Didn’t Sign Up for Part D Medicare – Double Ouch!

Category: Financial and taxes in retirement

November 24, 2015 — There are many classic examples of the kind of mistake made by your Topretirements.com editor. They include experts who don’t listen to their own advice: the cobbler with holes in his soles, the doctor who still smokes, the plumber with a leaky faucet – you get the picture. We’re sharing our mistake – the kind you would think someone who has a good grip on retirement matters wouldn’t make – so you don’t make the same one. Our mistake was not to sign up for Part D, prescription drug coverage, when we originally enrolled in Medicare. If you don’t currently have prescription drug coverage, consider yourself forewarned: you still have time to take corrective action during the current Medicare enrollment period, which ends December 7, if that is what you decide after reading this article.

2 very serious consequences

Failing to sign up for Part D insurance when you first become eligible can have two serious, even disastrous consequences:

1. You pay a penalty of 1% a month for every month you do not have “creditable” prescription drug coverage. In our case, it means a 30% penalty on our monthly premiums – forever!

2. Inability to get coverage immediately. There is an open enrollment period every year from Oct. 15 – Dec. 7 where you have the option to sign up for Part D insurance (or change your Part B or C plans). But let’s say you don’t take that option, and next February you are diagnosed with a serious medical condition that requires $25,000 worth of drugs, taken immediately, to treat it. Even if you register for Part D on Oct. 15 you are out of luck until January 1 – that’s the earliest your new plan can kick in. Although the odds are low of this (or something worse) happening – it is possible!

To Part D – Or Not

When you hit age 65 and sign up for Medicare you have many choices. Part A is the hospital component, Part B or C cover doctor and outpatient type claims, and then there is Part D – prescription drugs. Part C programs typically include prescription drug coverage, so you don’t need Part D if it is included there. In our case, at age 65 we signed up for Part A, Part B, and an commercially available Medigap policy from Anthem. When it came to Part D, we were like a lot of people we know – we don’t currently take any prescription drugs, and our insurance agent didn’t think it a pressing issue. Knowing we could always sign up in the future for the insurance, we opted not to take a Part D policy.

Expensive drugs made us reconsider

The recent experience of a relative drove home that it might be a smart idea to get Part D now, some two years after initially signing up for Parts A and B. Our sister-in-law had a terrible cancer and the drugs she needed were frightfully expensive – some of hers’ were over a $1000 a dose. Fortunately she was covered by Part D for most of that.

Last week we took advantage of the current open enrollment period to sign up for Part D, Medicare drug coverage. These plans are run by insurance companies approved by Medicare. Each plan can vary in cost and drugs covered. But because we delayed doing this for 2 years, we face a hefty penalty on our premiums.

How to sign up

If you go to the Medicare.gov website you will find their helpful “Medical Plan Finder“. (If you search on the Internet for Medicare Part D you will find other sites like it). At the Medicare site you start by typing in your zip code and then are asked what type of Medicare plan you have now. Then you enter what drugs you take now to get an estimate of how much your Part D premium will be. If you do not take any drugs you check that box. From there you will be able to compare an array of private Part D drug plans, along with the monthly/annual costs, deductibles, etc.

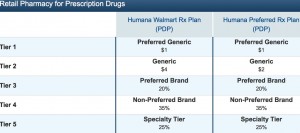

In our sample search we indicated that we currently do not take any prescription drugs. The cheapest plan we found was from Humana Walmart, which had a monthly premium of of $18.40. The most expensive plan shown was Humana Enhanced, with a monthly premium of $70.90. Other than the drugs you take, part of what drives the costs are the deductibles and co-pays – which are typically higher in the least expensive plans. It is up to you to decide which plan is the best for you, and how much out-of-pocket/self-insurance you can handle. If you check the “Compare Plans” feature you will be able to compare various plans on a variety of issues, including on some sites, information on the various tiers of drugs, as shown below.

No “Creditable” drug coverage means a penalty

You may owe a late enrollment penalty if you go without a Medicare Prescription Drug Plan (Part D), a Medicare Advantage Plan (Part C) that offers Medicare prescription drug coverage, or some other type of creditable prescription drug coverage for any continuous period of 63 days or more after your Initial Enrollment Period. The amount of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. The penalty is added to your Medicare Part D monthly premium, and you’ll have to pay it for as long as you have a Medicare drug plan. The reason for the penalty seems hard to argue with – you can’t insure your house for fire after it burns down. All of those years you paid the premium without an incident help assure that there will be money there when you file a claim.

How much is the Part D penalty?

The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Medicare calculates the penalty by multiplying 1% of the “national base beneficiary premium” ($34.10 in 2016) times the number of full, uncovered months you didn’t have Part D or creditable coverage. The monthly premium is rounded and added to your monthly Part D premium. The national base beneficiary premium may increase each year, so your penalty amount may also increase each year.

Example:

Mrs. M was without creditable prescription drug coverage from June 2012–December 2014, so her penalty in 2015 was 31% (1% for each of the 31 months) of $34.10 (the national base beneficiary premium for 2016) or $10.57 (rounded to $10.60). She pays $10.60 each month in addition to her plan’s monthly premium in 2016. If the national base beneficiary premium goes up in following years, the 31% premium will be applied to that number.

Bottom line if you don’t have Part D insurance

If you are currently enrolled in Medicare but don’t have Part D insurance (or prescription coverage from your Part C program), you have a choice to make. You can quickly sign up for it now during the enrollment period that ends Dec. 7, and face a 1% a month penalty on your premium for every month you delayed signing up. (Think about how much that was when your editor enrolled his 98 year old mother for the first time – 396%!) You can try to balance that with the consequences of not signing up – higher premiums if your future drug formulary includes expensive drugs. Or worse, finding yourself needing exorbitantly priced prescriptions and a long time away from an open enrollment period. The choice is yours, but it is something you definitely need to consider. Special shout-out to Pat and Lou, whose similar experience helped inspire this article!

For more detailed information about signing up, including instructions on how to join, visit Medicare.gov. You can also call 1 800 MEDICARE (1 800 633-4227)

Comments? Did any of you delay Part D and find yourself with a big penalty or other surprise. We look forward to your Comments in the section below.

For further reading

Final Medicare Part B Premiums for 2016 Announced

Open Enrollment for Medicare and Obamacare – It’s Here

Now That You Are 65 – 10 Things You Need to Know

Comments on "Didn’t Sign Up for Part D Medicare – Double Ouch!"

Marsha K says:

I have read this twice but still not sure... We will have an employment based secondary insurance policy which includes prescription drugs. Confirm, therefore, I will not have to sign up for Medicare Part D when I do turn 65. What if my employment policy eliminates prescription coverage in the future? Will I be penalized?

Kgk says:

marsha, just check and see if your former employer has creditable insurance (most likely yes) then you will be fine.

Karen says:

This is my 5th year without part D. If one has less than $24,,000 income per year, than there are several programs that will provide free or low cost medications for those of us on Medicare. I choose not to buy a drug plan because I have allergies to many drugs. Also many drug stores have prescription saving plans that provide similar savings to part D plans. If I need expensive drugs for cancer, I would probably go the clinical trial route. With my allergy problems, I won't handle the cancer drugs anyway.

Bob J says:

I have a question similar to Marsha's. My wife is 66 and not employed. She did sign up for Medicare part A but not C or D because she is fully covered on my employers policy. (I still work). She has MS and takes very expensive prescription medications. When I retire and we need part D coverage, will she be penalized?

elaine says:

Marsha, my part B is through one of my former employers and they do cover Part D and I was told by them not to sign up for part D when I "became of age". the material for this open period lists the prescription coverage. since I am covered, I should not have a problem...even if they drop coverage. It is meant for those who have had no coverage. The penalty is meant for those who do not pay until they need coverage...trying to game the system. Unfortunately, it is those "non scammers" who get caught with an innocent mistake.

Karen, if allergic to many drugs, you probably not be choosen for a clinical trial. Have you tried to get into a clinical trial involving drugs and been successful? The drug store route may work best for you.