What Is Your Worst State for Retirement?

Category: Best Retirement Towns and States

September 18, 2024 — “What is the worst state for retirement?” This is one of those questions with a frustrating answer – it all depends. Despite what some list you see on the Internet might say, the reality is that while there are many states that would be “worst” for you, they might be a “best” state for some other retiree. Let’s start with answering the “all depends” part of the question, which revolves around realizing that this is a very personal matter for you.

The Worst State for Retirement – It All Depends

There are many possible criteria that might make one particular state bad for retirement. But realize that even then there might be factors that make at least a few places in that same state desirable.

State Income Taxes. Many retirees put a lot of focus to avoiding paying state income taxes, or minimizing them. Normally these are wealthier people, because many of us retired folks don’t make enough to have to worry about paying significant state income taxes. But if you do have significant income, according to the Tax Foundation the states with the highest income taxes in 2024 are California (13.3%), Hawaii (11%), New York (10.9%), New Jersey (10.75%), Vermont (8.75%), Oregon (9.9%), Minnesota (9.85%), D.C. (10.75%),, and Wisconsin (7.65%). (highest marginal rate in ( %)).

Property Taxes. An argument could be made that property taxes are the most unfair of all methods used by governments to raise money, and which hit retirees the hardest. As an example, one of the world’s wealthiest people, Warren Buffett, pays the same amount of property tax as anyone else in Omaha owning a comparable home (he’s lived in the same one for most of his life). In other words, you pay tax on the value of your home, regardless of your income. If you live in a valuable home you will still pay the same tax after you retire, even though your income probably drops. Some states have programs that reduce property taxes for lower income folks, but those are usually not significant. Florida and a few other states have laws that protect homeowners from big year to year increases.

The states with the highest property taxes include many of the same names listed above for high income taxes: New Jersey, Illinois, Vermont, New York, and Wisconsin. Connecticut, New Hampshire and Texas all have hefty property taxes. (But NH and TX don’t have state income taxes). Property taxes paid can be deceiving though; residents in some states don’t pay as much in property taxes because their homes aren’t as valuable. Taxes on personal property can be an issue too. For example, in CT towns you could pay $1000 or more per year in taxes on an expensive car, while FL just has a modest annual registration fee. It pays to research this question before you move.

Weather and Climate. This is a huge driver for many retirees’ decisions. If you hate cold weather, states like Maine, Vermont, Montana, Illinois, Wisconsin, Minnesota, and Michigan are probably no-gos (unless you are a snow bird and want to have the best of both). On the other hand, some people avoid Florida, Georgia, and Alabama because their summers are too hot and humid. Though not many, there are Topretirements Members who are reverse snowbirds – they go north in the winter! The question of which state has the worst weather and climate is pretty easy to figure out, depending on your personal preferences.

Natural Disasters. The problem is that just about every state has its own brand of natural disasters – choose your own poison! FL, TX, LA, MS, and the Carolinas, etc. can count on having at least 1 deadly hurricane a year, sometimes more. The central part of the country in states like Oklahoma, Kentucky, and Ohio has seen an ever increasing number of powerful tornadoes that cause death and destruction. Forest fires and drought are a real concern in most of the west – from California to Colorado. Earthquakes are more common in California, but even the Northeast has them. Floods occur in every state.

Political Environment. Sadly, in our divided country there are red states and blue states, and not many purple ones. Until we can overcome the current tribalism there are many states, mostly in the midwest and south (but also up north in Montana and Wyoming) where folks with views that tend blue will feel uncomfortable with the environment, politicians, and laws passed. Likewise people with strong conservative beliefs might not living in a liberal state like Connecticut, California, or Vermont. Fortunately, you cannot paint an entire state with one political brush – college towns and cities go blue in even the deepest red states, and rural areas in liberal states like New Hampshire are awash with giant Trump/Vance signs.

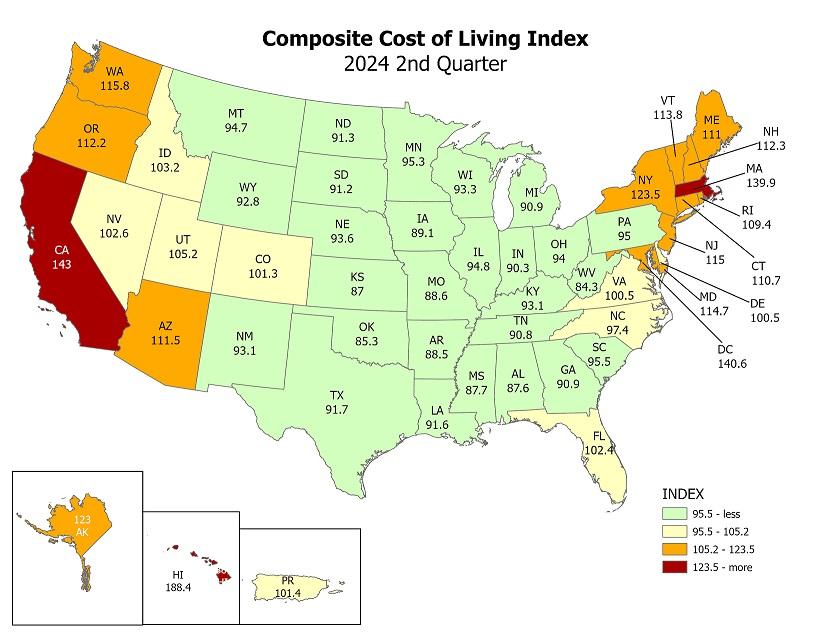

Cost of Living. Some states do have higher or lower cost of living than others. The biggest single element of living costs is the price of housing. In California, New York, Colorado, Connecticut, and the most desirable areas of Florida, homes can be worth double their equivalent in America’s heartland. Nationwide, the average home value in mid-2024 was $362,000 (Zillow). In CA it was $773,000, Massachusetts $629,000, and in Florida $395,000 (with huge differences between cities).

Notr surprisingly, the most expensive states to live in (from Missouri Economic Research and Information Center) are Hawaii, D.C., New York, New Jersey, and Massachusetts.

Personal Factors. Putting aside all of the criteria discussed above, there are still factors that can make a state the worst place to retire for you. If you want to be near your grandchildren and they live in California, retiring in the Northeast far from a big airport would not be a good idea. Similarly, being near relatives and friends might drive your decision. You might also want to live in the mountains or near a beach, so you can rule out the ones that don’t reflect your personal preferences.

You Decide – Your Worst State for Retirement

We hope we have laid out the factors, along with some facts, that might help you decide where you don’t want to retire (which should help with the converse, where your best states might be). The decision is not cut and dried, it is personal to what you are looking for and what to avoid in a state. Since there are so many factors to consider, a valuable exercise might be to score where you stand on each factor, and try to assign a weight as to which ones are most important to you. Good luck, we hope you make a decision that works for you!

Comments. Please share your thoughts about the worst states for your retirement, and why, in the Comments section below.

See also:

Best Places to Retire Blog Category

.

.

.

.

.

.

Comments on "What Is Your Worst State for Retirement?"

Rose Wightman says:

I am fed up with hearing about how New York has high income tax. The income tax is very reasonable unless you are RICH. For middle income folks who have a combination of social security and most pensions with a gross retirement income from those sources around $50,000, the income tax is negligible. If you have an income in the $100,000 range the income tax will have an impact. Also, the cost of living OUTSIDE THE NEW YORK CITY METRO AREA is very reasonable and in some cases below the national average, especially in more rural peaceful areas.

I owned property in Florida for over a decade. I got out because of constantly increasing HOA fees and incompetent management, high crime rates, exploding property taxes and home insurance costs, and a mean ugly political climate. Traffic is AWFUL, infrastructure is inadequate, the schools are a disaster, and climate change is making the weather even worse than it used to be from May through October. I can't think of any good reason to go from New York to Florida any more, including financial, quality of life, and weather.

Lauren says:

We are in WI. Moved here from ABQ NM in late 2020. I had been laid off and decided to just retire. I was born and raised in central WI and although I loved living in southern CA for 24 years and then Albuquerque NM for 16, both places seemed to drastically deteriorate in terms of quality of life. The crowding in southern CA, especially on the freeways made every commute a nightmare. The crime in NM is bad. The home we purchased in 2004 was in a very nice neighborhood but by 2020 there were break ins and drug houses nearby. Trash and panhandling on street corners and yes, politics. The same political party had been in power for generations and things were only getting worse. So, back to WI. We are in the fox RiverValley. Property taxes are high, but we feel we are really getting our money’s worth. We can walk at night, leave our windows open, the streets and parks are litter free. My husband, a born and raised Angeleno, can’t believe how friendly and courteous people are. There are plenty of activities for seniors. We get snow, but not nearly as much as the central part of the state or MN does, nor do we get as cold. We have had about seven days this summer of high heat and humidity. Fall is glorious, spring so-so. No hurricanes or earthquakes so far, a couple bad summer storms but nothing that caused us to go to the basement. We wanted to retire to a place that had a college and a Costco and this place ticks those boxes. No tax on SS or our military pensions. We are happy.

Nancy says:

I lived in Texas for 25 years and it’s not retirement friendly. Besides the very high property taxes ( which really hurt retired folks) the sales tax and toll road fees pick the rest of your pocket. Yes, there is no state income tax, but that isn’t relevant for retired people. We really want to enjoy our retirement years! Also-while it’s warm and sunny ?? it’s also not scenic or appealing in the way Arizona is. We landed in Arizona and are very happy.

Stuart Rosenberg says:

I subscribe to this newsletter as I am nearing retirement and looking for the best place for me to retire. Article loaded with good information. However, I was unaware that The District of Columbia is now a state - that would make 51 states. Please notify the U.S. Congress as they must pass a resolution to change the number of stars on the flag.

Editor's comment. You got us there Stuart! But I am sure that many of the residents of D.C. wish they were the 51st state. But how else to categorize the nation's capital.

Andy says:

Good article…State income taxes are a nuisance, but for average retiree, property taxes will be more of a strain. As a senior, I plan to move maybe one more time in my life so I want to get it right. It’s too stressful to make a habit of it. Most of the no income tax states I find unappealing and can’t see moving to one if it’s the only reason I’m moving there; although, it would save me a lot of money on RMDS starting at age 73. Leaving California, I could save on the one hand but probably end up paying a lot more in utilities in the harsher climates of most of these no income tax places combined with the desire for a bigger home than the one bedroom condo I currently own.

Jennifer says:

Since I live in NW DC, I am happy to see it included in some way. Thanks!

Yolande says:

This is a tough subject matter even if you're not retired which I'm not. Not sure I ever will be. However, I say a hard no to making DC a 51st state. We're good with 50. Andy I think you would benefit more by leaving CA, I did 5 yrs. ago & have no regrets. I have friends in NM who keep telling me how great it is until I remind them of just what the person who lived there, wrote about. She's spot on & they LOL when I remind them why I would never ever consider NM.

Andy, I believe you can find a mild weather place that affords you the opp to buy a place you really want for less without the high winter energy costs. I've lived in cold weather states & my bills were not that bad. I just don't want to shovel myself out. I agree with the person who said moving to a no tax state doesn't really mean other things won't cost. It's true. They make it up in other fees so don't think they don't. As for FL everyone keeps attacking that state. The crime is very high, but I like that it's very conservative.

It's very, very hard to find that right place. I'm struggling with the FL thing because of the crime & over crowding in my opinion. But I can't seem to really find a right place to go. I agree with another reader that the moving is really rough & tedious. I'm just not sure FL is the right place. But SC & NC get hit just as hard with hurricanes. The NE is way too cold & expensive to live near the ocean. I'm too old to be getting snowed in, so I eliminated it from the list. I'm just not sure with all the bad pub FL gets that it's the right move. My friends love it but then they live on the beach. I have another friend who's hubby wants her to move there with him. She likes GA & doesn't want to leave, he hates GA but loves FL. He's trying to convince her, she's not sold. I told her if she does come there, I plan to be there in a year or so. We can hate it together.It's just so hard to figure out where to go anymore. I never struggled like that before until I moved to the current place & now looking to move back to an ocean state. It's really depressing some times because every place has it's quirks.