had steadfastedly refuse (so far!) to share any Topretirements features with their audience.

9. AARP.com. A lot of people have a bad feeling about the AARP because of all the products like insurance they try to sell. But in our opinion the AARP does an excellent job of advocating for people of retirement age on issues like taxes, Social Security, and Healthcare. For example on the current tax reform bill in the Senate and House, they one of the few sources that offers factual information on how these bills will affect seniors (not well, is the answer!). See “House Bill Would Increase Taxes for Some Seniors” as an example

Honorable mention

Both the New York Times and the Wall Street Journal have “Retirement” sections that have thought-provoking and interesting articles – often about unusual lifestyles in retirement. You can subscribe to them online are on paper, or you can read them at the library. SquaredAwayBlog is another interesting resource.

One other tool from Topretirements is our “Baby Boomers Guide” a short eBook with checklists and quizzes that start your thinking process on all the aspects of retirement you need to consider.

What to Do in Retirement

10. RetiredBrains.com is a great resource for finding volunteer gigs. But don’t forget all the self-inventory tools that can help you find out what kinds of things you actually want to do in retirement. Our Blog section on “Work and Volunteering” can give you some great ideas you might not have thought of.

Comments? Please share your thoughts in the Comments section below. What tools have you used that you recommend we add to this list.

Comments on "10 Retirement Tools You Really Need!"

Sandie says:

Have never been able to get into the retirement ranger. The password username never works and is a nuisance. Either make it work, or stop touting the thing.

Admin Comment: Thanks for bringing this up Sandie. The first time you take the Ranger you have to create a username and password to take the quiz. Upon completing the quiz you need to enter a valid email so we can send you the results. In your case it looks like you registered some time ago but our system never received a confirmation back from you that you really wanted to register (we do this so to avoid people being spammed). Just now we confirmed this for you, so you should be all set now.

Please, if you have trouble on this site send us an email and we will try to help you out! If you forgot your username or password you can go the login page and use the "Need help with your password". It will send your username or password to the email you signed up with (you can also change those). Please don't create multiple logins, that definitely will cause a problem with your account. The login system does work, but you do have to activate your registration and provide us with a valid email.

Rich says:

I have used Retirement Ranger several times over a number of years as my thoughts on retirement have developed and matured. Specific that have influenced/changed my perspective have been the more than 30,000 miles of travel and visits by care throughout the US and effects of aging -- especially during our 60s! (We are now 69 and have been retired for 14 years.) Retirement Ranger has always worked and has provided us with good information. Best advice? Follow the instructions and respond as suggested above by Admin.

George Corrigan says:

Not listed is the calculator/tool from Fidelity. It's the one I find the most relevant to my particular set of circumstances:

None of these tools or tidbits of advice apply to Military Retirees -- or anyone with defined benefit pension income over and above Social Security.. So, save for the aforementioned Fidelity calculator, we're pretty much left to out own devices vis a vis exactly what we need for retirement.

Long story short -- the results of the Fidelity tool indicate I/we are in fairly good shape; most of the other "advice" indicates were seven figures short -- of something.

JCarol says:

US News & World Report also has an excellent retirement section - and it's free!

https://money.usnews.com/money/retirement

Rich says:

George, Unfortunately I was not able to find a specific calculator/tool on the Fidelity site that appears to meet your description. Can you please provide more specific direction or a url? After 14 years of retirement, I continue to look for resources. Thanks.

In general, I would ask the same of everyone who suggests a "tool" or "calculator" for retirement at any website. Many of these tools are NOT immediately obvious at the providers' websites and may require extensive searching to locate.

As for the simple Vanguard Nest Egg calculate referenced in this article, while it does not require the detail needed to truly plan your retirement, it is a decent "quick reference". Many folks may be put off by the extensive information required by some tools, but as George identified, in planning that will affect your life 10, 20, or even 30 years down the road, the detail can be very important. While I agree with George that the Nest Egg tool is not complete enough to use as a basis for retirement decisions, it can provide some early insight if you are just starting retirement planning. (In our case, the Nest Egg is far too optimistic when compared to other more advanced tools.)

Personally, I have not only taken the time to complete many of the online tools available, but I have also developed my own detailed spreadsheet which reflects our specific situation in regard to income, savings and expenses. My results correlate extremely highly with the best of the online retirement planning tools, but because it is "custom fit", it provides us with a great deal more detail and personal insight than any of the online tools. If you have good spreadsheet skills, I strongly recommend developing your own retirement management tool. Keep in mind that you must include all the detail of your assets and your expenses on a continuing basis to ensure accurate results. This is not a one time thing -- I revisit my tool "planning" input and calculations at least once a year. It is one of my most important retirement "pastimes".

Rich says:

JCarol PS: I wanted to add my thanks. After exercising the few options on the US News retirement calculator: https://money.usnews.com/money/personal-finance/features/calculator , I found it to be right on the money. A much better "quick" test of retirement readiness than any others I've seen.

Do keep in mind, that tools which require more from YOU as input also will provide more to YOU in guiding your retirement planning.

Admin says:

Rich, Here is the link to the Fidelity Retirement Income Planner, hopefully it is the one that George mentioned. To use it you either have to login to your Fidelity account or as a guest. The links to it and many more were included above in the article under the link to Caniretireyet.com

Kate says:

Rich - Thanks for that US News calculator. I found it matched up exactly with my calculations. I'll be giving notice of retirement in January at 65. Whooopppppeeeeeee. Hurray!!!!! Confetti, balloons & streamers. It's been a long 45 years. I just wish my spouse was alive to enter retirement with me.

Now I just have to stay within a $60K annual budget (home paid for), stay in a lower-cost-of-living state, and not live longer than forecasted. I gave myself into early 90s. I figure gruel and a blanket won't cost much after that.

Louise says:

Here is a great calculator to figure Required Minimum Distributions (RMD) for when you have to start drawing from IRA's at age 70 1/2. https://www.schwab.com/public/schwab/investing/retirement_and_planning/understanding_iras/ira_calculators/rmd

JCarol says:

Glad you found the US News link helpful, Rich.

My biggest problem with calculators is that they don't easily accommodate retirement income levels that are planned to vary from year to year, those variances being due to complicated SS filings, modest consulting incomes, heavier expenses in early retirement for travel, or other short-term changes.

I now figure those varying-income years before entering info into the calculators, reducing our nest egg by what we expect to pull from savings, and start the calculator as if we're retiring when we hit our final SS and (zero) outside income levels.

Congratulations, Kate! I hope retirement is all you want it to be.

Louise says:

Kate, I did some rough calculations too. I just found that RMD calculator I posted for required withdrawals at 70 1/2. You will find that if you put in a 6% return rate your money will still grow till around age 82 then start dropping slowly. Warren Buffet claims that historically the return rate is 6-7% a year. When I used the calculator my first withdrawal at age 70 1/2 was around 3.65%. The account balance will still gain each year for about 10 1/2 years but each year the RMD is progressively larger. By age 84 the payout is around double from the first payout.. At that point my principle has doubled and the payout rate is approx. 6.50%. Try the calculator!

We are going to do some withdrawals before 70 1/2 and will start when I am 65 1/2 and Hub is almost 67. The calculator predicts withdrawals till age 115 so I guess if we start a few years early we should be okay! I have to wait till I am off of Obamacare to avoid going off the income cliff for the subsidy.

Congratulations on your retirement!

https://www.thesimpledollar.com/where-does-7-come-from-when-it-comes-to-long-term-stock-returns/

Peder says:

Drifting off topic a bit, but if the tax reform/cut/whatever gets through and they raise the 25% bracket all the way to $200K, I'm seriously going to consider converting my IRA to a Roth before I need to make RMDs. Would be nice not to need to waste my brainpower managing their cut anymore!

Editor Comment. Great question. It prompted Louise to suggest an article on this, so please, if people have Comments about how tax reform might affect retirement including issues like Roth conversions, please make them on this article: https://www.topretirements.com/blog/uncategorized/how-will-tax-reform-affect-your-retirement.html/

Rich says:

JCarol, I agree that most of the retirement tools don't allow for irregular (but somewhat predictable) income or expenses. That is one advantage to relying on a custom spreadsheet. I allow the odd expense (such as replacement for major appliances or the purchase of a new car) to be identified for any appropriate year. I also allow for including unexpected expense as it becomes known as well as having the ability to "what if" major variables (such as an unpredictable significant long-term change in inflation or an unexpected reduction in anticipated market performance). As you noted, most tools don't allow for such irregularities. Many years ago, I did see a calculator that provided for detailed inclusion of all expenses and several "odd" options, but unfortunately I have forgotten its origin. As you might expect, it was quite complicated -- sort of like my own calculator.

My largest concern for all calculators is that while they will do a complex analysis of most all potential market conditions (resulting in a percent chance of assets lasting for set periods), there are still huge potential impacts buried or hidden in those calculations. My preference is to see what will occur within my lifetime if specific incidents occur and what I might be able to do to manage through that. An example would be an oft predicted market "plateau" which could affect the remainder of our lifetimes. My wife recently asked me what our situation would be in the event of zero inflation and zero market gain for the remainder of our lives. We could see not only those answers, but also how we might adjust our expenses (and therefore our lifestyle). These are unknowns that I would prefer to see in a modern retirement calculator.

BTW, describing this makes it seem rather obsessive, but actually it is just an interesting and productive "hobby" to go along with my woodworking, home theater and grilling/smoking activities. My spreadsheet has been developed, corrected and refined for the past 15 years -- since my original "sudden" decision to retire three years earlier than planned and therefore retiring "by the skin of my teeth". I've been observing the markets, reading retirement resources (such as TopRetirements) and massaging/correcting the spreadsheet calculations since then with at least yearly adjustments. I've kept archives of each of the past years' results. From the beginning, we have tracked all expenses and we run budget vs. expense comparisons 2 or 3 times each year. The sheet has moved from a "planning" tool (including appropriate incorporation of savings, IRAs, 401Ks, income, SocSec and pension) to more of a management tool. The latest significant adjustment was to include RMD since that begins for both of us next year. Aside from developing the formulas (the major early effort) and other spreadsheet functions, trying to keep up with the impacts of medical insurance, Medicare, and political meddling have been the most challenging aspects. To assist with managing and understanding our retirement outlook, over time I included a self-updating graph of our future outlook, and automated variable manipulation (i.e. inflation rate) which allows us to dynamically see the impact of any changes. When started, the outlook was for 40 years -- now, approaching 70, I'm satisfied with looking out for 30 years. I think all of these things belong in any "modern" retirement tool.

We've been retired long enough to realize that planning and management are fine and good, but other major impacts are also possible. Consequently, I copied this "tool" to provide options which cover 1) my wife going on alone in the event of my death, 2) selling our house and moving into a rental situation and, most recently, 3) looking at waiting to sell for 10 years when we reach 80. All these (even aside from the actual event) are true "impacts", but though the outlook changes, we can see that it would not be catastrophic (and we learned the actual anticipated best time to sell -- assuming we ever do...). So maybe I am a little obsessive -- but it still takes only about 1 or 2 weeks of time each year -- nice hobby. :<)

Admin says:

Note: We moved a group of comments that had to with retirement budgeting to a post where they fit better:

https://www.topretirements.com/blog/financial/living-in-retirement-on-a-tight-budget-ideas-from-members.html/#comment-307195

Barbara says:

Does anyone know what ever happened to that excellent site on choosing a place to live: findyourspot.com

It had the most detailed set of questions and wasn't just for retirement. It's been down for several years.

I really miss it.

MikeL says:

There are a lot of great tools out that for Retirement planning, but I have found 2 to be unbiased and very helpful:

www.newretirement.com - A good balanced tool to input ALL of your assets and expenses to produce a report of how long your retirement savings might last. Allows for 'What If' scenario changes and modeling your retirement income in different locations by changing the zipcode.

www.smartasset.com/retirement - a more rounded financial planning site, that also provides retirement planning calculators and location Cost of Living / Taxes calculators.

I like both of these sites because neither appears to be trying to sell me any services.

Linda says:

We did lots and lots of research and calculations on our own before our retirement 2 years ago. We created an extensive spreadsheet that included our monthly fixed expenses, lifestyle/hobby/recreation costs, travel, and an additional allotment for the unexpected things that always come up. We sold the big house and purchased a smaller one-story home in cash. We also have zero debt and paid for vehicles.

Counter to what most people do, we moved to an expensive state that we adored for a variety of reasons. We did this after hiring an accountant within that state to calculate exactly what our new tax burden would be before we made the move. We also calculated, on our own, the day to day cost differences and determined that they were doable given the fact that we would not need to snowbird or travel far for the type of recreation that we love.

So far, we are living exactly the way we did before retirement.

But - I can't say enough about the advantage of having a long-term relationship with a reliable, talented financial planner who has guided us through our earning/peak investment years, our retirement preparation, and onward to help us grow our nest egg regardless of market conditions. Both my husband and I were fairly savvy about finances but there came a point when our portfolio needed a professional hand. It's true, you have to be willing to pay them a fee but, in our case, it's been well worth it.

Mark says:

Useful list. A couple suggestions on sites I find very helpful.

1. To “George” above regarding “Millitary Retirees.” Go to Doug Norman’s site; one of the best available for military related financial & retirement info. https://af5.554.godaddywp.com

2. Try E-R.org; the best financial & retirement site on the web IMO. Lots of tools & knowledge there.

3. Try Bogleheads; also a tremendous source for financial & retirement info.

Cheers,

Mark

Alan E says:

All these retirement financial calculating web sites are fine and great. But, keep in mind these sites that perform a little bit of computerized mathematical convenience for you are collecting information to the keys of your kingdom.

Think wisely about what you are relinquishing. With some thought and minimal effort, you can privately create your own scenarios and formulas on a simple spreadsheet. After all, we are the generation of "Big Brother and the Holding Company".

LS says:

Mark: E-R.org is for sale and doesn't have anything on it currently except some links to other sites mostly dealing with medical issues.

Rich says:

Alan E, You make a very good point. While somewhat off-topic, it is still very relevant to this "tools" discussion.

While better tools (allowing input of your detailed financial situation) can be very helpful, does anyone really believe that the groups that can hack Yahoo, Experian, Uber, and many others are not capable of hacking TopRetirements or any of these other "retirement" sites that hold ALL of your financial info (keys to the kingdom)? With simply your hacked id and pw, they could have access to your full financial life. Once having identified potential "rich" victims, they could begin selectively attacking institutions relevant to you and others.

We tend to think of our banks and financial institutions as "safe". But how many also expected that the Pentagon and other federal institutions were "safe"?

We live in a world where someone is always trying to take advantage of any weaknesses -- including cyber weaknesses. As individuals there is little we can do other than the standard strong pw and "keeping tabs"-type actions. Those cautions and a big dose of suspicion/paranoia/awareness are our best safeguards.

Editor comment: Rich, you raise some good points. Too many of us have seen all of our confidential data sent across the Internet because of the evil people that roam there, as well as the careless behavior of many of the custodians. Before you give any confidential information to any site be aware that the possibility exists it will be stolen. Never use the same password and username for more than 1 site. No site is totally safe from hackers. For the record, Topretirements does not collect or keep any type of financial info.

Dave says:

Missed the best planning tool out there - The Complete Retirement Planner. It does cost $49, but worth every penny because it accounts for far more than any other tool. Gives you a year by year plan, not just a useless number or probability %. Check out the web site and it explains all that it does. At least worth a read to see what needs to be considered. Www.completeretirementplanner.com

Good luck to all!

Louise says:

Dave that planner sounds awesome! I visited the website and looks like a very good tool. My question is let's say you want to compare taxes and other costs in the state you live in but want to know what reduced cost of living would be in another state. Would this planner be able to do those calculations too? I live in CT which has a very high cost of living and would be interested to compare costs of living in GA and AZ.

Mark says:

To LS, et al regarding E-R.org. It is current & active, managed by ‘Social Knowledge’, and has 30,000+ members, 70,000+ threads & 1.6M+ posts. The link is below.

http://www.early-retirement.org/forums/