Is Travel Insurance Worth It?

Category: Travel

November 6, 2024 — Here’s a situation you’ve probably found yourself in more than once. You’ve just spent a lot of money on a dream trip, and along the way, the company urges you to buy travel insurance. You think: If I get sick, miss my plane, or face some other conflict, will I lose everything? On the other hand, do you really want to pay hundreds of dollars for a travel insurance policy you’ll probably never need? It’s a tough call: risk versus reward.

What the Experts Say: Is Travel Insurance Worth It?

A lot depends on your situation. If you’re older or have a complex health condition, those could be good reasons to buy travel insurance. Similarly, if you have family members who might experience an emergency requiring your presence, that’s another reason to consider it. Where you’re going and what you’re planning to do are also big factors. For instance, if you’re embarking on an expensive, distant, or extended trip, it may make sense to buy coverage simply due to the financial investment. If your destination has limited healthcare options, medical evacuation insurance could be invaluable.

On the other hand, you could play the odds. If you think the chances are slim that you’ll need to cancel, why pay for insurance on a low-risk trip? Similarly, if the trip isn’t very costly, it may not seem worth insuring. In fact, your editor believes that self-insurance is the best option for most trips. He figures that if he takes many trips before ever needing insurance, he’ll likely come out ahead in the long run.

What Kind of Travel Insurance Should I Buy?

The basic type of travel insurance is trip cancellation or interruption coverage. If something comes up and you can’t make the trip, this insurance covers you. Most policies cover other risks as well, such as lost luggage, weather issues, etc. Medical insurance is typically included in most plans. This provides coverage for medical care while you’re out of the country (since Medicare doesn’t usually apply overseas). Medical evacuation insurance is also an option; it covers the high cost of being transported back to the U.S. for medical care, which can run into tens of thousands of dollars.

How Much Does Travel Insurance Cost?

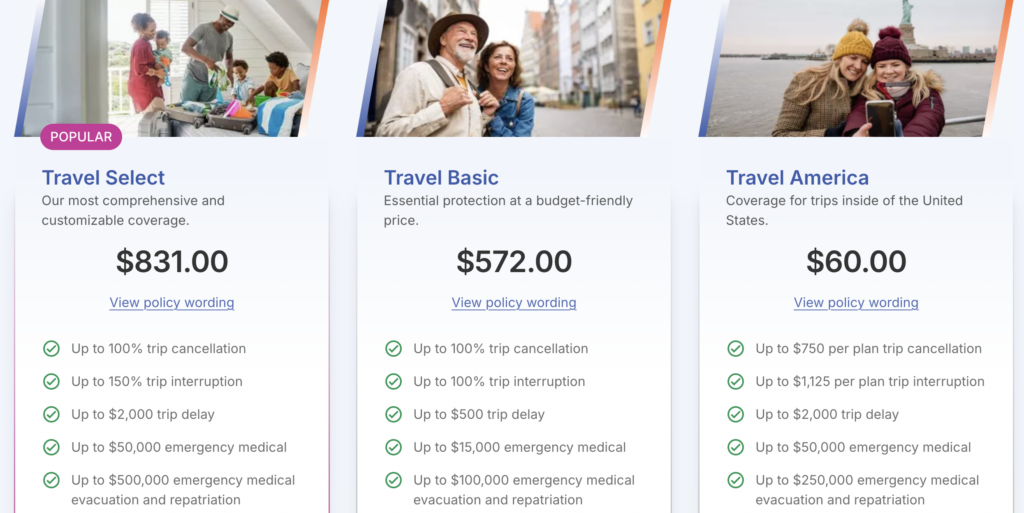

The cost of trip insurance can vary greatly depending on the company you choose, how expensive or exotic your trip is, your age, any pre-existing conditions, and the type and amount of coverage. A very basic policy from Travelex might cost only $60 for trip cancellation (100% of trip cost up to $750) and trip interruption (150% of trip cost up to $1,125). Of course, most trips cost a lot more than these reimbursement levels. But the policy does include coverage for $50,000 of medical insurance, emergency evacuation and repatriation for $250,000, and reimbursement for a variety of other types of issues. More expensive plans will cover 100% of the trip expense, lost baggage, etc. For example, we received a quote for a high-coverage plan priced at $831 for a one-week trip costing $5,000.

Where Can You Buy Trip Insurance?

There are many options to buy trip insurance. Your tour provider, airline, or cruise line will often suggest one or more companies. They may urge you to buy it because, in the event of an issue, it makes life easier for them and you. By searching online, you’ll find many companies eager to provide you with a quote. Travelex is one we have used. Insuremytrip.com is also a great option, as it provides quotes from many different companies for all kinds of plans. Forbes has a comparison chart of various companies’ plans. Before you buy, compare quotes from several companies and carefully compare coverages so you know what you are getting.

Are There Other Trip Insurance Options?

Besides self-insurance, one way to avoid paying for travel insurance is to book your trip with a credit card that provides basic travel insurance. Many credit cards offer this benefit, including the Chase Sapphire Preferred, American Express, and others. Check the fine print or call to verify what might be covered and/or excluded.

Bottom Line

Whether or not to buy trip insurance is a matter of personal preference and circumstances. If you think you’re at high risk of having to cancel a big trip, travel insurance is probably worth it. Before you buy a policy, compare several companies and carefully understand the coverages. Some people just feel better knowing they are covered. Note that sometimes it takes persistence to get a claim settled, so keep good records and don’t give up easily.

For further reading:

How to Choose the Best Travel Insurance

Comments? Do you buy travel insurance? Please share your thoughts and experiences below.

Comments on "Is Travel Insurance Worth It?"

Admin says:

I usually don't buy trip insurance either, unless it is a very expensive trip and I think there is a good chance I might have to cancel. But don't forget you can usually get some kind of credit if you do have to cancel. For example, twice i had to rebook my flight, once from a weather event and once an airline snafu. I booked an alternative flight rather than wait for the airline to sort it out, and eventually got reimbursed, at least for the amount of the original flight. Tour companies and hotels might give you credit for a future trip, depending on how long in advance you have to cancel.

Patricia Reynolds says:

I keep an annual policy with Allianz because I travel overseas a lot. I do a lot of cruises and medical evacuation can cost over 50000.

Steve T says:

I traveled quite a bit on business before retiring and still travel in retirement. I've never found it necessary or even advisable to buy travel insurance and I've never had an issue nor has there been a situation where I wished I had it. Some may need it for a specific reason but as for me the answer is no, it's not worth it.

Kay Lynn says:

I think it's irresponsible not to mention the risk of unexpected medical issues while traveling. Many foreign hospitals require payment before they'll treat you and then there may be the extra cost of an ambulance plane to get home. At a minimum people should buy medical travel policies with good evacuation coverage when leaving the country.

Larry says:

I am considering travel insurance for a domestic trip, but leaning toward “self insuring.” My wife and I will be hosting a family reunion in July on the coast of South Carolina for 22 family members. Only concern is hurricane season and longshot chance we might be required to evacuate during the week. Insurance would not cover payment for hotels for our 20 guests in the event of evacuation. Total cost of rentals is around $25,000 and the one insurance quote I received is $2,800. Risk of a major hurricane on that part of the coast at any given time is less than 2%. Hardly seems worth covering. Anyone have experience with this type of situation? Thanks much.

Staci says:

Friends of ours were scheduled to begin a cruise in August when the wife was suddenly diagnosed with cancer and needed to begin treatment immediately. They were able to get flight credits but unable to be reimbursed for the cost of the cruise, over $12,000. You never know what can occur unexpectedly.

Admin says:

Check out these tips on travel insurance denials.

Admin says:

On the subject of medical insurance for travel, this one is interesting.

https://www.early-retirement.org/threads/is-paying-with-a-credit-card-fidelity-rewards-sufficient-for-travel-insurance.122883/

JoannC says:

I always get travel insurance and pay extra for trip cancellation and trip interruption for any reason - i.e., reasons not covered under the standard policy. I have done this in the past because I had dogs with medical conditions and if something happened to them, I wanted to be able to come home immediately and have it covered. I've only used travel insurance once when I got Covid and had to spend an extra week in a hotel. Hotel, meals, and doctor visits were covered. I've purchased travel insurance ever since a friend slipped and fell off a mountain top while hiking in Switzerland, had to spend a month in a hospital there, and then was medevacked home. It was extremely expensive and travel insurance covered it.

LS says:

I took trips to Panama and to Costa Rica this year with Road Scholar. They require trip protection insurance for which the amount is reasonable. My upcoming trip to Peru for 9 days with them will cost $423 for trip protection. I think it is worth it.

Admin says:

Here is another article on the topic: Is Travel Insurance Worth It?

https://www.themanual.com/travel/is-travel-insurance-worth-it/