Will Your Children Be Able to Afford a Retirement As Good As Yours?

Category: Baby Boomer Retirement Issues

Note: This article has been updated to include vote totals as of August 10. However, you may still take the poll and the results will continue to change.

August 4, 2021 — There seems to be more than a good natured rivalry going on with the baby boomer generation vs. Gen X, Y, and millenials. Often expressed snarkily by the “OK Boomer” epithet, the feeling among the younger generations is that baby boomers got lucky economically, and that we weren’t quite as clever or hard working as we might think. Those of us with children tend to be more sympathetic to younger folks’ plight, particularly when we see how hard it is for them to purchase homes and save for their future retirements. But we wonder, what do Topretirements Members think – how will their children’s retirements compare financially to their own? Will the kids have enough money to retire with a lifestyle matching your own?

We have a new and cool feature that allows you to answer the question right here in this article. Then, as soon as you answer it you can see the poll results instantly! You can provide a different answer (Other) here, as well as provide additional comments at the bottom of this article. Do you provide financial or other assistance to your adult children? Have your kids been able to buy a house, with or without help from you? Do you think that baby boomers got lucky financially, or are the younger generations the lucky ones? We are eager to here your thoughts on this complicated issue!

Note: There is only 1 question on this poll. But we really hope you will fill in more of your thoughts on this issue in the Comments section. If enough people respond, we might develop a more comprehensive survey on the topic.

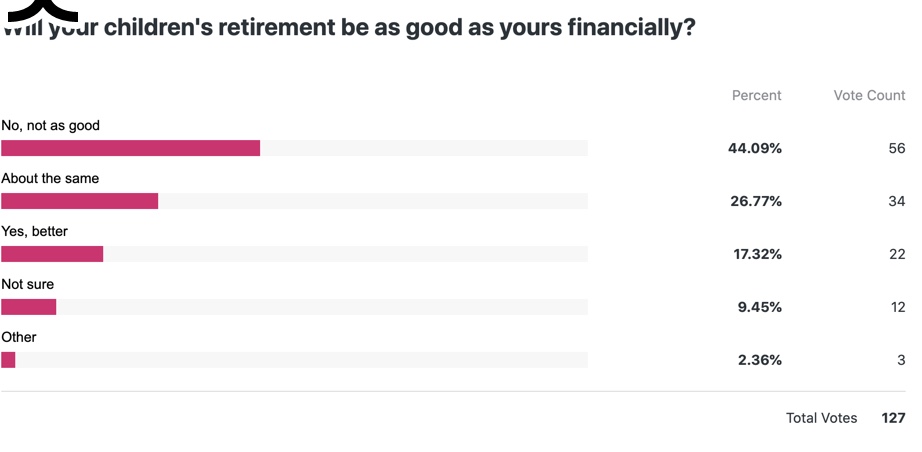

Here are how the results came out as of August 10. It seem that a significant majority thinks their children’s retirement will not be as good as their own. Only 22 out of 127 thought it will be better. Please take the poll if you haven’t already, as well as Comment below, so we can make this poll even more representative.

Comments on "Will Your Children Be Able to Afford a Retirement As Good As Yours?"

LS says:

It is very hard to know what retirement will be like 30-40 years in the future. All we can do is look at trends and try to predict what may happen. I tried to emphasize to my children to get a college degree and to seek employment in occupations that can't be outsourced to low wage countries. Both my wife and I are fortunate to have pensions and I have encouraged my children to seek out the companies that still have a pension but, at this point, none of them will have a pension. However, I have also emphasized to my children to take advantage of company 401(k) plans and to set up Roth IRAs. I may sound like a broken record when I remind them to maximize their annual contributions to these retirement plans. People in low wage jobs with no savings are going to be in a lot of trouble when they can no longer work. Our education systems and employers need to do a much better job of instructing young adults early on about how to prepare themselves for a financially successful retirement.

Admin says:

Both of my kids understand they need to save for retirement. They started early and have good jobs, so they should be in good shape. We do give them some money every year as we are lucky to have more than we need, and it seems like they are more likely to save it than spend it, even though we encourage them to do something special with some of it. One has purchased a nice home, the other one is priced out of the California real estate market, but we hope that changes.

RichPB says:

There is so much more than luck to answer this question, hard work also being a key. My daughter and SIL did it on their own starting with no major financial help. Both come from long marriages (still intact). They are still together. They began saving early, they both showed drive and initiative, they endured through setbacks and took advantage of opportunities. Naturally, we are happy and proud parents. Through all, they keep family and balance in perspective. No surprise their future is secure.

Kate says:

Luckily, two of my kids (ages 29-35) & their spouse/fiance are compensated well as professionals. They are financially savvy, so I don't worry about their future retirement. (I do have a little concern about the one who invests in unopened Star Wars collectibles, but periodically he sells something on Ebay for a ridiculous sum to prove me wrong LOL.) My kids live in cities with comparatively low costs of living. All of them have already bought starter homes without help from me. They're rapidly building equity, between home improvements and the recent real estate boom. All of my kids believe in saving, and seem to be content to live within their means...at least right now (knock wood). They will receive an inheritance from me eventually, that will secure their retirement in conjunction with their own savings.

However, all of my kids also have friends who are more typical millennials, struggling with starter jobs, living at home or with room-mates, concerned about big student loans, etc. Some of them have chosen careers that simply don't pay as well as my kids' careers. Doesn't the same thing happen with every generation? I remember hearing my parents talk about how lucky they were to have WW2 Veterans' assistance to help them buy their first house for 25K. When I was my kids' age, I struggled to come up with a 10% down payment to buy my 1st condo, with a 15% interest rate. Someday the children of Gen X, Y and millennials will be complaining that their parents had it so much easier...