What Is the Best Medicare Plan for You?

Category: Medicare

Best Medicare Plan

October 24, 2023 — In case you missed all the TV ads and the envelopes flooding your mailbox, The Annual Open Enrollment Period is here again. It happens each year from Oct 15- Dec 7. During this time people can change coverages without fear of pre-existing conditions not being covered. If they have a Medigap plan and original Medicare they can change plans, select a Medicare Advantage plan, or switch from Medicare Advantage to traditional Medicare. All changes become effective on January 1.

During this time beneficiaries should examine their current coverage to see what changes might have happened within their health and drug plans – such as what pharmacies or medical providers are in their networks and the cost of prescriptions, including copays.

There are some new changes affecting your best Medicare Plan taking effect in 2024, mainly lower out-of-pocket cost limit for some patients taking expensive drugs (we’ll discuss that later in the article). The standard monthly premium for Medicare Part B enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90. That premium increases with income, up to a maximum monthly payment of $594/month for couples with income over $750,000/yr.) The annual deductible for all Medicare Part B beneficiaries will be $240 in 2024. For more detail on premiums, see 2024 Changes to Medicare. Seniors on Medicare with diabetes have already had their insulin costs capped at $35 per month since January of 2023, thanks to Biden’s Inflation Reduction Act.

Original Medicare vs Medicare Advantage plans.

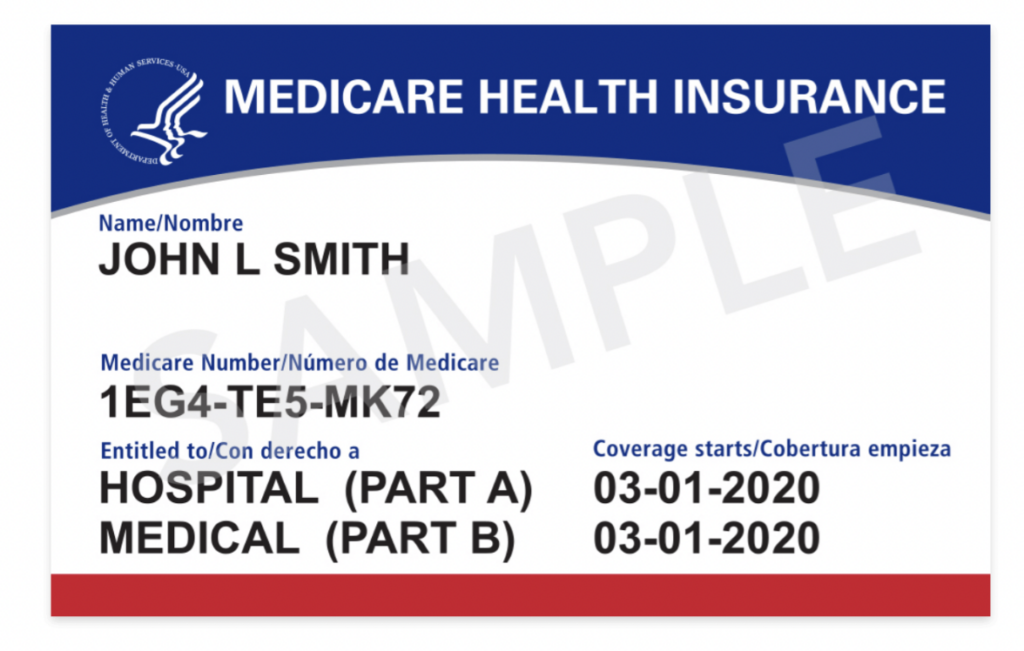

Original Medicare allows a person to go to any provider who accepts Medicare nationwide. There is no network. Original Medicare covers about 80% of Hospital and medical services, so a supplement is a good idea to complete coverage for that difference, which can be significant in case of a major illness. Supplements are called Medigap plans and are offered by private companies.

A Prescription Drug plan (Part D) should also be purchased to go along with original Medicare: premiums range from $17 to $77 per month for a reasonable plan. In 2023 the average national premium is $32.74.

Medical Advantage (MA) plans must cover what Original Medicare covers without exception. The same limitations and exclusions apply to each. Most MA plans include prescription drug coverage (MAPD). A MAPD plan covers the same things as Original Medicare but usually have some added coverages such as dental, vision, or hearing. MAPD plans are written by private insurance companies. Premiums can range from zero dollars to more per month.

There are several types of MA plans:

The most popular type of MA plan is a PPO (Preferred Provider Organization). These plans are offered by a few large insurance companies from a national network.

HMO (Health Maintenance Organization) plans are the most restrictive, offering only in-network coverage in a specific geographic area. There are very few national HMOs.

A POS (Point of Service) plan is an HMO hybrid that extends coverage to out of network providers, so it is the most flexible type of plan. If you go out of network you might pay more for service, but you are covered. The type of plan dictates which providers are are in-network or out of network.

All MA plans treat emergencies anywhere as in-network and fully covered. So when traveling your plan continues to protect. MA plans are also characterized to include co-pays, co-insurance, or deductibles for most services except preventative care. There is an annual cap on out of pocket expenses at $6700.

Comparing the costs between Medicare + Medigap and Medicare Advantage Plans

The plans are about the same cost-wise when considering the population at large. The tradeoff for people choosing a plan is how much health care you think you will utilize. If you are a heavy user you might be better off with original Medicare. But if you typically only have 4-5 office visits a year and a few tests you might see savings, because your out of pocket for co-pays and deductibles under a Medicare Advantage plan might only be $600 per year, much less than typical Plan premiums). In some states the gap is more narrow.

Many Medical Advantage plans also offer the added value of vision, dental, and hearing benefits, which make them attractive.

Can you switch back and for from Medicare Advantage to Medicare?

You can switch back and forth. But changing from Medicare Advantage back to traditional Medicare during open enrollment can be a problem for some people who also intend to purchase a supplemental Medigap policy. That is because Medigap insurers can raise premiums and/or limit coverage of preexisting conditions, or even reject applicants with certain health conditions.

Good news about drug plans for 2024!

President Biden’s Inflation Reduction Act implemented a new annual limit on out-of-pocket costs for drugs for those on Medicare. It particularly effects those who faced high costs for serious illnesses like cancer and rheumatoid arthritis. This catastrophic coverage tier means there is annual combined spending limit from insurers and recipients of $8,000. That new cap could save some people thousands of dollars per year in out of pocket costs. For more info see 2024 changes to Medicare drug coverage.

Need help finding and comparing plans?

It is easy to find and compare plans for your zip code on the Medicare Website. The State Health Insurance Assistance Program, which operates in all states, can be another reliable source of finding and comparing various insurance plans. Additionally, Medicare’s hotline is at 1-800-633-4227, or 1-800-MEDICARE.

Questions or Comments? Are you confused about what you can do in the Open Enrollment Period? Have you ever changed plans or insurers during this time. Please list your Comments or questions below.

For further reading:

Part 1: So You’re Turning 65: Here Is Your Medicare 101 Course

Part 2: “Topretirements Members to Washington: We Like Medicare, Please Keep It That Way“

Part 3: What to Do about Medical Insurance When You Retire Early

Part 4: Medicare Advantage vs. Original Medicare

Part 5: What Is Medigap Insurance and How Can I Find the Right Policy for Me

Comments on "What Is the Best Medicare Plan for You?"

Clyde says:

The article states the annual Maximum Out of Pocket (MOOP) expenses for Medicare Advantage (MA) plans is $6700. That might be the case in some MA plans, but it isn’t across the board. It is usually lower. For example, my MA plan (AARP United Healthcare PPO) has a MOOP of $3400 for in-network expenses and $5100 for out-of-network. Once you’ve paid those amounts, MA covers all future medical expenses completely, with no copays, for the rest of that year. Drug coverage, though, is in accordance with Part D rules for both Medicare supplement (Medigap) and MA. MA also covers emergency services throughout most of the developed world, whereas most Medicare supplement plans don’t.

John Brady says:

Thanks for the clarification Clyde. Looks like you have a great plan!

PS - According to the National Council on Aging: In 2024, the out-of-pocket maximum for Part C (Medicare Advantage) plans is $8,850 for approved services, but individual plans can set lower limits if they wish.

So obviously your plan is more generous than it is required to be.

Admin says:

Oops! Somehow, we have no idea how, this article was accidentally deleted and was therefore unavailable for a day or part of a day. We apologize for that.

Clyde says:

John is correct about the MOOP being more generous in some MA plans. My plan is from Palm Beach County, Florida, where we reside. We also spend some months in Hartford County, Connecticut. As I mentioned, my plan (AARP United Healthcare MA PPO) based in Palm Beach County has a MOOP of $3400; the same plan in Hartford County, Connecticut, has a MOOP of $6300. The MOOP in Florida is likely less because there is more competition among MA plans there and healthcare costs may be generally lower than In Connecticut. So your county of residence does affect MOOPs, and probably other MA plan provisions, such as copays, etc.

Beebs says:

Clyde

You do have a great plan! I live in WA. State and Humana has one with MOOP at $2900 but it cast $60 a month. Most of the plans are between $5000-$6700.

Admin says:

For another great rundown of the advantages and disadvantages between original Medicare and Medicare Advantage, check out this article from the NYTimes.

Mike says:

A new wrinkle in the Advantage world is hospitals dropping plans due to slow or no payments from insurers and excessive prior authorization rates and administrative burdens.

From https://www.beckershospitalreview.com/finance/hospitals-are-dropping-medicare-advantage-left-and-right.html

- Mayo Clinic in Arizona and Florida no longer contracts with most Medicare Advantage plans.

- Samaritan Health Services in Oregon terminated its contract with UnitedHealthcare.

- Scripps is terminating Medicare Advantage contracts for its integrated medical groups in California.

- Stillwater Medical Center, a 117-bed hospital in Oklahoma ended contracts will all its MA plans. It said that MA plans denied 22 percent of prior authorization requests; traditional Medicare denied 1 percent.

- Brookings Health System, a 49-bed hospital in South Dakota ended its MA contracts effective 2024.

- St. Charles Health System in Oregon is still on the fence but told its patients to enroll in Traditional Medicare.

- Baptist Health Medical Group in Louisville, Kentucky ended its Medicare Advantage contract with Humana.

- Adena Regional Medical Center is ending its Medicare Advantage contract with Anthem BCBS and managed Medicaid plans in Ohio, effective Nov. 2.

-Regional Medical Center in Missouri ended its Medicare Advantage contract with Cigna and plans to drop Aetna and Humana in 2024.

More here:https://www.usatoday.com/story/news/health/2023/10/27/hospitals-terminate-medicare-advantage-contracts-over-payments/71301991007/

Daryl says:

Yes, Mike, those recent articles are making us think about switching to Medigap. But the MA plan through spouse’s job said once we leave we can’t go back to their plan. I don’t look forward to all the research, including trying to predict the future since we’re healthy now and not on any medications yet. Keep putting it off.

Clyde says:

Remember that switching from MA to Medigap (aka Supplement) usually involves medical underwriting that may exclude you from Medigap due to preexisting conditions. CT and NY allow residents to switch from MA to Medigap, no questions asked. Going forward, there should be less providers and hospitals that don’t accept MA. Since the majority of beneficiaries now hold MA plans, and this percentage is growing, most providers and hospitals will not be in a budgeting/financial position to exclude MA. That would mean they wouldn’t get any Medicare business from more than half of Medicare recipients. Most facilities can’t afford to lose that much of their Medicare business since they get a huge amount of their revenue from persons 65 and over.

Mike says:

Daryl, As Clyde said switching to a Medigap policy is often not easy. Underwriting requirements vary by state but if you are healthy the process may be easier now. If you have been in your current Advantage plan for over a year in most states you will have to answer medical questions. I have a hard time finding official discussion of guarantee issue rights. This is from a commercial source: https://www.medicarefaq.com/faqs/medicare-guaranteed-issue/ I would contact https://www.shiphelp.org/ and ask for help if you are considering a change. They provide counseling and assistance where an insurance broker or agent has a financial incentive to put you in plan that provides them the most commission.

Clyde, unfortunately the hospitals can’t afford to keep proving care and not getting paid. The insurance companies certainly wouldn’t operate that way but they expect hospitals to do so. On average Advantage plans have a gross margins double of their commercial plans, they receive at least two times as much from Advantage premiums as they pay in claims! Denying claims and not paying is the basis of their business model, they are paid upfront by the taxpayer with no consequences when the fail to pay expenses on the back side. The consequences are to unpaid providers and patients that don’t get the treatment they need.

Scripps Health in San Diego had an annual loss of $75 million and terminating Advantage will affect 32,000 people. Most of those 32,000 probably blame Scripps but they aren’t the bad guy here, the insurance companies are. Another hospital had $93 million in unpaid claims from just one insurer. Advantage plans would not continue to operate if they were owed hundreds of millions of dollars from Medicare. The effect will be greater in rural ares where care could now be hours away and out of network. Eventually people will be come uninsured due to a lack of network providers even though they continue to pay for an insurance plan they can’t use for all practical purposes.

The 7 biggest health insurance companies made more than $40 billion in profits in the first 6 months of 2023 and their growth is mainly from taxpayer supported plans. Meanwhile estimates say 100 million Americans have medical debt and 62% of bankruptcies are due to medical debt.

"It's become a game of delay, deny and not pay,'' Chris Van Gorder, president and CEO of San Diego-based Scripps Health, told Becker's. "Providers are going to have to get out of full-risk capitation because it just doesn't work — we're the bottom of the food chain, and the food chain is not being fed."

Admin says:

Here is a great article that explains the issues and options to consider for your Medigap insurance. Medicare Advantage and traditional Medicare plans each have their plusses and minuses. This is an exceptionally comprehensive explanation. https://www.nytimes.com/2025/02/15/business/medicare-medigap-advantage.html?unlocked_article_code=1.xk4.7hXw.UgiUxVA8Rhts&smid=url-share

Mike says:

An omission with the Times article concerns switching from Advantage back to a Medigap policy outside of your initial guarantee issue period. There is a one year trial period after you start with an Advantage plan to switch back to a Medigap policy where the insurer must issue the policy and can't charge more for and must cover preexisting conditions. There are 9 states that offer some sort of protection if you decide to change back to a Medigap, the article only mentions 4 states that have the most generous protections. How many people missed an opportunity to change back to a Medigap plan because of not knowing about the one year trial period? Medicare makes it harder than it should be to find this information.

What's below is direct from Medicare's website at https://www.medicare.gov/health-drug-plans/medigap/ready-to-buy/change-policies

If you have a guaranteed issue right, an insurance company:

Must sell you a Medigap policy

Must cover all your pre-existing health conditions

Can't charge you more for a Medigap policy because of past or present health problems

You have a guaranteed issue right if...

(Trial right) You joined a Medicare Advantage Plan or Program of All inclusive Care for the Elderly (PACE) when you were first eligible for Medicare, and within the first year of joining, you decide you want to switch to Original Medicare.

You have the right to buy...

Any Medigap policy that’s sold by an insurance company in your state.

You can/must apply for a Medigap policy...

60 days before your coverage ends. No more than 63 days after your coverage ends.

I laughed at the woman from the company that charges a fee to help you pick a plan. She said she would pick the cheapest plan available. Besides being terrible advise I wonder if that is how the company does business? Sure we are in the business of making the least amount of money as possible. One way to dramatically lower Medigap prices would be to eliminate the "advisors" selling plans. Around 20% of the premium goes to paying paying commissions. Even if you buy directly from the insurance company that 20% is still figured into your premium. Who wouldn't like a 20% cut to their insurance cost? While the Times article correctly says agents have incentives to sell the most expensive plan it ignores the incentives to sell Advantage plans. On average Advantage plans pay 2.5 times the commission a Medigap plan does and are the most profitable type of plan insurance companies sell.