Are You Prepared to Die?

Category: Family and Retirement

March 27, 2023 — If that is an unpleasant question, it certainly is. Less than half of Americans have discussed their end of life plans with a relative. The result of that inaction is incalculable trouble and work for those left behind. Like finding out that all your money is a checking account you don’t have access to. Or not knowing what your debts or assets are, or having no idea whether your loved one would like to be treated if he is a coma with no chance of recovering.

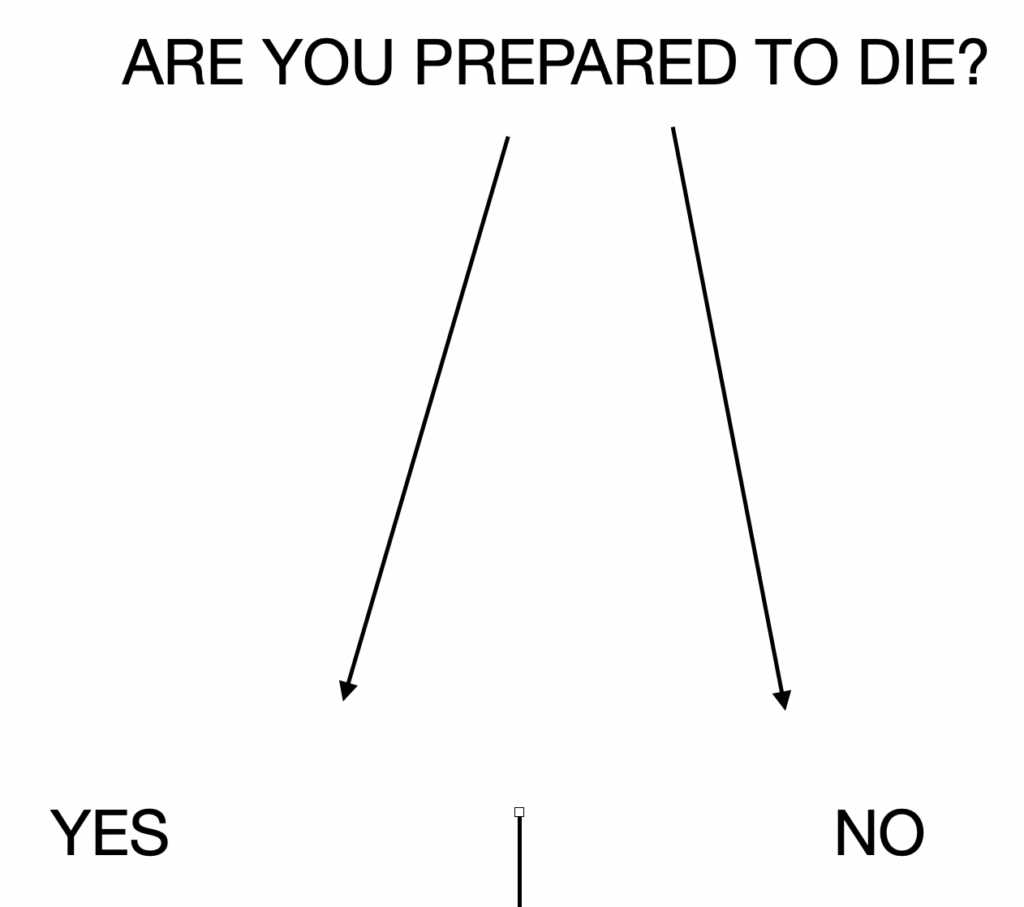

The New York Times has published a very handy decision tree in an article “I Asked My Mom If She Was Prepared to Die“. It can be a big help to cope with the many plans and decisions that need to be made, and avoid needless anxiety and work for your survivors. It has are simple questions like, “Have You Thought About What You Would Like to Happen to Your Body?”, and your answers help guide the family. Another question is: “Have You Thought About What Will Happen to Your Stuff?” If you answer “No”, then the answer is: “Well, You Should, because otherwise your survivors could end up in court.” Then it tells you how to create a will or a trust to avoid that all too common situation.

Bottom Line

The importance of being prepared for your death cannot be overstated. As one person quoted in the article said, the number of important decisions that have to be made immediately in the 24 hours after death is staggering. Do you really want to put your loved ones through that without your input? Now is the time to be decisive, so take a look at this helpful article and get busy. You will be giving your family a break in what is likely to be a difficult time for them.

Comments? Have you made end of life plans? Do you review them periodically, and have you discussed them with family members? Please share your experiences in the Comments section below.

Comments on "Are You Prepared to Die?"

RichPB says:

The NYT article is very good. In our world, no death event is truly simple. I was my mother's executor 11 years ago. While all the suggested actions were covered and there were no surprises and no major inheritance, the exhaustive legal requirements are rather complex and time consuming. Leaving my heirs without these steps taken WILL NOT HAPPEN! Few heirs, small but decent inheritance, but the impact after a death is still huge and we should all do what we can to ease it.

.

.

RichPB says:

ADMIN: With this new site, I haven't been able to review and correct my comments before submitting other than the last three lines (and there is no edit/correct after the fact). My thanks for assisting on my last long post, but we should be able to proofread before submitting.

Admin says:

Thanks for this and all your Comments Rich. It sounds like maybe you are composing on an ipad or iphone. On my computer I can see everything I type, before I hit Submit. It is a Wordpress Limitation that users can't edit their comments. That said, anytime you need to correct something just let us know and we will be happy to fix.

RichPB says:

Ok, thanks. It was my Android phone, but there are workarounds (copy longer posts from an editor or use on my laptop). Special thanks because I know how much you must handle to host TopRetirements! :)

Daryl says:

Had two very different experiences with both parents passing within an 11 month span. My mother’s was a nightmare since she was so secretive, untrusting, no list of passwords for her online accounts, refused to discuss any end of life subjects, etc. My dad witnessed that mess and let me get everything in order for him (although I bitched so much about my mother’s probate, he might have feared I would strangle him prematurely…) We even joked together about where to spread his ashes which lightened a heavy time. Give your kids a break and make it easy for them, they will already be trying to function under crushing, mind-altering grief.

Bill Bamber; Edmonton Alberta says:

Am getting to be "An Old Guy!!" & wish to do "the Right Thing!!" Got an Older Sister who now is in "Retirement Home" as Husband has passed & She is losing it. HRH reminds me that I am "Losing It" too. My Reply Comments are reserved at this Time!!

Anyway; going to write & see a Lawyer shortly. I do owe My Kid's & GKid's to do It "Right".

Toni says:

When we retired to Florida in 2012 we moved away from Texas and immediate family. I started every January creating a Word document with all of our assets listed along with addresses, phone numbers, account numbers, etc. for everything to do with financial, our home, our personal assets, our will, bank accounts, funeral arrangements, etc. and shared it with our sons. I also created a Password Book that I keep updated and family knows where it is located. I am constantly amazed at how every January there is something new to add or change! I keep a copy in our safe deposit box, a strong box at our home and send our sons a copy. Peace of mind!

Admin says:

Wow Tony, that is a great way to tackle this issue. It is a great blueprint for us all!