Your Worst Case Scenario About Social Security? The Answer Might Surprise You

Category: Financial and taxes in retirement

Update Nov. 15, 2015: The Budget Bill signed into law in late 2015 dramatically changes the popular “File and Suspend” strategy discussed here. People who can take advantage of it by April 1, 2016 are grandfathered, but depending on your birth date, the strategy has gone away for other folks. See our article “How the New Social Security Claiming Rules Affect You” for more.

Update March 11, 2015: The publication of this strategy on air generated a good-sized controversy about its fairness (see Comments below as well as this article in Politico: The Debt Wars: Boomers vs. Millenials.

March 1, 2015 — There has been a flurry of features lately on a subject we feel is critically important to almost every retiree – maximizing your Social Security benefits. One of the most instructive pieces we have seen is a short video segment by Paul Solman, the economic correspondent for the PBS Newshour: “Trips and Tips for Getting the Most Out from Social Security Benefit”.

Even for the experts, navigating the system can be confusing and costly. In this entertaining video Solman gives 2 major tips for maximizing your Social Security benefit. Both could mean hundreds of thousands of dollars to many people. The first is on the often misunderstood spousal benefit. The second has to do when to claim, and that depends on your answer to the provocative question, “What is Your Worst Case Scenario”.

Spousal Benefit

One day during a tennis game Solman’s friend and Social Security expert Larry Kotlikoff told him that he was entitled to nearly $50,000 in spousal benefits. Solman, the seasoned economic correspondent, was shocked that he didn’t already know this strategy (although he has since collected on it). Basically the strategy for 2 working adults who are of approximately the same age works this way. At age 66 one spouse, presumably the higher earning one, claims and suspends her Social Security benefit. When the 2nd spouse turns 66, he files for the spousal benefit (50% of Spouse 1’s full retirement benefit at age 66). At age 70, Spouse 1 claims her benefit, getting 8% more each year for waiting past age 66. Spouse 2 drops the spousal benefit and claims on his own benefit at age 70. The advantage of this strategy is clear – both spouses get their maximum benefit at age 70, but the couple also gets the spousal benefit from age to 66 to 70 on one person. In the case of an earner whose SS benefit is $24,000, those 4 years of spousal benefits add up to $48,000. According to Solman, Americans are leaving at least $10 billion in unclaimed spousal benefits like this on the table every year.

“What is Your Worst Case Scenario?”

Think about that question, because we didn’t get it right. According to the authors the correct answer is not that you die soon after you start collecting and lose out on your fair share. It is unfortunate that you didn’t get to live a long life and that you lost out on some money, but worse things could happen. Nor is the right answer that you held out for the maximum benefit at age 70 but died before the break-even point – once again you are dead and it doesn’t matter. The real answer to the worst case scenario is this: you live too long, exhaust your savings, and spend years living in poverty on a smaller than it had to be SS benefit. With our increased longevity, this is the most serious problem that most of us face. In fact in the March 4 New York Times there is a quote from The Center for Retirement Research at Boston College: “…more than half of all American households will not have enough retirement income to maintain the living standards they were accustomed to before retirement.”

So how do you overcome that problem?

The best way to avoid running out of money in your 80s, 90s, and even 100s is to claim your Social Security benefit as late as possible. For a variety of reasons a very high number of folks take SS at age 62, the earliest they can claim a retirement benefit. But every year you wait to claim will put more money in your check. If you can put it off to age 70, either by working, spending less, or using your savings, your monthly check will be 76% higher than at age 62. Yet surprisingly, only 2% of people do this. Think about that 76% bump – with the average benefit currently about $12,000 a year, by waiting you can turn that into $21,120, which by the way, is indexed to inflation. That is a huge difference for people who live into their 90s. For higher earners, the extra dollars are even greater.

Too many claim too early, and lose out

Solman and Kotlikoff, along with their co-author, financial journalist and aging expert Philip Moeller, believe that the vast majority of people claim their benefits too early. There are of course good reasons to file before age 70. One is because you have nothing else to fall back on: you are unemployed, have no savings, and will starve otherwise. Another is that you and/or your spouse have a life threatening illness – there is no point in delaying (but even then don’t forget that if the deceased spouse is the higher earning, the 2nd spouse is eligible for 100% of that higher benefit for the rest of his/her life). Many others claim early because they don’t know any better, or they are afraid the system is going to run out money and they will lose out.

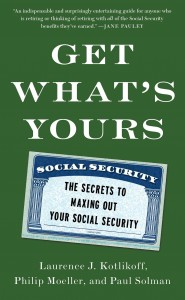

The authors address early claiming and many other questions in their new book, Get What’s Yours: The Secrets to Maxing Out Your Social Security. They think that it is nuts to worry too much about questions like: “How long do I have to wait before break even analysis”. Instead, you should worry about living in poverty if you live beyond your savings. They also dismiss the notion that you should collect because Social Security is broke. The facts are that SS has every dollar needed to pay all benefits for the next 20 years. And after that, even without reforms that could fix the system, it has enough to pay 70% of what is promised. Solman et al raise the excellent point that because Social Security is the 3rd rail of politics, no one is going to see any benefit cuts soon. No politician would be willing to let that happen. Update: Since the publication of this strategy on air there has been a mild controversy about its fairness (see Comments below as well as this article in Politico: The Debt Wars: Boomers vs. Millenials.

Want the Book?

In GET WHAT’S YOURS: The Secrets to Maxing Out Your Social Security (Simon & Schuster; February 17, 2015; $19.99 U.S.), Boston University economist Laurence Kotlikoff, financial journalist and aging expert Philip Moeller, and PBS NewsHour business and economics correspondent Paul Solman explain the traps to avoid and strategies to employ in obtaining the highest possible retirement, spousal, child, mother/father, survivor, divorcee, and disability benefits.

Find out for yourself

There are a number of tools including those online and personal consultation services to help you figure your potential SS benefits. You should start with the Social Security Administration’s free Online Retirement Estimator. After you use that you will have a much better idea of what you are entitled to.

For further reading

Our Social Security Quiz: A Learning Experience for All

What You Don’t Know About Social Security: A 3 Part Series

Comments: Please tell us how you like the video, and if will affect your Social Security claiming strategies, in the Comments section below.

Comments on "Your Worst Case Scenario About Social Security? The Answer Might Surprise You"

Lulu says:

And remember, there are spousal benefits even when you divorce (as long as you were married at least 10 years).

Lucy says:

This article on Social Security has my husband and I thinking about delaying our claim. He was going to claim his benefit at 62 but we have decided to do more research.

MARY says:

Fortunately we are doing things exactly as your experts recommend. My husband (older by a year) filed and suspended when I turned 66 so I am claiming my 50% spousal benefit. When we turn 70 we claim our full benefits. The 8% a year extra for delaying filing is adding up fast! So glad we didn't do what many of our friends did and file at 62.

Mark Martin says:

I guess I don't agree with the philosophy here. All these "reduced benefits" assume you work right up until you take Social Security. The bare-faced facts are that your SS credits are calculated from the best 35 of THE LAST 40 years of earning. So for me, retiring at age 57, at age 62 I'll have 35 earning years, and years in which I earned a professional income. If I take SS after age 62, the early years start dropping off and my SS credits will decrease. So this "fact" that everyone espouses that if you take your SS at age 62, it's 25% less than at FRA (usually 66-67) is ludicrous. And, since my wife's and my income were about the same, playing games with spousal benefits has little advantage for us. We are taking our at age 62 and avoid draining our well-earning 401Ks for subsistence income.

Editor's note: Thanks for your perspective Mark. Everyone has to decide this question for themselves, thanks for explaining your perspective on your situation. One factual correction though. SS calculates your benefit on your 35 highest earning years. Not the last 35 of 40. See http://www.socialsecurity.gov/pubs/EN-05-10070.pdf

Lulu says:

Social Security gives you a report on your life-long earnings about this time every year. That same report gives you an estimated amount you will receive at several various ages. It used to be mailed to you, but now you have to go to the site and print it out.

The very best suggestion I can give to anyone is to make an appointment with social security and discuss what you will receive based on different scenarios. It will probably amaze you. But that way you get advice specific to your earnings and situation. They won't do it over the phone or web. Do it with enough time to think about your options.

As for dipping into your differed earnings, you will be required to do that beginning at age 70.5 anyway. Look at the whole picture.

I just hate to see folks not get everything they have coming to them! They earned it!

Scott says:

I read this recommendation in column after column. I took SS at age 62, after doing much planning and some calculations. I calculated that, based upon the difference in monthly payment between age 62 and 66 1/2, it would take me 14 years to make up the money that I would collect by taking SS in the interval between ages 62 and 66 1/2. Only at this point would I begin to see a benefit from delaying the benefit. Additionally, since I had been planning and saving for retirement for my entire working life, SS is just one component of my retirement income, making my investments last that much longer. It really is important for each person to assess their own situation and not simply listen to the "experts".

setabt says:

Lulu- You are correct about being able to claim SS benefits based on your ex-spouse's earnings as long as you had been married for 10 years AND have not remarried.

Art J says:

This approach assumes you will live long enough to make waiting worthwhile. Look at the length of time to break even between filing early and waiting, and remember break even is just that... the day you start getting more. Especially if your health is in decline it may make sense to claim earlier.

Brigitte says:

Suppose you wait to collect SS at age 70 and also start making mandatory minimum withdrawals (starting the year you turn 70.5) from your deductible IRA and/or 401K. If the latter has/have a sizable balance, isn't there a danger that your 32% higher Social Security payments could push you into a higher tax bracket both for federal and state returns which would effectively negate the advantage gained by having waited? Has anyone investigated the implication of this?

Blockhead says:

Brigitte -

In order to be tax efficient regarding Soc Security, the first thing you need to do is determine what portion, if any, a taxpayer's SS benefits are taxable. Complete the SS Benefits worksheet first. Then you can determine the tax impact of filing early versus filing later. For more information, Check out Social Security Benefits Worksheet

http://www.irs.gov/pub/irs-pdf/p915.pdf

Jean says:

I worked for almost 40 years for SSA. Financial advisors are selling "strategies" that take advantage of unintentional glitches in the SSA system. The benefits received using these options are NOT money you "earned" or would otherwise "leave on the table." Spouse benefits are intended for spouses who did not work or whose own retirement benefit is less than half of their spouse's retirement benefit. Being able to file at full retirement age and suspend benefits so a spouse can receive was intended for situations when a worker chose to work past full retirement age but had a spouse who was at least 62 and could otherwise not collect benefits. Delayed retirement credits which add 8% per year from full retirement age up to age 70 were intended to reward people who continued to work and pay FICA taxes. DRCs were not intended for people who are receiving spouse or widow(er) benefits, but the glitch is that the law says they are paid to people who are not receiving their own retirement benefit. It's unfortunate that Congress did not eliminate DRCs and the suspension for a spouse option when they eliminated the earnings test after full retirement age in 2000. Congress could easily act to close these loopholes as they did when financial advisors used to encourage people to file for benefits, then later withdraw the claim, pay back the benefits received (without any interest collected), and start receiving at a higher rate. Now the withdrawal option is very limited. It's ridiculous to say these unintended windfalls don't hurt the retirement trust fund. These options tend to be used by wealthier people who live longer than low income people who have less leeway. It's equivalent to "Medicaid planning" in which people plan ahead to conceal resources in order to force the government to pay for their future nursing home care. Many of the people who take their financial advisors' advice to use these "strategies" are likely the same people who complain about the government benefits received by truly needy people. SSA works so well because almost all workers have a stake in it. It doesn't work well when people think it's ok to game the system to collect more than intended.

elaine says:

and us single people just keep on truckin' Not much choice

SandyZ says:

Also, the "system" denies SS benefits that have been earned by thousands of teachers across the country due to the fact that they also collect small state pensions. Paying into SS for many years in part time jobs and summer employment is disregarded and considered a windfall! Seriously! Even worse, should said teacher's spouse pass away, survivor benefits are also denied! The teacher is then left to exist on her, or his, modest state pension for the rest of her life. Yes Jean, the system needs repair and FAIRNESS needs to be applied to every person who has paid into and is eligible for benefits! It is infuriating that the payments that I have made into SS will benefit the gamers of the system, and I will receive nothing for 40+ years of contributing to their comfortable retirement years!

Carolyn says:

I am 65 and have not yet filed to collect SS. My SS statement estimates my benefit if I continue working at my current earnings rate, but I have already stopped working. How can I calculate my future benefit assuming I will have no more taxed SS earnings, but am delaying filing? Thanks.

Kate says:

Jean - I understand what you're saying, especially since I'm one of the "lucky" people who will be able to take advantage of a loophole. I called SS and learned that my spousal widow benefit at age 62 is approximately $1880/mo. (My spouse was nearly at the maximum and retired at 66). If I don't collect his benefit at 62, I was told my spousal percentage of his benefit will continue to grow until it reaches 100%. My own benefit at 66 will be near the maximum too. I will be able to take widow's benefits, and delay collecting my own benefit until age 70 to maximize it. I don't view myself as a "gamer" of the system. While I usually agree with SandyZ's posts, I have to note that we are all paying school taxes throughout our lives, a large portion of which paid for teacher pension and health care contributions. We are all stuck paying for each other.

ella says:

I have a question i haven't seen before (hopefully an expert will see this). My husband took 'full' retirement quite a few years ago (it was 65 years + due to the year he was born), and then he continued to work for over 10 years. Would he have been better off waiting until a later date, or because he continued to work is his final benefit the same as it would have been had he waited. As for me, is my spousal benefit lower than it would have been if he had waited?

Many thanks!

Kathy says:

Carolyn, go to the SS website. They have a calculator that lets you plug in different scenarios. We used it to help us decide wether to take SS early or wait until 66. It is pretty easy to use.

Louise says:

This is a very good chart to see Full Retirement Age: If You Were Born Between 1943 And 1954

http://www.ssa.gov/retirement/1943.html

Hubs 63rd Birthday is today and we got the 'award notice' yesterday from Social Security that his first check will come in May! He retires April 1st! We applied on line. It was fairly easy and then a gentleman from SS called to confirm details. I will apply for my SS closer to the end of the year.

Another chapter in our lives...

Louise says:

Just wanted to add that we are taking our SS at age 63 (Hub) and I am taking it at age 62. With SS being the big chunk of our income, we will only need to take minimal amounts out of our savings, some from an inherited IRA and from another IRA to keep below the threshold of income to qualify for Obama credits. This SS income is GREAT and keeps our precious IRA's chugging along. To retire 'young' is the dream we have had for many years! For us, this is the way to go! We will not regret taking it early either! To each his own!

15 more working days to go for Hub!

Kate says:

Congratulations, Louise. Can't wait to join you both! I bought one of those little digital "Retirement Countdown Clocks" from Amazon, and I check it every day LOL.

jim says:

I am wondering what Louise was referring to when she wrote "to qualify for Obama credits" on 3/7.

Louise says:

Thank you Kate! What date is your Retirement Countdown clock set to?

Believe it or not this first year of retirement has required a lot of plotting and planning. We never thought it would be so involved.

Obamacare is on of the biggest hurdles in this first year. We still have to keep an eye on our income to make sure we don't go over the income threshold otherwise we will lose out on the credit which is almost $1,000 towards purchasing insurance. So depending on Hub's final income, when he leaves his job, will determine when I take my SS benefit. I may wait till January but have to be very careful because $1 over the threshold kicks you out of getting the credit.

I also learned that there is a special earnings limit rule for the first year of SS if you retire mid year. Read this for more information on that: http://www.ssa.gov/retire2/rule.htm I was worried that my Hub would go over the limit where you have to pay back $1 for every $2 earned over $15,720 because he has not reached full retirement age. I know he will exceed that amount but according to the special rule it won't matter how much he makes! That made me very happy!

The one thing I haven't figured out yet is Dental Insurance. It appears to be very expensive! I live in CT so if anyone has any input on where to get good dental insurance at low cost please let us know. Dental insurance through payroll deduction is so cheap, this really has surprised me to see such high costs when buying on your own!

Vicki says:

We just started getting insurance from the government website as my husband was laid off so we are both officially retired now.

With government insurance you can make up to around $79,000 and still qualify for a credit. We both get SS and my husband got severance until the end of February. Our yearly earnings will be between $50,000 and $55,000 for this year. Our insurance cost is $430 per month. If we did not qualify for the credit we would owe nearly $1500 per month.

As for dental, my dentist said most people just pay for dental care. If you need crowns or root canals, may God help you! Regular cleanings and exrays are pretty reasonable.

Vicki

Louise says:

Jim, Depending on family size and income you may be entitled to get a credit to apply towards buying health insurance. My family size is 2 people and to get an approximate $1,000 credit a two person family cannot make more than $63,720 per year. See this article: http://www.compliancedashboard.net/hw-2015-poverty-guidelines-and-health-care-subsidies/

botch57 says:

Louise, the special earnings limit only applies if your husband takes his SS and then plans on working part time. If he doesn't work part time and only collects SS, the rule does not apply to him.

Jim C says:

My wife and I were both on Obamacare (ACA) for part of last year. I just did our taxes and found that we earned more than what I had originally projected when I applied for ACA. We owe about 800+ dollars so don't make the same mistake I did, make sure your estimated income for the year is accurate.

I am now on Medicare effective Feb. 1st but my wife will be on ACA until September when Medicare kicks in for her. Keep in mind that these subsidies to help pay for ACA could go away in those states that did not setup their own insurance marketplace. The Supreme Court will make a decision on this sometime in June of this year.

NoVa says:

On dental insurance (or any health insurance) visit this website: www.ehealthinsurance.com.

Louise says:

Botch57

If you haven't read the special rule here it is: http://www.ssa.gov/retire2/rule.htm

It is a special rule that applies to earnings for one year, usually the first year.

If you retire mid year and for an example you earned $30K at your job before you retired, even though you have almost doubled the $15,720 allowance for the year, the special rule is that for the first year they only count earnings you make AFTER you start collecting Social Security.

After you retire and If you take a job and earn more than $1,310 a month that is when you will get penalized.

The link for the Special Rule shows and example of a John Smith who retires mid year and has made a total of $40K but due to the Special Rule he can collect SS without penalty and did so for 3 months. After the three months John Smith worked more than 45 hours a month for 3 months which is another stipulation you get penalized for and he wasn't eligible to collect SS for the last 3 months of the year.

My husband has no intention of taking any jobs so that is not going to be an issue.

Art says:

For Jim and his question about Obamacare limits (and other limits too):

http://news.morningstar.com/articlenet/article.aspx?id=686983

Louise says:

Jim C. Thanks for the advice on the estimated income caution. I have seen our accountant and she and I went over all the income we expect for the year. Delaying my Social Security a few months is one strategy I may consider if we get too close to the income limit. Another is to draw from savings as it is not considered income. I am aware of the subsidies and the possibility of it going away but CT set up their own marketplace so my State should be able to keep subsidies. However, I spoke with an insurance guy and he told me that the subsidies were only approved for 3 years. So 2016 could be the last year unless future subsidies are approved.

My Hub and I are in a similar situation as you and your wife. Hub will be on Obama care for two years then go to Medicare. I will have to continue on Obama care for an additional 1 1/2 years after he goes on Medicare.

Kate says:

Louise:

My countdown clock is set to age 66 right now. It's about 1455 days, which includes weekends, holidays and vacations. I may re-set the clock back to age 65, retiring when I get to Medicare eligibility. It gets harder and harder to get up and go into a very stressful work environment every day.

Unfortunately, I expect to be laid off by my company at any time now that I've hit 62. I've been around long enough to see a lot of hidden age discrimination in corporate America. I'm using this time to try to accrue a little more money in my 401K, doing retirement research, finish paying off debt, and getting ready for the next stage of life. I will have about $45K-$50K a year to live on if I get laid off today, between widow benefits and non-401K savings. At 66 I can switch to my own Social Security plus 401K withdrawals, for a more comfortable $60K-$65K a year. It's scary to think about giving up work benefits and a steady paycheck, but it's also exciting. I am looking forward to that first morning when I can watch the morning news with my coffee, and not have to go into the office....

Louise says:

Kate, I was laid off almost 4 years ago at age 57 1/2 and could not get a professional job as I had held for 22 years. I still look for jobs but there is nothing much out there and like you said age discrimination is definitely a problem. I turn 62 in August and hopefully will take SS then but I have to review all of our income so we don't go over the Obama care income limit.

Good to see the writing on the wall and do whatever you can to prepare for the worst. I had no idea I was getting laid off. One minute I had a job and the next moment I was walking out the door with my 'severance package'. Four others were also laid off. Glad it wasn't just me or I would have really felt discriminated against! Funny though, 4 of us were in our 50's and the fifth one was a token 23 year old part time worker. Then right after that, they hired one very high paid young Ph.D.

You are certainly going in the right direction paying off debt and saving more in 401K. Also, I might suggest you do your homework on the Widow Social Security. You can probably stay on it till you are 70 years old THEN switch over to yours which will have probably grown a lot. Do the math and see if waiting makes sense or not. My Mother was on Widow SS and switched when she turned 65 but I don't think she had any idea she could wait longer. I think she would have done so if she knew.

Ah, yes, Hub will be a contented pussy cat with his coffee, morning news and newspaper! We have a nice deck with awning so we may just have breakfast out there too!

1455 Days! Sounds better than years! LOL! Hope you can do it sooner!

Jim C says:

When I applied for SS at age 62 I told them I was planning to continue working partime. I estimated my gross income to be over the limit by about $3000.00. They in turn held two SS checks that year. When I filed my tax return the adjusted gross fell under the income threshold and SS payed out the two checks held by them the previous year. The annual cost of medical insurance (about $6000.00) through my job came off the gross income resulting in an adjusted gross below the maximum amount you could earn that year. I was pleasantly surprised assuming that SS was looking at total gross income only.

Admin says:

March 11 Update: Professor Kotlikoff's promotion of the "file and suspend" strategy has provoked a mild controversy in the national press. Some heads were wagging since he had recently testified to Congress that the government is flat broke. Politico has an interesting article explaining this called "The Federal Debt Debate: Boomers vs. Milllenials". http://www.politico.com/story/2015/03/the-federal-debt-debate-boomers-vs-millennials-115961.html While most people seem to agree that the file and suspend strategy is unfair and a bad idea for the soundness of the SS program, the controversy might help lead to steps to reform the system.

KT says:

The entire topic of Social Security frustrates me, because just as SandyZ described, I am a retired public school teacher who will never see one nickel of the thousands of dollars I contributed to Social Security. I did not embark upon a teaching career until age 35, but I dutifully contributed to SS for all my work years prior to my teaching. Also, since my retirement a few years ago, I have been working part time and, once again, paying into SS every month. However, since I receive a modest pension for having taught 25 years, I am prohibited from collecting my own Social Security stipend. And, no, paying school taxes does not, in any way, contribute to teachers' retirement -- not in my state, anyway. The Windfall Elimination Provision (so ironically named) needs to be repealed. It unfairly punishes teachers and could well persuade many potentially fine teachers from entering the profession at all.

ella says:

I am amazed to read that teachers do not receive ss income after contributing for years. Is this true in every state or just some???

Sharon says:

In PA, teacher pensions and health benefits are the largest chunk of school taxes. On a $300K house, my local school taxes for a suburb of Allegheny County are approximately $6K a year. That doesn't include local or county real estate taxes -- this is just for the schools. I've never hear of teaching pension funds that are funded solely by teachers. If that is the case, it definitely isn't fair since the reason for the windfall tax is to prevent double dipping (ie, having teacher pensions be paid by both school taxes and SS taxes). I definitely agree that it doesn't seem fair if KT and others are precluded from collecting SS for the years in which they weren't covered by a teacher pension funded by taxpayers. It seems like teacher unions should compare the pension benefits on teacher salaries vs. SS benefits for equivalent wages in private industry, and fight either for equalization or to terminate the publicly funded portion of pensions in exchange for SS benefits.

Tony says:

STATES EXCLUDE TEACHERS FROM SOCIAL SECURITY

Alaska

Maine

California

Massachusetts

Colorado

Minnesota

Connecticut

Missouri

Illinois

Nevada

Kentucky

Ohio

Louisiana

Texas

SandyZ says:

Thank you Tony. I currently live in Maine and I can tell you that we have lost many excellent teachers who cross the border to teach in NH border towns for this exact reason. Yes, we contribute through payroll deductions to our own retirement fund, but the taxpayers also contribute a small amount. What is irritating is that the OTHER jobs that most of us worked during our careers - summer hospitality jobs, moonlighting during the year as painters, carpenters, delivering papers, working weekend retail jobs etc...in which we paid into social security are considered a windfall in the states listed above! To pile on even more, when a teacher's spouse passes away, the government also denies us survivor benefits!!! I have friends who devoted their lives to education and are now substitute teaching in their 70's and 80's and grocery shopping at the local food pantry because they cannot afford groceries on their 1200-1500 dollar monthly pensions. Very sad! How embarrassing that our country allows this to continue - the SS system needs fixing!

says:

SandyZ you are speaking about state governments, correct? Like Ella, I am amazed to hear this.

Side note to SandyZ....Ii am taking an OLLI class at Dataw.

Louise says:

This may seem like a stupid question but if you are a retired teacher in a state that does not allow you to collect SS could you move to another state that does not exclude you from collecting SS?

I think it is outrageous that some States have excluded teachers from SS!

My Hub and I worked for corporations and we both walked away with a pension from them. We live in CT. He draws a monthly pension and I took mine as a lump sum. What makes this any different than a teacher with a teacher pension and a SS check as long as they have paid into the system for 10 years like everyone else? We will have our pension money and SS.

My Father was a State of CT employee and was able to collect a State of CT pension AND SS. CT is on the list that doesn't allow teachers to collect SS! Why would State workers be allowed to collect both?

I would be going over the boarder too to teach elsewhere if I were a teacher!

Seems very wrong. Does anyone know WHY teachers have been targeted?

ella says:

Thanks from me, too, Tony. Here's a bit more info.

"When Teachers Go Public

State teacher retirement benefits may qualify as a government pension in some states and could prevent you from drawing Social Security or result in reduced benefits. If you live in Alaska, California, Colorado, Connecticut, Illinois, Louisiana, Maine, Massachusetts, Missouri, Nevada, Ohio or Texas, you are not covered by Social Security because you are a public employee, according to the National Education Association. In Georgia, Kentucky and Rhode Island, the NEA notes you may not be covered in some localities.

In New York, retirement benefits and Social Security benefits are not related, according to the New York State Teachers' Retirement System. The NYSTRS notes, however, that if you retire with a tier 4, article 14 benefit, your NYSTRS benefit will be reduced. In Texas, eligibility for a Teacher Retirement System pension does not disqualify you from receiving Social Security benefits, however, your benefits could be reduced if you worked in a job in which you paid Social Security taxes for at least 10 years."

Interesting. I guess NY (my state) is not always the worst!

SandyZ says:

Easily amused and Louise, no, moving to another state does NOT change the Federal SS rules for these 14 states. We will be moving to SC from Maine and the SS that I paid into the system for many years in summer work is gone, for the rest of my life. As well, my husband has worked in the private sector for his entire career, and the survivor benefits that he has earned, will never be available to me should he pass away either! Thank God he also grew his 401K during his career! Too late for me, but if you have kids who are teachers in these 14 states, advise them to plan accordingly! It never occured to me at 30 years old how much of a sacrifice I was making...oh well, still good to be retired!

LS says:

There appears to be a lot of confusion and misinformation on this topic listed here. There are two provisions in the law which impact individuals who do not have at least 30 years of substantial Social Security earnings regarding entitlement to Social Security benefits. These are the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). The WEP will reduce the amount of your SS if you receive a local, state, or Federal pension from wages not covered by SS. The GPO will reduce or eliminate the receipt of spousal SS if you receive a local, state, or Federal pension from wages not covered by SS. The Social Security website has fact sheets on these two provisions that explain the reasons behind these provisions and how they are computed. I suggest that rather than rely on second hand information, you go to the SS website and read the official explanation.

Stan Rajczewski says:

I have always lived in Ct., but I taught English for 31 years at Mt. Vernon (N.Y.) High School for 31 years. I still substitute at Newtown (Ct) Middle School. I receive my New York State pension, my social security, and pay from substituting. Every day I work with Ct. teachers. I think it's difficult for them to realize the benefit and security that comes form receiving SS. I was hired to teach at 23. I had no concern regarding retirement and social security. I tell student teachers, interns looking for a teaching position and youth I know who are going into teaching that they should become certified and attempt to teach in New York rather than Connecticut. Just like I was at 23, they are unconcerned about gaining an additional certification to teach in New York. I was as blind about my retirement years when I was 23!

ella says:

Good for you, Stan. Keep telling them! Someone at some time will hear you, and years later will thank you every day they receive SS in addition to their pension!

SandyZ says:

Or better yet, LS, go into your local SS

office and they will give the bad news in person! My husband and I went in together and they were helpful. Stan, Thank you for your many years of service!

Louise says:

SandyZ, do you have an SC destination picked out or are you still in the decision process? I have been to Myrtle Beach several times on vacation and always loved it. We stayed in North Myrtle beach. There are several things I like about Myrtle beach and one is the airport and another might seem ridiculous but there is a Costco there too. I would be interested in the surrounding area to be away from tourists though. When you are on vacation that's one thing but to live with it day and night would be annoying. Anyone have suggestions on good locations out of the hub bub? I had a friend who moved to Longs, SC. Not sure what is there or if it is a desirable place to live. I would be interested in buying new construction. Anyone know of any new communities without HOA?

Louise says:

Scott wrote this March 4th: I read this recommendation in column after column. I took SS at age 62, after doing much planning and some calculations. I calculated that, based upon the difference in monthly payment between age 62 and 66 1/2, it would take me 14 years to make up the money that I would collect by taking SS in the interval between ages 62 and 66 1/2. Only at this point would I begin to see a benefit from delaying the benefit. Additionally, since I had been planning and saving for retirement for my entire working life, SS is just one component of my retirement income, making my investments last that much longer. It really is important for each person to assess their own situation and not simply listen to the “experts”.

Scott, I am in 100% agreement with everything you have said! I also did the calculations and came up with a similar scenario. As you said, SS is just one component of our retirement income. We have our other savings invested with a Financial Planner. We plan to take very little out of investments at this time. Our two SS checks will be a huge portion of our retirement money and we will withdraw from other sources as needed. Our SS checks will help keep our other investments in tact so they can grow. The other side of the coin is to withdraw from investments and let the SS grow. However, between Hub and I starting to collect early (Him 63-3 years early, Me 62-4 years early), we will have collected approximately $144,800 by starting EARLY! Everyone has different thoughts on this subject and there is no right or wrong. To each his own! Can't wait to apply for my SS and hopefully I can do it in August!

SandyZ says:

Louise - congrats on your planning and savings! Go and enjoy it soon! Yes, we have purchased a lot in a gated community in Beaufort SC. Things are on hold at present, as our builder with whom we designed our house, passed away in December. We are starting over with a new builder, hopefully soon! Visit Beaufort if you are planning another trip - nothing like Myrtle Beach!

Louise says:

SandyZ, How great you are building a new dream home! We built our home 40 years ago and still are living in it today! My Father was into building Spec. houses and guided us on building our home. I am ready for a different style home that is one story and to put in a bathroom that would be handicap accessible. Neither of us are handicapped but our current bathrooms are so small that it would be a nightmare if anything should happen.

How did you choose Beaufort, SC? Do you have friends or relatives there? I don't know anyone in SC. Makes it hard to choose an area.

Editors note: Sandy and Louise. Please try to keep comments on this Blog post to Social Security. We are going to move your comments about SC to the 100 Best Places to Retire blog post.

Brigitte says:

LS's comments about the WEP and GPO are correct. The intention of the WEP was that individuals who have a government pension as well as having worked less than 30 years at jobs covered by SS would not end up being treated the same as people who had a low income throughout their earning years since the SS formula favors the latter with a larger percentage. The WEP greatly reduces, but does not totally eliminate the SS benefits a public employee has earned through other jobs. Sounds just, but often does not turn out that way. My husband retired with a Federal Pension and also had 10+ years of earnings covered by SS. Ironically, while he was an active employee older than 66, he was entitled to his full SS benefit (85% of which was taxable) in addition to his salary. The moment he retired, his SS benefit was cut by more than 55% because of the WEP. He chose to receive a reduced pension so that I will be entitled to the maximum 55% survivor's benefit. (Had he worked only in SS jobs, my widow's benefit would be 100% of his benefit.) I have paid into SS for more than 40 years, but should I predecease my husband, he is not entitled to a survivors benefit based on my SS because of the GPO.

Another interesting quirk is the tax situation of people receiving only a public pension. The February 2005 edition of the NARFE magazine compared the tax situations of two one-earner couples, one covered by SS with the spouse receiving a spousal benefit and the other receiving only a Federal Pension equal to the previous couple's combined SS payments. Turns out the couple receiving only the Federal Pension paid $4104 more in Federal taxes each year. (For a single person, the additional federal tax for the Federal pensioner was $2931 per year). Go figure!

Kay says:

New budget deal has changes to deeming and file and suspend. See pbs news hour article.

Editor's note: We just wrote an article on this topic: Current Budget Bill Could Eliminate File and Suspend Strategy Thanks for the tip Kay - this is potentially a game changer!