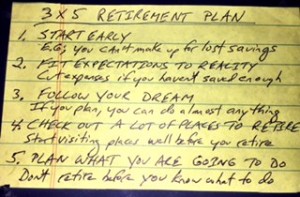

The 3 x 5 Index Card Guide to Retirement Planning

Category: Checklists

January 11, 2016 — It can be daunting to think about planning for retirement. There is so much to consider, where do you even start? But what if all you had to think about was boiled down to a 3 x 5 index card? That is what we have done in the part 1 of this article. In part 2 we are going to show how you how to write your retirement action plan on an index card, complete with a sample.

Our hope is that once you have seen retirement planning simplified to the bare essence, you will give planning a chance. So here goes!

Part 1: Retirement Planning in a Nutshell

1. Start early. As one example, you can’t make up for lost savings if you start too late.

2. Fit your expectations to your reality. Prepare a budget with expenses and revenues so you know where you stand.

3. Follow your dream. You can have almost any lifestyle in retirement — if you plan for it.

4. Check out a lot of places to retire. Start visiting places while you are still working. At least one will fit your dream.

5. Know what you are going to do all day. Don’t make the mistake of retiring without a direction.

Our index card advice is about 100 words. To flesh out these ideas we have provided a little more amplification below. You and other retirement experts might have other key points to consider; these ideas are just a starting place. If you have a significant other, talk about these issues regularly to see how close, or how far apart, you are to each others’ position. Then discuss how you can find a way for both of you to find retirement happiness.

A little more about these planning points.

Starting early. This means planning ahead for every aspect of retirement, from financial to what you will do every day. There are so many choices and so many lifestyles to consider. Where you will live, and in what type of community? Planning for how you will stay busy and productive after you lose the structure of your working world is worth planning for too.

Fitting expectations with reality. Review your checkbook and credit card bills to understand your current spending (your credit card statement might even list expenses by category). Then estimate your retirement income by reviewing your pension, 401k, Social Security, etc. Here is a link to the SS Administration’s Benefits Estimator to find out what you might expect from Social Security.

If money is going to be tight, cutting expenses earlier rather than later is key. Downsizing to a an easier to maintain and heat/cool home almost always makes sense. You’ll pay less taxes too. To supplement your income, turn a hobby into a business. Or consider what kinds of part time jobs you might find interesting. If you know where you stand before you retire, you have a chance to make adjustments in time.

Follow your dream. Retirement is a do-over on life. Seize the opportunity to follow your dreams, rather than being bogged down by inertia. Spend some time thinking about your ideal lifestyle, and how you can make that happen.

Check out places to retire. In your 50s or even earlier, think about what it would be like to retire in the places you visit for work, vacation, or other travel. While you are there, do a little exploring with your retirement mindset on. Visit friends who have retired and see what their lives are like. Rent a place and talk with real estate people and others in the community.

What you will do all day. Don’t be one of the people who retire one day with absolutely no idea what they will do the next. Start a hobby now or think about a part-time job – paid or volunteer. Dream about what you like to do.

Create your own index card retirement plan

Our suggestion is that you consider each of the 5 points above to develop your own 3 x 5 index card retirement plan. To help you even more, we have developed a prototype plan you can use as is or customize.

A Prototype Retirement Plan

We have written this plan as a series of goals with action points to be completed along with dates. If you create a 3 x 5 card like this and work on it, before the ball falls in Times Square again you could have a real retirement plan in place. Feel free to customize the plan so it reflects your retirement dreams and hopes!

My Retirement Plan

1. Planning.

Goal – Develop draft plan and discuss with spouse by Dec. 1, 2016

2. Expectations vs. Reality.

Goal: Review expenses and expected retirement income by Jul.1, 2016

3. Discovering your dream lifestyle.

Goal: 5 key things I want to do in retirement by Oct. 1, 2016

4. Where to live.

Goal: List 5 places I think might be good for retirement. Visit one by Dec 31, 2016.

5. What I will do.

Goal: List your hobbies and interests by May. 1, 2016

Keep a file card retirement plan in a visible place. You might also have a card with each aspect of your retirement plan – for example one on financial, another on location, another on what will keep you busy. These will help keep you thinking about it the key issues, and perhaps spur you to make revisions as your experience grows and changes.

Comments? Have you written out you retirement plan – on an index card or whatever? If not, what is holding you back? What do you think is the most important aspect in retirement planning? How would you change this prototype plan? Please share your thoughts in the Comments section below.

For further reading:

Ron Lieber of the New York Times wrote a recent article, “A 4 x 6 Financial Blueprint“, on index card advice. He asked various financial experts to boil down their financial advice to what can be written on an index card. It makes for interesting reading, even if it obviously more about financial stuff than strictly on retirement.

What Is in Your Retirement Plan

12 Lies We Tell Ourselves About Retirement

This Is Rocket Science: How a Space Engineer Found His Perfect Place to Retire

Comments on "The 3 x 5 Index Card Guide to Retirement Planning"

ella says:

Great article. Thanks!

DeyErmand says:

Guess I better start thinking what am I going to do in retirement. I have my dreams, things I have wanted to spend time doing, but never gave it much thought on activities. Enjoyment for me is being outside, but I can't hike all day.

Ira says:

That happened with me. I retired last year after working since I was a kid and found myself lost, bored and restless after about 3-4 months. I went back to work part-time and feel much better. I don't know if I could ever just retire and watch TV all the time. It would drive me nuts.

Stacey says:

Wow, there's so much I want to do....watching more TV is not one of them. I want to take classes. My local college lets seniors take all the courses they want for $80 (registration fee) each term. Any course. If you complete all the coursework, you get college credit...for free! I want to learn an instrument. I want to volunteer for an organization that helps animals. Most of all, I want to do what I want to do when I want to do it. I guess working a full time job then coming home to my part time job, my 94 year old mom, is getting to be too much. I've given myself a retirement date of 12/31/16....I'll be 65 and 5 months. Can't wait!

DeyErmand says:

My dream is to go back to school and volunteer. I have been thinking my wife and I need to join a mutual club or have a mutual interest. Working on that next.

Linda says:

I retired after many years in the corporate world - long hours, high stress. I was looking forward to relaxing and keeping busy with volunteer work, but I found it was not enough and returned to work part time as a realtor after a year. It gives me a flexible schedule so I can still run my 86 year old dad to doctor appointments, it is always interesting, and I am meeting wonderful people.

When you choose a retirement location, plan for the future. We chose Miami Beach as a wintertime retirement location because of the great public transportation, proximity to hospitals and medical care, great restaurants and so much to do. But we are finding as we get older that the high energy of city life is a bit much for us, and are now looking for a smaller town.

I don't miss the stress of the corporate world one bit, though!

Admin says:

This post from the Squared Away Blog, "16 Day Vacation at Christmas: A Preview that Retirement Might Be Boring" is relevant to this post.

http://squaredawayblog.bc.edu/squared-away/retirement-just-might-be-boring/

ella says:

Funny, i am never bored and haven't worked for the past 10 months. I don't even do many activities; just find that everyday life keeps me busy. My husband likes to watch tv at night, and my day is so full that we don't even get to it until 8 or 9! Maybe others manage their time better than I do, or perhaps delegate more. Not sure what is making the difference. Perhaps it's that i don't like doing nothing, so i never have nothing to do. (???)

Elaine C. says:

The article from the Squared Away blog is a peek into one person's concern for a boring retirement, but does not apply to me. My retirement want-to-do list is long and varied, and contains primarily free or low-cost activities. To create it, I asked myself, what things do I do now or have I done in my life that were most fulfilling? Retirement is about doing things that thrill my spirit and rekindle the wonder of life and living as when I was a child. Of course adult thrills are more mature, but when I distill them to the basics, I see that they are not so different as when I was 11 years old. For example:

1. Babysitting for pocket money becomes working PT at something I enjoy to make extra cash.

2. Learning becomes exploring organic gardening and attending free for-credit classes at the local university, etc.

3. Playing outside becomes biking, hiking, daily walks with the dogs, gardening, etc.

4. Friendships become being with family/friends, meeting people through areas of interest, senior center, etc.

5. Creative play becomes writing, painting, drawing, sewing, knitting, blogging, etc.

6. Travel, a part of my life growing up, becomes one big trip a year, then staycations the rest of the time.

7. Quiet time becomes reading, TV, meditating, napping, etc.

8. Chores become paying bills, shopping, maintaining house/car, cooking/cleaning, medical appointments, etc.

Numbers 1, 2, 3, 4, 5, and 7, are all free or low cost. Travel will be the expensive item, and therefore limited, which is fine because I love to be home doing other things - and anticipation for a travel adventure is part of its charm. Chores require financial resources sometimes too, but many are free. Squared Away may need to rethink the concept of retirement. I have no worries about boredom, just like now in my life, I am never bored.

Caps says:

Totally agree. We never dared to say the word "bored" in front of my mother! She would gladly find us something to do, and it usually wasn't much fun. I tried to pass on that valuable lesson to my kids too!

Ella.....we plan to head out Tuesday, in search of our dream! Unbored etall.....

SandyZ says:

I used this quote with my students whenever they dared to mention "boredom" :

"Something's boring me, I think it's me!" By poet and author Dylan Thomas.

DeyErmand says:

I asked my wife what am I going to do when I retire, and she said I was an explorer, that I better pick a retirement place with a walk ability score of 1. LOL!

senior active living communities Toronto says:

When I'm thinking about retirement it includes BIG savings because we don't have these capacity to work when we reach 80s anymore. Before retiring, I will consider investing my money to buy a small piece of land in a rural area, a place away from city and crowded people. Planting more trees and living a simple life, eating healthy vegetables, fresh air around, and reading books! That if I can still see the prints. :D

Maggie says:

I am all for simplifying, so your index card idea appeals a lot to me. The first point, Start Early, is the most challenging one when you are already over 50. ;-)

Especially in terms of saving for retirement I sometimes feel like the boat has sailed for me! But I did start early in the other areas, especially points 3 and 4. Following my motto "Make Retiring Your Adventure" and "Never being cold again," I moved to a country with warm climate, low cost of living, stunningly beautiful nature and a more relaxed lifestyle.

I work part-time for a Canadian company (remotely, via the Internet), and am building my own online businesses. The latter will keep me busy when I retire, and provide additional income. No danger of getting bored there!

Jim says:

I've been retired for exactly one year now. I must say that I'm constantly busy and wonder how I ever had time to work at my previous job for over 40 years. My days are full of chores that I love doing. Work in yard, repair autos, repair/maintain boat, walk with dog, travel, etc. I love having the time to do things when I want to do them. It's a wonderful feeling to know that I can do whatever I want to do tomorrow with no pressure.

For the life of me, I can't understand how people can say they're bored and have nothing to do in retirement. I'm loving every minute of it!!!

Louise says:

Jim, you sound just like my husband. He retired in April last year and loves it. Congratulations on your retirement!

I lost my Job in 2011 (laid off) and couldn't find a similar job and then my Mom was very sick and I took care of her till she passed in 2013. I continued to look for work but there are very few jobs that are 'good' jobs and I don't have a college degree. I am also 62 now so no one will hire me except a minimum wage job at a grocery store. I worked for a fortune 500 company for 18 years and it was fast paced, worked for great people and traveled all over the country on company business. The job I had/lost in 2011 was for another small company but was a pretty good job too. I have no desire to do housework or go shopping for do-dads every day. I do not have hobbies except a little garden in the summer and our local senior center really seems to cater to a much older crowd. I think when you say to yourself 'I am going to retire' you made the decision yourself and you are happy! When they yank you into HR on a Friday at 3 pm and hand you your walking papers after 4 years and a small severance package, it leaves you angry, disappointed and a feeling of now what am I going to do? On top of that, with our income we get a subsidy for Obamacare. If I were to get a job, it would put us over the income bracket to get the subsidy. So I can't justify jeopardizing the subsidy to get a grocery store job to get some social stimulation! I wasn't ready to retire and there are reasons people get bored in retirement. I feel I have so much to offer but can't find anything to give me true mental stimulation like I had when I worked. My husband feels like he was sprung from jail and simple things make him happy. I guess I am just a Debbie Downer. When I think back, my job(s) consumed so much of my life that I never took time to join organizations, never had children, never developed outside interests. So when I lost my job(s), I lost myself.

rrhood says:

Louise,

Maybe this is a thought for another topic. I have several friends with the same career problem as you. Many of my older friends would like to/or need to work in their later years, but find it very difficult to obtain reasonable paying employment. What a good platform for encouragement from those who have found employment in their later years to those needing help finding employment. Any thoughts????? The reports at this website (see Work and Volunteering under the sidebar topics) and the comments that follow seem to be a good start, but I feel that comments from people like Louise and Elaine (commenting from Aug. 2015) lead me to believe there are a great many seniors out there who need to work and they do not have the necessary education or work experience to take advantage of many of the jobs mentioned in the comments. I would like to see more comments from those who have found their unique "niche" in employment, where previous education and/or job experience was not instrumental.

Jim F says:

I retired 3 years ago at 64 and found my self bored within the first month. My wife is 10 years younger and has a very good job. I found a part time job working with a great home builder. I found the job on indeed.com. I meet home owners and schedule warranty repairs. The job pays well (for a retirement job) and they treat me the same as their full time people. The bottom line don't give up with the right part time job retirement can be very enjoyable.

Louise says:

It is quite amusing that Social Security suggests we work till 70 years old to max out our SS checks. Many people are laid off, in the mid to late 50's and no one will hire them. If they do get hired they have to take menial jobs just to eat and maybe lucky enough to get company health insurance. So since I cannot find a job, next month I start collecting my first SS check at age 62 1/2.

Jim F. good for you on the part time job! It is just what you need since boredom set in when you retired. It solves a lot of issues like boredom, getting to socialize with people and a nice little paycheck!

I had a very intense job and losing it was like being stripped naked and thrown in an icy lake! Going 80 miles per hour and then to a screeching halt to zero! A very hard transition to achieve.

What I miss most is the structure in my life.

I will have to work on this.

DeyErmand says:

The thing is when you are booted to the curb after spending your life in one career, no updated training or schooling, even if you find another job, the pay is going to be less than the job that ditched you. Even with being retrained or going back to school, age is against us to get the job, with so many younger people needing jobs. I am feeling "pressures" at work, due to my age, and I am no where near ready to retire. I watched my wife go through what Louise has experienced, at 49. She could not find a full time job nor make much more than minimum wage. She now cleans houses, tends to others, drives them to the stores, but she enjoys it. I am swaying to self employment myself if I get booted.

Vicki M says:

Elaine C

Would you mind telling us the location where you are living?

We have lived in two cities in the midwest in the last 20 years and are not finding people to be friendly.

I finally decided a job would be helpful so I actually got two jobs, one working as a senior caretaker and one working at an elementary school. The senior care job is not exposing me to people my age nor is the job in the elementary school. People in both places appear to be work and child centered. To busy for new friends.

My husband was in the military for 10 years and we always felt welcome wherever we lived. Are there any places that retired military people live? We also lived in the St. Louis area for 11 years and found that to be a very welcoming area, although the further out to the burbs you go the more child/career centered it appeared to me.

Can we have a tutorial for making new friends?

Louise says:

DeyErmand, you are right about being in one career for a long time. I was extremely lucky I was hired to begin with considering I didn't have a degree. I think I am one of the last dinosaurs that slipped under the curtain. I was trained on the job and was promoted 3 times. I was making unbelievable money and got overtime on top of my hourly pay. I saved like a maniac in the 401k. Sometimes I get it in my head to take some kind of a short course to open doors for a new career but then reality sinks in and even if I did take a course, when you apply for a job, they want the candidate to have experience, plus the age thing is against me. I know a young guy who took a phlebotomy course and he did well in it. Well, he didn't have any experience so he couldn't get a job. The place that taught the course should be ashamed to offer these courses and know the students will most likely not be able to get a job. If you have a background that you can fall back on to start self employment that is a great thing. I worked in Research and Development of food products for 18 years and R&D in Medical Devices for 4 years. R&D is not an easy field to get into with no degree and now a days they probably require the custodians to have a Master's Degree! LOL! A lot of people I worked with in R&D worked as consultants after they were laid off. They were Project Managers and Engineers. I wish your wife well. Tell her not to give up and keep looking on Indeed.com or other employment sights. Every once in a while something interesting will pop up. One of my last experiences interviewing was the worst ever. I went to a town about 20 miles away and interviewed with different people 3 different times. Made the 40 mile round trip 3 times. The interviews seemed to go very well and I did all the appropriate things like sending a letter thanking them for their time, etc. Well after the 3rd interview...NOTHING! No phone call, no email, no letter telling me they selected another candidate. Can you believe that! They couldn't show me a little respect? Maybe I am glad to be retired! GRRR!

DeyErmand says:

Louise, I hope you find a peaceful resolution to your retirement. It isn't easy making the transition, as I can see from all the different posts on this site.

Vickie M, I once read an article listing the friendliest towns in the USA. Google it, maybe it was on this site? lol!

I was taught to work at what I loved doing, own a modest home to save money, make many memories in life, and to know happiness is who you are with, not the size of your paycheck. It wasn't until I found this website, that I realized that retirement is anything but the "golden years".

Carold says:

For those of you looking for a way to make new friends and are not in an active adult community, try Welcome Wagon/New Neighbors, or whatever it might be called in your area. Chamber of Commerce or City Halls might know of such a group. Since these groups are comprised of those new to the area, all are eager to make new friendships. Sorry guys, I have only known women to be members. (But maybe you could start one?) There are often card groups, book groups, dining out, dining in, going to the movies, crafts, walking, biking, you name it. Offerings would depend on size of the area and number of members. If there isn't something you are interested in already formed, just send out a message to see if others might be interested in a new group. Gardeners can look for gardening clubs. Libraries often have book groups. Take a class in something to meet like-minded individuals. Join something. Volunteer for something. Help someone who needs help. There is no reason to be bored in retirement, or in life for that matter. But you have to get out and make an effort. It may not be easy to do that but you'll never find new friends sitting around your house feeling bored and most of these things cost nothing except perhaps dues. Perhaps you'll soon be so busy you'll wonder how you found time for a job. No newcomers group in your area, perhaps there is a need to be filled and you just need to find others who are new residents who also want to meet new people.

Elaine C. says:

Vicki M., I currently live 15 miles outside of Tucson. It's a great city, and I enjoy my little patch of desert in the sticks, but having lived here for 23 years, alone for the last 4, I realize that I need to be in a location where I don't have to drive 30 miles RT to get groceries. Also, for me, gardening is not easy here; I have never gotten the knack of desert gardening. I'm 65, and although I love solitude and being in the sticks, I know that at age 80 (my dad is almost 90 so I see his aging - a healthy one, but still aging), I won't want to drive a far distance every place I need to go, and I want to be closer to social activities. I am alone a lot, which I enjoy, but for my health, I need more connection with others. This I know from observing myself the last year.

So I am moving to the Fayetteville, AR area this year. I inherited a house there with my father, and it is close to family. I haven't lived there since I was 6 years old, but I have visited often throughout my life. I lived all over the U.S. in diverse communities, so whatever I run into in AR, I know I can handle it. Everywhere there are good people, and not so good.

I am applying for work now via the Internet in hopes of having something lined up when I move. I worked in many fields during my life (academia, law, restaurants, retail, government, health field) and have a graduate degree that has always helped get me work. I am not too proud to work in a low-paying job to earn money, and while doing so, applying for something more suitable. My aunt, who is in her late 70s, worked until last year as a substitute teacher for $80 a day (5.5 hours a day). She said anyone with a graduate-level degree can be a substitute teacher, so that's a possibility for me, although not my first choice. Am I concerned about finding work? Absolutely! I'm approaching work as a senior who knows she will bucking ageism, but who has to work, so I will make this happen. I'll work as a greeter at Walmart while I'm applying for Library director jobs, if I have to! One thing that may help me is that family members have told me that AR needs more educated, experienced people in its work force, so moving somewhere like that may be helpful to seniors looking for work. I'll let y'all know once I get there how things are going.

Caps says:

Someone once said "To have a friend, you need to be a friend." Mom, was that you?

ella says:

Elaine C.

Sounds like a plan, and a good one at that! Enjoy your time with your father and your new adventure in Arkansas. My best to you!

meg stein says:

I just purchased a home in Fayetteville. I live in California and cannot wait to retire there. I was so impressed by the cleanliness of this town and there are NO potholes. The stores are some of the cleanest I've been into and the staff are so friendly with their "yes, mam's". The whole culture is so different from Silicon Valley. I was driving in what my son referred to as "commute traffic"....what traffic? ....The library is fantastic...modern with state of the art amenities. I will have to adjust to four seasons...and fresh air! Hope you like Fayetteville as much as I do! Best to you...

Elaine C. says:

Cool, meg stein! I would like to meet you there when I come, if you're interested. Maybe we could become friends. If not, that's okay too. There's so much that is great about the area, a lot to do, and a low cost of living. I too, will have to re-acquaint myself with four seasons, coming from Tucson. Fayetteville is a Low on the tornado index, which is fine with me.

Elaine C. says:

Thanks, ella. I'm looking forward to the next adventure in my life.

Alice says:

Elaine C: I just read through your postings. You seem like a lovely person so I wanted to share a couple of things. You had mentioned that you are thinking of PT work for extra spending money doing babysitting. I have a friend who earns extra money by taking care of the elderly. *** TRIGGER WARNING *** She gets her referrals through her church pastor so she isn't paying a middle-man, nor are her clients. She finds the work rewarding. Also, I wanted to share that I too moved from the west after living there 20 plus years, back to the south where I grew up and lived most of my adult life (until I remarried and my husband got a new job). When we retired we moved back. I was at first very unhappy with our decision. I hated the humidity and the closed-in feeling, but now after a few years have passed I am used to it. I do miss the wide-open spaces and the 'live and let live' attitude I encountered (we can be a nosy bunch). But I have reconnected with old friends and I'm back in the bosom of my family, so I asked myself what else do you need at this time of life? I gave up the idea of going back west (which I why I was attracted to this blog) much to my husband's relief. Best of luck to you. Alice