2017 Medicare Part B Premium to Rise $4.10/Mo. for Most

Category: Financial and taxes in retirement

Nov. 11, 2016 — The Centers for Medicare & Medicaid Services (CMS) has announced that 2017 premiums for the Medicare inpatient hospital (Part A) and physician and outpatient hospital services (Part B) programs will increase.

Because of the low Social Security COLA, (0.3 percent for 2017) a statutory “hold harmless” provision designed to protect seniors will largely prevent Part B premiums from increasing for about 70 percent of beneficiaries. Among this group, the average

2017 premium will be about $109.00, compared to $104.90 for the past four years.

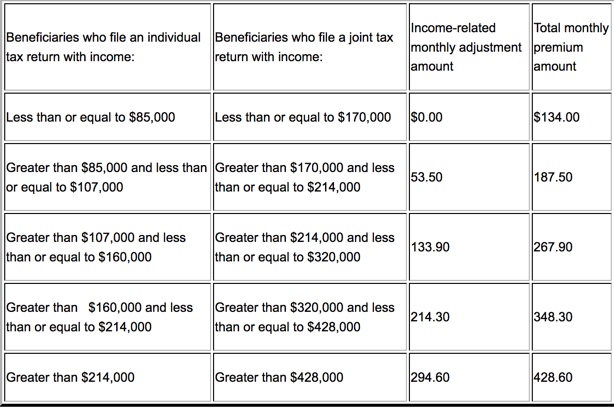

For the remaining roughly 30 percent the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. The standard premium applies to people applying to Medicare for the first time, who are paying for it directly, or who are not yet receiving Social Security benefits. Individuals or couples with higher incomes will pay more on a sliding scale. The increase could have been higher if CMS had not decided to use reserves to help mitigate the increase.

Higher incomes to pay more

For higher income couples filing joint returns less than or equal to $170,000 the monthly premium will be $134/month. That premium escalates along a scale to $428.60 for couples with incomes over $428,000. You can see more in this chart:

Deductibles rise also

CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement.

For more information

CMS Press Release on 2017 Medicare Increases

So You Are Turning 65: Your Medicare Guide 101

Comments on "2017 Medicare Part B Premium to Rise $4.10/Mo. for Most"

Louise says:

I found this today: For 2020, Plans C and F will no longer cover the Part B deductible, therefore will no longer be sold. There are no other proposed changes to any other Medigap plans.

What will replace Plan F? AARP in CT doesn't off a Plan G which is identical to Plan F with the exception you pay the Part B deductible.

Staci says:

I'm not sure how it works in CT, but you may try checking with other companies besides the one offered through AARP.

Admin says:

Mary posted a Comment here about retiring to Washington State so we moved it to this article, which is more relevant. http://www.topretirements.com/blog/great-towns/dueling-retirement-states-the-pacific-northwest-or-and-wa.html/

brenda says:

How can anyone set a price on anyone on Medicare when they have a set income to live on? Only in America can you charge our seniors for health care and take it out of their food money! Our Seniors and Veterans are what has made America Great!