File For Social Security at 62 or 70: Who Wins?

Category: Social Security

December 18, 2024 — The subject of when to take Social Security is one of the most hotly debated retirement topics. Although the system was designed for both decisions to be equal, there are plenty of proponents for each approach.

Case Study – High Earners

Let’s explore the following case. Two people aged 76 made the maximum contribution to Social Security during their 35 year working careers. One files for benefits at the first opportunity (62), the other waits to get the max benefit at age 70 We wanted to find out who comes out ahead, and when. So we asked AI to do the calculations for us. The results came back instantly, and judging from the sources they used, they look accurate. Here is what we found:

Total Benefits Received

The person who claimed at 62 started receiving benefits 14 years ago, while the other began 6 years ago:

- Claimed at 62: $2,800/month × 12 months × 14 years = $470,400.

- Claimed at 70: $4,555/month × 12 months × 6 years = $328,000.

Comparison

- Monthly benefit now: $2,800 (62) vs. $4,555 (70).

- Total received to date: $470,400 (62) vs. $328,000 (70).

Key Observations

- The early claimant has received more total money to date due to the longer payment period, but their monthly benefit is much lower.

- The later claimant benefits from higher monthly payments, which may amount to more over if they live long enough.

Deeper Dive – Break-Even Points

Let’s take a deeper dive into life expectancy break-even points.

The life expectancy break-even point is the age at which cumulative benefits for the person who claimed Social Security early (age 62) catches with the one who delayed to the maximum age of 70.

Key Assumptions

- Monthly Benefits:

- Claimed at 62: $2,800

- Claimed at 70: $4,555

- Time Receiving Benefits:

- 62 claimant has been receiving benefits for 14 years.

- 70 claimant has been receiving benefits for 6 years.

- Difference in Cumulative Totals:

- At the current age of 76:

- 62 claimant has received $470,400.

- 70 claimant has received $328,000.

- Difference: $470,400 – $328,000 = $142,400 advantage for the 62 claimant.

- At the current age of 76:

- Annual Difference in Benefits:

- $4,555 – $2,800 = $1,755/month, or $21,060/year.

Break-Even Calculation

To determine the break-even age:

- AI used a very complicated formula (we won’t show it here) to come up with 6.76 years for when the late claimer to break even.

- Add this to the current age of 76: Age 83.

2 Lower Earning Workers

Here’s the same analysis for two workers who made the minimum Social Security contributions over their 35-year careers, assuming the same conditions as before:

Assumptions:

- Minimum Wage Contributions:

- The workers earned at or near the federal minimum wage over their 35-year careers, resulting in Social Security benefits at the lower end of the spectrum.

- For simplicity, we estimate their monthly benefit at Full Retirement Age (67) to be approximately $1,000/month, based on Social Security Administration (SSA) data for low-wage earners.

- Claiming Ages:

- Worker 1: Claimed benefits early at age 62, resulting in a 30% reduction in monthly benefits (~$700/month).

- Worker 2: Delayed benefits until age 70, resulting in a 24% increase in monthly benefits (~$1,240/month).

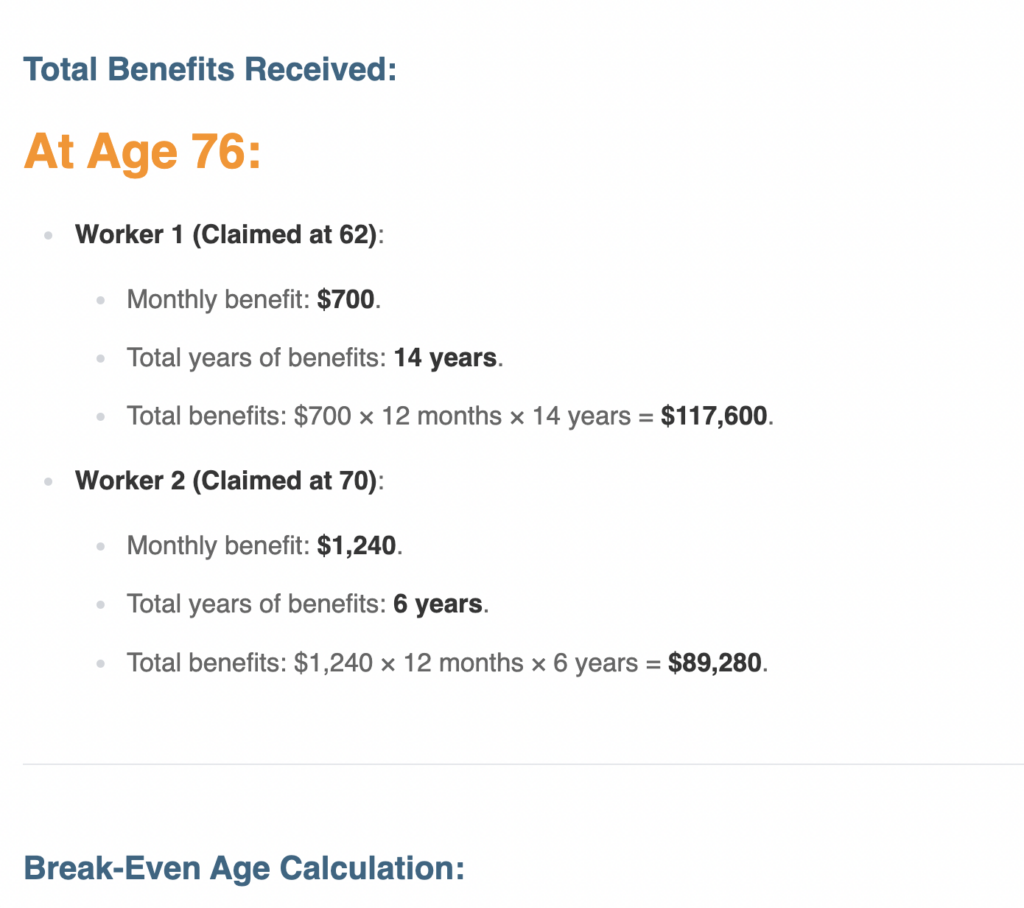

- Difference in Cumulative Benefits at age 76:

- Worker 1 has received $117,600.

- Worker 2 has received $89,280.

- Difference: $117,600 – $89,280 = $28,320.

- Annual Difference in Benefits:

- $1,240 – $700 = $540/month, or $6,480/year.

- Break-Even Age:

- Divide the difference in cumulative benefits by the annual difference and AI comes up with 4.37 years.

- Add this to the current age (76): 76+4.37? Age 80.

Results:

- At Age 80, Worker 2 (who delayed claiming) surpasses Worker 1 (who claimed early) in cumulative benefits.

- Beyond 80, Worker 2’s higher monthly payments continue to compound their financial advantage.

Overall Observations – Claiming Early vs. Delaying

- Claiming early benefits is better if you have shorter life expectancy

- Delaying benefits is advantageous for those with longer life expectancy or other income sources during their 60s.

- Note that lower earning individuals have an earlier break-even point than higher earners (80 vs. 83)

Additional Considerations

- Longevity: If life expectancy is below 83, claiming earlier might be advantageous. For those with a longer life expectancy, delaying Social Security maximizes lifetime benefits.

- Immediate financial needs. If you don’t have any other source of funds, claiming early might be advantageous.

- Cost of Living Adjustments (COLAs): Actual break-even points might vary depending on annual COLA increases, as higher benefits for the 70-claimer compound more significantly over time.

- Spouse Life Expectancy: A surviving lower earning spouse receives the higher earner’s benefit, so any longevity equations should factor this in. If the lower earner is younger, that could be a big consideration.

How These Calculations Were Made

The estimated maximum Social Security monthly benefit for our 76 year old in 2024 is:

Approximately $4,555 for those who claimed at 70 (24% increase from FRA).

$3,822 for those who claim at full retirement age (67).

Sources Used in These Calculations

The calculations for Social Security benefits were based on the following sources and general assumptions:

- Social Security Administration (SSA) Publications:

- The SSA provides specific details about benefit amounts for those who earn maximum or minimum contributions. These include adjustments for claiming early or delaying benefits:

- Benefits at 62 are reduced by up to 30% compared to Full Retirement Age (FRA, usually 67 for most workers born after 1960).

- Delaying until 70 increases benefits by 8% per year after FRA, up to 24%.

- SSA Benefit Formula and Factors

- The SSA provides specific details about benefit amounts for those who earn maximum or minimum contributions. These include adjustments for claiming early or delaying benefits:

- 2024 Social Security Maximum Benefit Data:

- The maximum monthly benefit for high earners at FRA in 2024 is $3,822. This value informed the benefits for those who made maximum contributions.

- Minimum Contribution Estimates:

- Workers with minimum contributions are estimated to receive about $1,000/month at FRA, based on SSA data for low earners. This informed the calculations for low-income scenarios.

- Social Security Life Expectancy Data:

- The average life expectancy for retirees is used to estimate break-even points. For example, SSA estimates that a retiree at 67 typically lives to their mid-80s:

- Cost-of-Living Adjustments (COLAs):

- While COLAs can influence total benefits, the calculations assume static 2024 benefit values for simplicity.

For precise and personalized benefit estimates, SSA’s Retirement Estimator or a Social Security benefits calculator can be used.

Comments on "File For Social Security at 62 or 70: Who Wins?"

Mike says:

Amazed at the quality of analysis! Great idea to use AI to analyze.

PE says:

the "Life Expectancy Tables" link does not work

Steve says:

I agree but with one (maybe two?) caveats, COLAs & Taxes are not figured into the break even point. Case in point: I turned 62 in 2017 and started receiving benefits, my initial benefit was $2,037/mo. After 10 months I decided to withdraw and paid back all benefits received. Fast forward to 2025, my projected benefit at 70 will be $4,693/mo! I calculated the COLA effect on my early (62) benefit and it would be $2,682/mo. Then I fast forward to see the break even date WITH COLAs and it’s between 78 & 79. I used 2.5% COLA going forward and actual going back.

Taxes do have an affect on break even too, SS benefit is tax favored- at most 85% of your benefit is taxed, however if that is your only source of income it would be taxed at 0%, which will be my tax rate since I converted my entire IRA to Roth over the past 10 years.

Vicki williams says:

I saw an article awhile ago about taking SS at 62 then stopping around 67, then starting again at 70 when benefits would increase greatly. Is this possible?

Rufus says:

In my case I started receiving benefits at age 62. I did it because my job was very physical and I wanted to go into retirement reasonably healthy in terms of joint damage. I was self employed. I continued working at my job part time to supplement my S.S. without going above my earning limits so as not to be penalized. All that to say there are multiple options. The analysis in this article was very well done however I was definitely taken aback at the idea of retiring after working only 35 yrs. That sure wasn't my world. For me, 48 yrs. I am now 71 and I have zero regrets about taking benefits at 62.

JD says:

Breakeven calculations are worthless. The only way to know when the "optimum" time (financially) to start taking Social Security is if you know the exact day you are going to die and unless you are planning your own suicide you don't know that. After analyzing and pondering this question for years I came to the conclusion that the only valid answer to "When should I take Social Security?' is "When I need it."

Admin says:

Thanks PE, we have corrected that link, and also one that goes to how Social Security calculates benefits. Good catch, and thanks for letting us know!

JCarol says:

When we made the decision to delay the larger of our two benefits, the breakeven point was 78.8 (as it still is).

We were born in 1952 and a loophole that we took advantage of has since closed: I filed for SS at 65. When he turned 66, my husband filed for 50% spousal benefits, so our personal breakeven point will come earlier than 78.8.

Even without that loophole we'd have delayed filing benefits against his earnings until 70. Our parents all lived into their 90s, as did nearly all of our grandparents and many of our great-grandparents. In the likely case that one of us predeceases the other, DH's benefits delay and resulting larger check will undoubtedly come in handy.

Note: SS breakeven points are based on male actuarial tables. (Men who make it to 62 can expect to survive to 78.9 years old. Women at 62 are expected to make it to 84.) Breakeven points for filing anywhere between 62 and 70 converge at 78.8 years. After that, it's beneficial to have delayed benefits. I'm rather mystified about the above analysis being based on reaching 74 instead of 78 or beyond.

https://www.socialsecurityintelligence.com/calculators/social-security-break-even-calculator/

https://www.ssa.gov/oact/STATS/table4c6.html

Admin says:

One thing that makes some people decide to collect early is the reality of SS running out of Trust Funds in the early 2030's. Assuming you will only collect about 80% of promised benefits at that time, should that help decide which option to take?