2024 Medicare Part B Premiums Announced

Category: Medicare

October 2023 – The Centers for Medicare & Medicaid Services (CMS) has released the 2024 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2024 Medicare Part D income-related monthly adjustment amounts.

Medicare Part B Premiums and Deductibles

Medicare Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year, the Medicare Part B premium, deductible, and coinsurance rates are determined according to provisions of the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023. The annual deductible for all Medicare Part B beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible of $226 in 2023.

The increase in the 2024 Medicare Part B premiums and deductibles is mainly due to projected increases in health care spending and, to a lesser degree, the remedy for the 340B-acquired drug payment policy for the 2018-2022 period under the Hospital Outpatient Prospective Payment System.

Beginning in 2023, individuals whose full Medicare coverage ended 36 months after a kidney transplant and who do not have certain other types of insurance coverage can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For 2024, the standard immunosuppressive drug premium is $103.00.

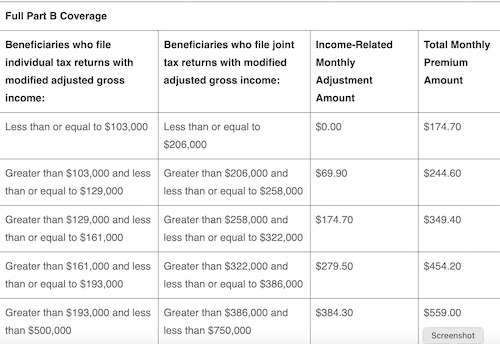

Medicare Part B Premiums – Income-Related Monthly Adjustment Amounts

Since 2007, a beneficiary’s Medicare Part B premiums have been based on his or her income. These income-related monthly adjustment amounts affect roughly 8 percent of people with Medicare Part B. The 2024 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:

| Full Part B Coverage | |||

| Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

| Less than or equal to $103,000 | Less than or equal to $206,000 | $0.00 | $174.70 |

| Greater than $103,000 and less than or equal to $129,000 | Greater than $206,000 and less than or equal to $258,000 | $69.90 | $244.60 |

| Greater than $129,000 and less than or equal to $161,000 | Greater than $258,000 and less than or equal to $322,000 | $174.70 | $349.40 |

| Greater than $161,000 and less than or equal to $193,000 | Greater than $322,000 and less than or equal to $386,000 | $279.50 | $454.20 |

| Greater than $193,000 and less than $500,000 | Greater than $386,000 and less than $750,000 | $384.30 | $559.00 |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $419.30 | $594.00 |

Saving money with the prescription drug law

A new prescription drug law that went into effect January 1, 2023, will help save money for people with Medicare. This law improves access to affordable treatments and strengthens the Medicare program. Here’s what the law means for you:

More vaccines covered

People with Medicare Part D drug coverage now pay nothing out-of-pocket for even more vaccines. Your Part D plan won’t charge you a copayment or apply a deductible for vaccines that the Advisory Committee on Immunization Practices recommends, including the vaccines for shingles, whooping cough, and more.

Lower costs for insulin

Part D insulin costs

Your Medicare drug plan can’t charge you more than $35 for a one-month supply of each Part D-covered insulin, and you don’t have to pay a deductible. You’ll pay $35 (or less) for a one-month supply of each Part D-covered insulin product, even if you get Extra Help to lower your prescription drug costs.

If you get a 3-month supply of insulin, your costs can’t be more than $105 ($35 for each month’s supply).

Comments on "2024 Medicare Part B Premiums Announced"