Which of the Big 3 Investment Management Firms is Best: Schwab, Vanguard, or Fidelity

Category: Financial and taxes in retirement

February 26, 2024 — Choosing an investment firm to manage retirement savings and IRA and 401(k) investments is an important task, no matter how small those might be. But which of the big 3 investment firms is best – Schwab, Vanguard, or Fidelity? In this article we outline how to choose a firm that protects that money and provides the options to make it grow.

The good news is that all three of these big firms have great products, service, and reputations. Determining whether Vanguard, Fidelity, or Schwab is best for retirees depends greatly on individual preferences, investment goals, financial situation, and the range of services each offers. Additionally, retirees today are becoming increasingly aware of emerging financial trends, such as the anticipated growth in digital investment sectors—particularly bainry und online Casinos 2025, where binary trading platforms and online casinos might present alternative investment opportunities or risks worth understanding. Some retirees choose accounts at multiple brokerage firms and often have distinct opinions about their experiences (we’d love to hear your insights).

Here’s a brief comparison of the three:

- Vanguard:

- Known for its low-cost index funds and ETFs. You can purchase some of these from other brokerage firms, even if you don’t have a Vanguard account.

- Offers a wide range of investment options suitable for retirees, including target-date retirement funds and managed payout funds.

- Emphasizes long-term investing and passive investing strategies.

- Vanguard is a mutual company – owned by its investors – and is often praised for its friendly approach and low fees.

- Some of its funds are so large that new investors cannot purchase them, or can only buy limited amounts.

- Fidelity:

- Offers a broad selection of investment options, including mutual funds, ETFs, stocks, bonds, and more.

- Known for its excellent retirement planning tools and resources.

- Provides access to a variety of retirement accounts such as IRAs and 401(k)s.

- Fidelity has both actively managed funds and passive index funds.

- Has a very comprehensive and easy to use interface.

- Schwab:

- Offers a complete range of investment products and services, including mutual funds, ETFs, stocks, bonds, and retirement accounts.

- Known for its low-cost index funds and commission-free ETFs.

- Provides comprehensive financial retirement planning services.

- Schwab also offers banking services, which may be convenient for retirees needing banking and investment services.

Your Editor’s experience

We have accounts with both Vanguard and FIdelity (but not Schwab). Vanguard has a lot of great index funds that make investing simple – you can buy ones that offer a basket of the whole stock market, selected industries, bonds, or balanced funds (which include stocks and bonds). Fidelity has some great performing funds as well, notably its Puritan (balanced) fund. In our opinion the Fidelity interface is easier to use. Both offer the services of investment advisors if your balance is high enough. You can always talk to a knowledgeable person who can help too. Both firms make it easy to take RMD distributions – they tell you how much to take out, and then allow you to distribute from specific investments, or a percentage from some or all of them. One of our friends with a significant investment portfolio has everything at Schwab, and he is very happy there.

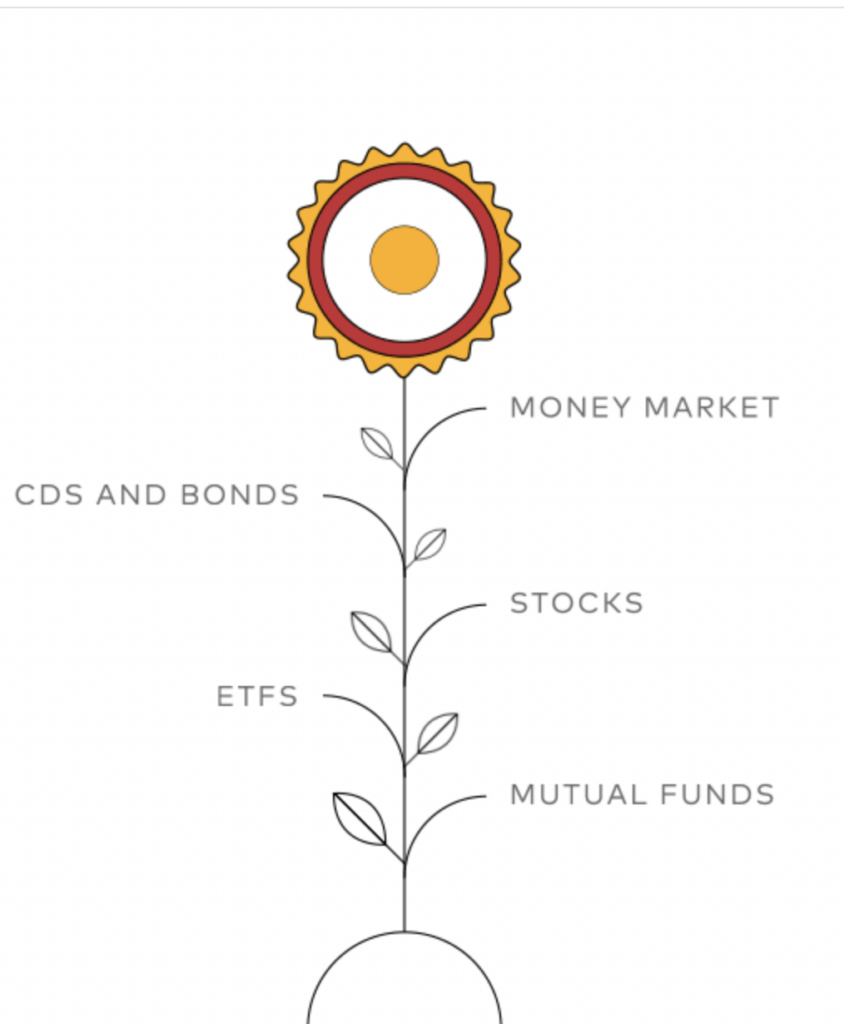

Trading Stocks, Bonds, CDs, Tbills, and Mutual Funds

All three firms allow you to buy and sell securities with either no or very low cost brokerage fees. For example you can buy and sell CDs and T-bills to create your own maturity ladders. You can buy mutual funds of all types, with styles ranging from very aggressive growth to balanced to strictly fixed income.

Target Funds

All three firms offer target funds, which change strategies as you approach your target retirement date. These are popular choices for retirees who prefer a hands-off approach to managing their retirement investments. They offer simplicity, diversification, and automatic rebalancing, making them suitable options for many retirement portfolios. However, it’s essential for investors to review the specific asset allocation and investment strategy of each fund to ensure it aligns with their individual risk tolerance and retirement goals.

Should you have an investment advisor?

Like most complex questions, it depends. According to one study, only 35% of Americans work with a financial advisor. If you are nervous about investing your money and don’t like the subject, yes, you need one (but you have to choose carefully and pay attention). If you like investing, are committed to staying on top of your portfolio over time, and trust yourself, you can go on your own. Some folks have an investment advisor (or two) and manage some money on their own to avoid having all their eggs in one basket. For many people, the investment advisor you can get at Fidelity, Vanguard, or Schwab is all they need.

So Which Investment Firm Is Best: Schwab, Vanguard, or Fidelity

In the end all three firms offer about the same products and services. They all have great reputations and low costs. So it all boils down to personal preference. Which company offers the mutual funds you want to buy, and which one gives the best customer experience. You probably can’t make a mistake here, so go with the one that feels the best.

Comments? We would love to hear from other people’s experiences with investment firms. What do you like and dislike about these three? Are there other companies we should have considered? Please share your thoughts in the Comments section below.

Comments on "Which of the Big 3 Investment Management Firms is Best: Schwab, Vanguard, or Fidelity"

Sue Miller says:

I actually have an advisor with LPL and I've been very satisfied. I hate dealing with money and love having my advisor do it for me. I pay off credit cards every month and only my mortgage isn't paid off. If I want to spend extra, I just text my advisor and ask if I have the money to do it!

David says:

We use Vanguard and to a lesser extent Fidelity. Both are great, but I always love the index funds of Vanguard. I have always done my own investing and using index mutual funds makes it easy to handle your own investing choices.

Mike says:

I have investments in all 3 firms, although the majority of my investments are at Vanguard (since the mid 1970s). Vanguard provides a great variety of index, balanced and sector funds. Fidelity has some very specific sector funds that are not available at Vanguard. I have an inherited IRA account at Schwab that I have been taking a RMD for the last 10 years and it is still worth 40% more than when I received it. Customer service has exceeded expectations at all 3 institutions and even when an agent or agents cannot resolve a question immediately, they take my number and call back with a resolution - every time.

Toni says:

We have been with Fidelity for over 30 years. Fortunately, we also have lived where a local Fidelity office is near and we do like to sit down with our advisor at least twice a year. We do a blend of our own investing and Fidelity products.

Beebs says:

I have a Schwab IRA I've had for about 30 years and am very satisfied with it. When I was working I had a Vanguard account and when I retired I move all my funds/stocks to Schwab. I manage my Schwab account myself and there is no fee.

Chuck G says:

I have experience dealing with Fidelity, T. Rowe Price and Vanguard. I decided to consolidate our holdings with Fidelity, in large part because of the presence of a local office and the opportunity to sit down twice a year with our financial advisor. I really like their web site, research and planning tools and we've also consolidated our annual charitable giving through Fidelity Charitable. I love how easy it is to move assets to Fidelity Charitable and the reporting I can get out of Fidelity Charitable. Plus, I get one acknowledgement of our giving, which makes tax prep easier. As we have moved from self-planning to professionally managed planning (with Fidelity) over the past couple years, we're confident in our investments and can focus our time on how to spend the retirement funds we've accumulated.

While we are very happy with Fidelity and have no plans to change, I also have good things to say about T. Rowe Price. I found them to be very knowledgeable and helpful when dealing with an Inherited IRA.

My experience with Vanguard was more limited than with either T. Rowe Price or Fidelity, though they have some good product offerings with low expenses.

Lastly, through Fidelity, I have access to funds from the T. Rowe Price or Vanguard families.