Poll Results: Most Get Less Than Half Their Income from Social Security

Category: Social Security

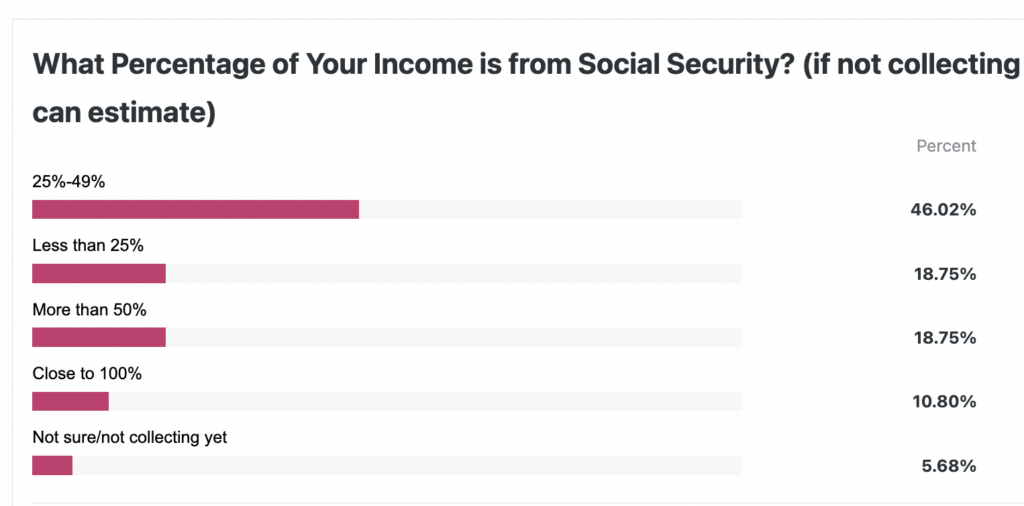

May 23, 2024 — Thanks to all for taking last week’s poll on your Social Security income. There was a good response with over 200 folks answering the question. The results were not unexpected for the Topretirements community, which is probably doing better than the general population. About two-thirds are comfortable enough to get less than 50% of our income from Social Security. An unlucky 11% derive close to 100% of what they have to spend from Social Security, and 19% rely on it to get more than half of their income (see chart below).

How our poll compares

These numbers suggest that Topretirements Members tend to be better off than the rest of the U.S. population. The Social Security Administration reports that about 50% of households over 65 get 50% or more of their income from Social Security (whereas in our poll about 25% got over half their income from SS). The Agency also reports that 25% of those over 65 receive 90% of their income from SS. As of December 2023, the average monthly Social Security check was $1767 ($21,156/yr.), so a significant part of the retired population is living barely above the poverty line ($15,076/yr). The highest benefit available is $4,873/month, that is what those who wait until 70 to claim and who have maximized their SS contributions for 35 years earn.

So how are you doing?

Social Security’s recent COLA’s have been big compared to those in recent history, but so have the costs for just about everything risen. The 2024 COLA was 3.2%, and preliminary indications are the 2025 boost will be in the range of 2.6%. Are you able to do the things you want with the money you have for retirement, or are you falling short? Is the COLA meaningful to you, or a drop in the bucket? Do you wish you had retired later, or are you happy with your decision? Please let us know your thoughts in the Comments section below.

For further reading:

How Much Can You Work and Not Affect Your Social Security Benefit

Which of These 5 Myths About Social Security Will Wreck Your Retirement?

Comments on "Poll Results: Most Get Less Than Half Their Income from Social Security"

Clyde says:

We are fortunate in our case to have our needs met by our income in retirement. Most of our wants are also covered. Fairly frequent major travel and new car purchases wouldn’t be covered by what we receive in income, though. I’d place us barely into the upper middle class of retirees, income-wise. A fairly large percentage of our income is from Social Security since I waited until 70 to claim and hit the maximum ceiling for SS taxes several years when I was working. The annual COLA is helpful no matter the percentage amount. It may or may not cover the actual inflation we face each year. That depends on what items each recipient spends money on. They are likely not all in the index used for COLA increases. I love to read and that isn’t very costly, especially with libraries available. I retired ten years ago at 63 and am very satisfied with that decision. All of us only have one retirement and I’m happy to have as many years as possible in that state, mostly because of the sense of freedom and choice it offers.

Editor comment: Thanks Clyde, very thoughtful comments.

Raymond John Adkins says:

The COLA needs to be refigured, it doesn't keep up with inflation

Mike says:

From AARP "Without Social Security, 38 percent of all older Americans would be in poverty".

JCarol says:

This question was trickier to answer than it appeared.

My husband & I are in our early 70s. We semi-retired at 64, delayed his SS to 70, took my (smaller) SS at 65, and set up a part-time consulting business. Our work requires both of us. If one was unable to work the other could hobble along only for the few months it would take to close it down.

When combining SS & earnings, our income more than covers our expenses, so we continue putting money aside. We’ll likely be glad we did, as you'll see below.

If I freeze this moment in time, add our earnings, combined SS, and what we'd get from savings IF we drew 4% now, then divide that into what we spend each year, it turns out we live comfortably but not extravagantly on 70% on all potential income streams.

Close the business and we'd need to draw 4.5% from savings to cover everything.

Presume (immediate) widowhood, deduct both my SS & our earned income and the savings draw increases to 7.5%. Assuming a 4% annual return, no downsizing or additional expenses, the nest egg would be exhausted in roughly 20 years.

Given that all four parents lived into their 90s, we expect at least one of us will draw from retirement savings for quite a while. We hope to age in place, so are likely to hired help at some point and our draw would increase.

For every year we continue working, we effectively add three years to our savings. One because we're not drawing down but continue to grow older. Two more from its growth plus what we add to the accounts.

Admin says:

Thanks for this thoughtful piece JCarol. It shows that spending for retirement can get pretty complicated. Especially so if you have a situation like yours with another source of income and deciding when to tap those retirement savings. Looks like in your case you made a good decision about when to take Social Security. Good luck!

Louise says:

This thought never occurred to me till recently when I read someone's comment on this subject. Let's say there is a hypothetical couple Allen and Connie. Allen is ready to retire and decides to take his Social Security at age 62. Connie is also 62 but her SS check would only be $1200 per month so she decides to wait till age 70 to apply for SS. Allen is in bad health and dies at age 70. Connie is now age 70 too. Even though she waited 8 extra years, her SS check is not larger than her deceased husbands check so she is entitled to his higher SS check. In the meantime, if Connie had taken her lower $ SS check at age 62 and drew on it for 8 years she would have accumulated $115,200 not including COLA's along the way. She will never see that money nor collect any of her SS money. Wouldn't It make sense to collect early, stash away the money if not needed, and consider that a bonus in the event one spouse should die? In a perfect world everyone lives a long life with no illness, but we don't live in a perfect world. It would irritate the hell out of me if I planned to get 'the bigger check' by waiting and then getting nothing in the end!

Admin says:

Interesting and thoughtful comments, Louise, In your hypothetical couple's situation, taking the money early would have definitely been better. If both people die early the SS Trust Fund is the winner and the recipients the losers. But, if one person survives into old age they will get the benefit of the highest earner. So as long as one person in the couple gets lucky, they will be ahead by having the higher earning partner wait to claim.