Rising Home Prices Offer a Silver Lining for Some Retired Baby Boomers

Category: Retirement Real Estate

June 5, 2018 — Almost half of baby boomers, unfortunately, have not saved enough money for retirement. That means they face a cut in the quality of their lifestyle. But for many fortunate folks who own a valuable home, particularly in a hot real estate market, a potential rescue is at hand. For example, retirees in coastal California in places like San Francisco, San Jose, Los Angeles and San Diego have the option to sell their home, buy or rent a home better suited to a retirement lifestyle elsewhere, and pocket hundreds of thousands of dollars in the process. People with valuable homes who live in New York and its close-in suburbs, as well as other affluent markets, can catch a similar lifeboat. This article will explore where some of the refugees from America’s hottest real estate markets are moving.

According to a recent report on the Trulia Blog, coastal California Metros are the perfect example of real estate good luck. In San Francisco, San Jose, Los Angeles, and San Diego homes on the market averaged $720,000 in March 2017, almost triple the $250,000 reported nationally. New York registered high median listing prices too, nearly $440,000. While these high real estate prices are not good for first time buyers in those markets, they are a potential gold mine for retirees looking for greener pastures.

Finding a better place to retire, and put money aside in the process

Baby boomers exiting pricey real estate markets have many cheaper options. Florida and the Carolinas attract many of them. Arizona, Colorado, Washington, Oregon, and New Mexico are also popular. And the middle of the country offers great bargains. If chosen carefully, someone selling their suburban home in New Jersey, Connecticut, DC, or Massachusetts can easily end up cash positive after buying their new home. We know boomers who have migrated to Delaware, Colorado, the Carolinas, Tennessee and Florida. All seem very happy with their new lifestyle, and their reduced cost of living is a big plus.

Our advice if you own a home and have a budget shortfall

1. Use your home to improve your financial situation. Even if your current home is not particularly valuable, you still can make changes to improve your economic situation. For one, if you live in a house in the suburbs, the sooner you can get rid of it the better. You are paying to heat, maintain, power more square footage than you probably need. You have to drive everywhere for your shopping and other needs – biking and walking are probably not options. While the neighborhood might have been great when you had kids, it is probably not ideal for your life in retirement, where social interaction is often in short supply.

2. Decide what kind of move to make. If you decide to move in retirement then you need to figure out where to move to, and what type of home you want. Because there are so many options, that takes some planning and thinking. For example, do you want to live in a 55+ community, active adult, a city, a small town, a regular neighborhood, etc. Do you want to buy or rent? Fortunately the reviews of towns and 55+ developments on this site can help you with all of that.

3. Decide how much to spend for your new home. After analyzing your finances, do you know how much extra income you need so you can maintain your pre-retirement lifestyle? The answer to that question will help you to decide how much to budget for your new home. If you don’t need much extra, you can spend about what you realized from the sale of your current home. But if the shortfall is big, then you better plan on banking/investing a bigger part of the proceeds to help finance your comfortable retirement.

4. Set a budget for post retirement. It might be exciting to suddenly have a hundred thousand or so in the bank after a sale. But if you spend it all too quickly, you are back in the same situation. Better to consult your financial planner and figure out a safe way to use it.

Where They’re Moving

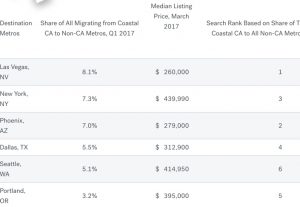

To find out where they are moving, Trulia.com analyzed home searches on its website for people of all ages leaving coastal California metros. Overall, the most popular searches were for large metros like New York, Atlanta and Chicago. The high job-growth centers of Seattle, Denver, Dallas, and Portland (OR) were also popular, probably more for younger people than retirees. Less expensive Sun Belt markets popular with retirees such as Las Vegas, Tucson, and Phoenix also elicited high interest.

The image below from Trulia shows the most popular destinations for California retirees along with their median listing prices.

For further reading

Trulia: Where They Are Moving

7 Out of the Box Ideas for Saving Social Security

Comments? Are you contemplating moving from a market to take advantage of your home equity? Please share your thought process along with what you are looking for in your new home.

For further reading:

Comments on "Rising Home Prices Offer a Silver Lining for Some Retired Baby Boomers"

Mary11 says:

I will be selling the family SanDiego condo and netting a profit of $180000 because of a 500% increase in property value. This should carry me through my retirement years. I'd like to purchase a home but also looking into renting in an active retirement community in the city where you can walk to everything and don't need a car.....even in California you can find a 1 BR apt for about $1300 per month and that includes free WiFi and a full time activity director to keep you busy and entertained. Id like to hear from others who are contemplating renting instead of purchasing a retirement home......

HEF says:

Not everyone can cash in - we recently sold our house in SE Tenn. for much less than the $$ we put into it - but we sold it. Two friends of mine have had their (more expensive) houses on the market since last fall (2017). We had hoped to buy a new place with cash but the shortfall caused us to apply for a mortgage as we bought into a slightly higher priced market. Hopefully the value will continue to rise so we can use the equity to ultimately land in the CCRC we want, so kids won't worry and we won't either. Don't always believe the graphics either - they all say that New England isn't the place to be but we are deliriously happy here!

JCarol says:

With apologies to William Shakespeare:

To cash in or not to cash in, that is the question

Whether 'tis wiser to stay put and suffer

The fate of lower savings and higher utility bills,

Or to move with some profits and take arms against a new sea of troubles

Drew says:

Yeah. All these retirees from high dollar states moving to the southeast are causing our real estate prices to soar in many cities, way beyond what a typical southern income can support. We're being forced out of.our iwn cities and farther out jn many cases. So if you're moving from such areas, please do not contribute to these increases by paying more than what it should cost. Also be aware that if you come from a highly taxed state auch as California or New York, you're not going to have all the free or low cost services to help you if you're handicapped, have transportation or health issues you can't afford to manage on your own income. There may also be shortages of providers in some areas as well.

ARETI11 says:

Drew, that's very true about southern states. For example most of these states don't have extended Obama care and they don't provide an extra SSI check if you are low income. Btw, California for some of us is not a high tax state. We only pay $850 for property taxes and you can defer them if you'd like to. Also income tax rates are much lower than some other states such as Oregon. And if you sell your home and buy again you only pay the same amount of property taxes that you were paying from your previous home. These are important issues .....

Jennifer Lee says:

HEF--where are you located in New England and what type of home do you now own? Is it a single family or a condo?

Laura says:

For those with very valuable homes, would they be better staying and just getting a reverse mortgage? Several of my friends have done that and seem quite happy wit it?

HEF says:

Jennifer - we are now in Maine. We sold our 3500+sf home in SE TN and moved to 1450sf single family home just outside of Portland, Maine. We purchased the home while husband was still working (making it easier to obtain a mortgage) then hoped to pay off the A.R.M. with the sale of our primary. Well, that didn't happen exactly the way we hoped but we put a chunk of the proceeds in an investment account and are paying extra principal each month. When the ARM comes due we can re-finance and possibly pay down some more.

We also used some of those $$ to re-model the tiny, dark & sticky kitchen (we doubled the cabinet space and it looks twice the size) and are planning to extend the living room out for a little extra space. Ultimately this is our nest egg to use to buy into that CCRC we have our eye on - but, not just yet.

Steven Kaufman says:

JCarol,

You are very funny! That’s just hysterical!

Ron F says:

What is CCRC? What does it do?

LisaJ says:

HEF, which CCRC are you interested in? We are looking at CCRC’s.

Admin says:

Good question Ron. CCRC stands for Continuing Care Retirement Community. Another name for same concept is Lifecare. The idea is that you buy in to a community and once there you can normally remain for the rest of your life, with some exceptions. My parents lived in one for the last 10 years of their lives and it worked out great. At first they lived in a spacious 1 bedroom apartment (independent living) and ate 2 meals a day in a great dining room. Indoor pool, loads of activities and outings, gym, etc. At various times they had illnesses and one moved into a smaller unit temporarily (assisted llving) where more care was available. At the end of life one moved into the skilled nursing unit while the other stayed in the original apartment. Though expensive, the idea of never having to move again and to have round the clock care available made everyone's lives better. They were at Cypress Cove in Ft. Myers, FL .

Admin says:

JCarol - Fantastic!

HEF says:

LisaJ - There are actually a LOT of CCRC campuses around here! (There was only 1, very old one, in SE TN). We have yet to tour any but Oceanview - Falmouth ME is at the top of our list. We have heard very good things about Piper Shores - Scarborough ME and Gorham House - Gorham ME. There are a LOT more if you search for Retirement Communities in Maine.

Whichever way we go - the equity in our house will most likely determine where we land. It is our hope to buy in. My father is in an Erikson Community in SE Pennsylvania. It is FANTASTIC but there is nothing in the area that draws us there. My husband's brother & SIL also looked at the Erickson Community in Palm Gardens - Florida and they immediately put themselves on the list. We love New England.