Medicare Advantage Overtakes Medigap Plans

Category: Health and Wellness Issues

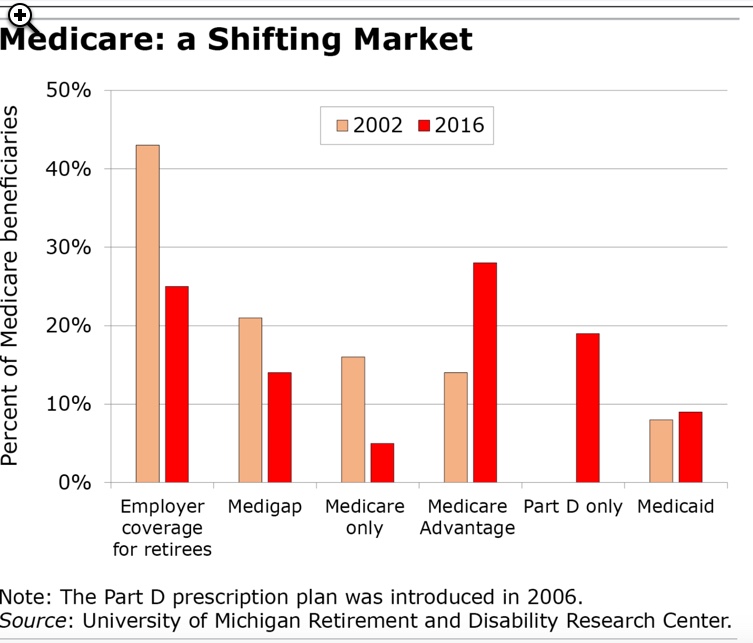

July 7, 2021 — Not so long ago the two most common types of supplemental medical insurance for retirees were employer sponsored plans and Medigap insurance. Medical insurance for retirees is increasingly rare, with very large corporations and governments about the only employers providing it. Medigap plans, which cover additional expenses over and above their Part B (doctors and other medical) coverage insurance, are being eclipsed by the increasing popularity of Medicare Advantage plans (Part C). Run by insurance companies and funded by subsidies from the government, Medicare Advantage has doubled its enrollments in the past decade.

The main reasons for Medicare Advantage’s increased popularity are their low cost and extra coverages. According to kff.org, about 60% of Medicare Advantage enrollees pay no premiums, and another 34% pay less than $100/month. Advantage plans also usually offer a wide number of other coverages not available under Medigap policies. For example, about 3/4 of Advantage plans include vision, dental, fitness, over the counter drugs, and hearing benefits. Nearly all (90%) Advantage plans include prescription drug coverage.

Advantage plans now account for 40% of Medicare beneficiaries in some states, but as low as 1% in other states. The biggest number of Medicare Advantage plans are run by UnitedHealthcare, Humana, or BlueCross BlueShield affiliates. Medicare Advantage plans are far more popular in urban areas than in rural ones, mainly because there are more health care providers and insurers willing to insure there. Coastal and the Great Lakes states tend to have the highest Medicare Advantage enrollment rates, but even within states the enrollment percentages can differ dramatically.

Tradeoffs. Retirees are increasingly choosing Medicare Advantage plans. Although they generally provide much cheaper coverage, Advantage plans do have some disadvantages compared to traditional Medicare. For one, you might not able to choose your own doctor – you have to use one who is part of the insurer’s HMO system, or pay more for a PPO plan. Certain procedures require advance permission. If you stay in the hospital more than 5 days you might end up paying more in copays than a traditional Medicare recipient would. The federal limit on Medicare Advantage in network deductibles and copays is now $7,550 per year, while some Medigap policies have no maximum. Writing at the SquaredAwayBlog, some experts believe Medigap plans give more protection from large medical bills, however. Snowbirds or people who live in two different parts of the country might find themselves out of network with Medicare Advantage plans, and therefore be better off with a Medigap policy.

Bottom line. Choosing between Medicare Advantage and traditional Medicare (Medigap) policies is complex and difficult. You can go to Medicare.gov and compare plans. You can also use an insurance agent who specializes in Medicare to help find the best plan for you. These agents will not generally charge you anything, as they are compensated by the insurance companies.

For further reading (both of these articles have dozens and dozens of Comments):

Comments on "Medicare Advantage Overtakes Medigap Plans"

Admin says:

I am really tempted by the Medicare Advantage plans. Some of my friends have them and get great extra benefits like vision and dental, and they have 0 or very small premiums. The problem for me is that in my summer home in New England I would get great coverage, but in my Florida town for the winter I would be out of network. So it's Medigap for me.

Florence says:

When I was ready to sign up, my doctor advised Medicare. She stated that there were often procedures that the advantage plans would not cover. I know snowbirds would have a problem, but what about those who travel frequently? Am I correct in assuming you’re only covered in your in state network? My husband and I had issues out of state and had no problem with our Medicare and gap policies. Any experience with Medicare Advantage plans while traveling?

Bill says:

Nick,

Have you looked at any of the Medicare Advantage PPO plans, like Humana. It has a large network of providers. We live in Indiana and go south in the winter. There are providers all over the country.

Caroline says:

Please, please, please be careful with Medicare Advantage! The reason that these companies can afford to add all these freebies is that they are stingy with care when something catastrophic happens. I can’t tell you how many stroke, multiple trauma, head injury, and other patients I have seen be denied access to an acute rehabilitation hospital after these catastrophes and instead be put in local nursing homes for much lower level (cheaper) rehabilitation. Every rehabilitation professional advises their family and friends to say “no” to MA’s perks and stick with traditional Medicare.

Tim says:

During the open enrollment period of 2019 I knew I was coming up to a hip replacement very soon. I spent two months researching and trying to determine if regular Medicare or one of the advantage plans available to me would be a better choice. This included seeking the help of a local independent insurance agent and speaking to several advisors who offer counseling services through the local senior center. It was utterly impossible to sort out. I'm a medical professional and understand what's involved, but that didn't help. The system is so labyrinthine and non-transparent. We are supposed to make informed decisions but all we can do in the end is guess. I think that's ridiculous.

In my case I stuck with regular Medicare and it worked out. I made that choice because ultimately Medicare gives you more control even if it provides fewer services. I still have no idea if I paid more or less than I would have with one of MA plans.

One of the downsides to sticking with Medicare is part d. The local plans are awful. GoodRx beats them by a substantial amount every time.

LynnB says:

Another disadvantage to moving to Medicare Advantage is that you cannot return to standard Medicare once you have enrolled in an Advantage program. Check out some of the supplemental programs. Many organizations offer these. Medicare has some pretty hefty copayments than can put a serious dent in your budget so just having Medicare isn't a great idea.

Debra says:

I had a Medicare Advantage plan and switched to regular Medicare.

Clyde says:

Although we often bemoan the challenges of Medicare plan selection, I think we could all agree that the US has this very good health insurance program for nearly all people 65 and over. We have President Johnson (LBJ) and the Congress at the time to thank for Medicare, established in the 1960’s. Also, we’ve all paid into Medicare with the 1/2 percent tax on our wage/salary earnings throughout our lives.

As was stated in the article, medicare.gov provides a wealth of information about all the plans available in local zip codes. And, as also mentioned, insurance agents specializing in Medicare plans are readily available with no charge to clients for their services. They receive a small compensation from the insurance companies and that compensation is required by law to be the same from each company, so there’s no incentive for an independent agent to push one plan over another. In choosing a plan, lots of valuable assistance is available at no cost. We just have to utilize it.

Clyde says:

It should also be noted that the Open Enrollment Period for 2022 Medicare plans begins begins this year on October 15 and runs to December 7.

Staci says:

Debra

Just wondering why you decided to switch?

Thanks

Roberta says:

Everyone,

As others have mentioned, when you are new to Medicare or when you are thinking about making a change during open enrollment PLEASE contact your local SHIP or SHINE organization through your Area Agency on Aging. All the counselors are volunteers, and are background checked and finger printed and they do not share your information with anyone. They do not receive any compensation from anyone. They also know all the good, the bad and the ugly for their area because they get calls every day about issues with different plans such as not enough providers, co-pays too high, rehab facilities that will not accept Advantage plans etc.

Once you have made your choice, you can enroll on line or you can go through an agent. Agents do get a small commission for everyone they enroll for each plan but they also get residual money for every month you stay on an Advantage plan. That could be an incentive to enroll clients in Advantage plans.

As others have mentioned, in most states, if you do not enroll in a supplement plan when you are first eligible for Medicare or during your first year trial right time, you many never be able to purchase a supplement again. If you do pass the medical screening later on, your supplement premium will be more than was originally quoted. These are big choices. Let a counselor go over all your options and select what is best for you. There is no absolute right or wrong way but if you have health conditions it is critical that you make the right choice.

One last thing-everyone should check their drug coverage every fall during open enrollment. Drug coverages change every year. Good luck with your choices.

JoannL says:

I am now confused after reading some of these posts. I will be 65 in a few months and already received my MC card in the mail for Parts A and B. However, my husband is still working (very large company) and we have excellent healthcare coverage, dental and prescription coverage through his employer.

I understand his employer coverage will be considered as my Primary Insurance and then Medicare picks up any left over fees - if that is correct? I realize I can delay paying for the Part B coverage but I don't want risk future penalties when my husband retires. There are certain documents and deadline that must be met which I don't want risk messing up.

Roberta - can you clarify your post in how that would impact my situation? At this time, I do not need to buy more healthcare coverage such as Medicare Gap but I do not want to encounter future penalties for when I do need it. I never heard of SHIP or SHINE organization - no clue what those are.

Thanks for any clarifications as this certainly is complex information with certain penalties if you error.

Off Topic - I am very leery of these govt run offices after some very bad experience with our local Social Security Office. That was in regards to replacing a SS card for my elderly mother age 94 in a nursing home. After signing forms and providing IDs plus letter from Director of Nursing Home who is also her personal physician - they still insisted that I had to hire an elder attorney for a court order. Basically so I should pay a few thousand dollars to a lawyer to get a physician exam to declare her mentally and physically unable to make the SS card request herself. Been there - Done that years ago with my father to the cost of $18K - BEWARE of some elder attorneys.

Debra says:

Staci - I had sinus surgery the year I had Medicare Advantage and ended up paying a significant amount out of pocket. I would not have paid that with regular Medicare.

My takeaway is get reliable information from a SHIP counselor and not rely on intern forums.

LynnB says:

A relative of mine mistakenly enrolled in an Advantage Plan (he thought he was enrolling in a supplemental plan) after getting a misleading sales pitch. As it turned out, he ended up becoming ill and costing that company quite a bit of money and saving himself a good deal. But, even with that plan the hospital that is nearest to his home is not part of his Advantage network, so if they call an ambulance, his care at the hospital where they would take him is not part of the plan.

Staci says:

JoanneL

Different states have different names for volunteer Mediicare Counselors. In my area they are scheduled at our local library. You might want to check a local Senior Center. They should have information about their services.

I would check the Medicare.gov website to find out information about filing. I believe you need to sign up

for a prescription plan, even if you don’t use it, to avoid penalties later. Double check. I could be wrong.

Ron says:

Unless you are on Medicaid STAY AWAY FROM THE ADVANTAGE PLANS!

Many doctors do not accept them and also the co-pays and other charges are much higher

Roberta Parillo says:

JoannL

You need to talk to a SHIP/SHINE counselor ASAP because it sounds like you do not need Part B and there are issues about when you start your Part B. Google the Area Agency on Aging in your state and look for their SHIP or SHINE program (they are both the same) . Ask to have a counselor call you to go over this issue. These are not government programs like SS. They do get grants to run the program but are not allowed to sell anything or provide anything monetary like SS.

Lanell says:

We have been exceedingly happy with our Medicare Advantage plan (Kaiser). Their system offers efficient and inclusive.coverage. My husband has had both knees replaced as well as a complete reverse shoulder replacement, each costing us only the $25 copay. Also included was the physical therapy that came to our home, and post surgery equipment needed - at no charge.

JoeG 2010 says:

The Medicare Advantage retiree plan (UHC--Aetna before) sponsored by my former employer has had low premiums, GREAT copays, low--and then no--deductible, and networks that include every provider we deal with. We couldn't be happier.

Jennifer says:

I used a great company, Boomer Benefits. They are paid by the insurance and never will charge their clients a fee. They have won awards for their work and have many YouTube benefits to assist those with questions. They also assist with any coding errors that may occur once you have coverage.

I, for one, questioned my need for Medicare Part D for prescriptions since I was on no meds at the time, but I found that if I did not sign up when I became available for Medicare, that I could be penalized later on if I suddenly needed medication. Well, two months later I was admitted to the hospital ICU with a virus that caused my heart to go into A-Fib, I had a fever and a severe cough (sound familiar?) which caused me to be prescribed three medications--one is a tier 3 which I still am on to this day as a preventive measure. I am so glad that I was advised to purchase Part D coverage-- an inexpensive policy with United Healthcare AARP.

JoannL says:

SEND for previous message said SPAM - so here is the rest of my message.

We will make more phone calls today to employer HR to get to the 'right' person for employee/spouse information who transition to Medicare while still covered by the employer healthcare coverage. How does this affect Medicare Plan B and D if delayed or signed up for now? I also read there could be problems with the employer drug prescription plan if I took Medicare Plan D now. So I need confirmation of credible coverage for these areas to avoid future problems and penalties.

PS - The Boomer Benefit site was very helpful - never heard of it until mentioned here. Again, Thank you all for your comments!

JoannL says:

Thank you everyone for your feedback. It seems this is far more complicated than I had realized. Yesterday phone calls to MC support site, a Medicare insurance advisor and employer HR dept were okay but just basic facts repeated. Reading the MC site and booklet provides the facts - just lots to read. AARP site has some helpful information too in their forum.

I didn't realize Plan D prescription drug also has penalties as several of you described. I was able to reference the Medicare Drug list and confirmed it does NOT cover my prescription medication that I've been on for 10 years. I can see now why people use the GOODRx site for coupons as that will be my backup when I do apply for Plan D. I refuse to change a medication to accommodate insurance coverage list. That IMO is a medical decision between a patient and their doctor but that is another topic.

Maimi says:

I have not read all of the comments, but I want to give my experience. I was just weeks past my 65th birthday and newly on Medicare(B, And F) when I was diagnosed with a rare cancer. Thank God I had plan F! It has covered everything at the hospital with the specialist I need, unlike my friend who had an Advantage Plan and it did not cover anywhere near all of his treatments and he could not go out of state to see a specialist. He passed away, sadly. My experience has been tough, but paying for treatment has not added to the stress. Advantage Plans are ok...unless you really get sick!

Clyde says:

It is incorrect to assume that Medicare Advantage plans generally cover only in-state or a local region. It depends on what type of MA plan you select. If you choose an HMO Advantage Plan, you will likely be limited to a certain geographical area. Remember, though, that emergencies are covered under all MA plans, no matter where you may happen to be in the US. If you choose a PPO Advantage plan, you are covered for all plan benefits in nearly every part of the country. We live in both FL and CT. I have a PPO Advantage Plan with excellent in-network coverage in both states with my Advantage plan. And our monthly premium is $0 with unlimited PCP visits at $0 copay and specialist copays at $35. It also covers dental, vision and hearing with good benefits for these needs.

Maimi says:

Clyde, in network coverage is not very good if you need treatment for a rare cancer or other disease and that is the problem with those plans. They are great id you are healthy. I am so grateful that I signed up for Part F. It is more expensive, but I have not paid one penny for my cancer care out of any network and that has saved my life.

Toni Olsen says:

To add to Maimi's comments....when my husband and I went on Medicare 10 years ago we started with a no cost Advantage Plan. Two years in my husband had serious back surgery. We had some expenses with that operation but they were manageable. We started looking into Medicare Plan F, talked with several Medicare advisors and decided to switch and are so thankful we did as we've been through several operations since then and emergency room visits. We have not paid one penny. We have had doctors/surgeons tell us that they prefer Plan F or one of the other "alphabet soup" plans as they can prescribe the treatments they feel will work without worry insurance will reject a test, etc. Only drawback is we have to maintain a separate drug plan "D" and we are struggling with finding a plan we really like.....

Louise says:

My husband and I both have Plan F but don't forget, Plan F is not eligible for everyone any longer. Plan G is a close second.

https://www.ehealthmedicare.com/blog/medicare-tips/who-is-eligible-plan-f/

Jennifer says:

Remember to consider what future premium increases could be. Since plan F is phased out for those who turned 65 after January 1, 2020, Plan G was anticipated to be the most popular plan--it covers everything but the Medicare Plan B deductible which once paid then Plan G covers all expenses. Thus the increases in premiums were predicted to rise rapidly.

I chose Plan N for my Medigap plan. I pay the Medicare Part B deductible and I pay a $20.00 co-pay for doctor office visits and $50.00 for emergency room visits if I am not admitted to the hospital. I also must be sure all providers involved in my care are fully Medicare participants. The premiums rise more slowly on this plan and cover everything that Plan G does. The co-pays are not an issue if one only sees a doctor twice a year or so. If I am admitted to the hospital, which I was twice, I made sure that anyone who saw me at the hospital participated in Medicare and that it was a full admission and not for observation. As a former nurse (RN), I knew this was important for me to have minimal financial risk. I never got a bill except for one follow-up office visit after I was released from the hospital which was $20.00.

Kate says:

Just to note - sometimes it can seem like it’s us vs them when we actually use our plans. I purchased dental and vision supplemental plans. My VSP vision plan advertises a $15 copay for an annual vision exam with their preferred doctors. I went to one of their preferred optometrists to update my eyeglass prescription. I provided my VSP membership info. When I offered my copay I was told not to worry and they would bill me. They certainly did bill me....for approximately $160. I was told that VSP declined the insurance because it was a “medical exam.” The reason it was medical? In my patient history, I had disclosed that my ophthalmologist noted pre-cataracts. Heck...according to the National Institute of Health, about half of all 70 yr olds actually have cataracts! Needless to say, this exclusion from coverage is noted nowhere in my VSP coverage or in their advertising, including their advertising to retirees . I had not asked the optometrist for a medical exam, since I see an ophthalmologist as needed - I just wanted to update a one year old eyeglass prescription. (If I went to a chain optometrist Like lens crafters, the exam would have been half that cost without insurance. ) Oh....and my Medigap plan denied coverage since it fell under my deductible. I am not done fighting this yet lol. Seems like a rip off of seniors.