10 Years Later – What We’ve Learned About Retirement

Category: Retirement Planning

Nov. 29, 2016 — Your editor has been retired 10 years now. And over that time he has written hundreds of articles that freely dispensed advice about retirement to tens of thousands of people. So what, if anything, has he learned during this decade, and what advice would he give anyone ready to enter retirement?

First of all, let me say how great it has been to be part of the Topretirements.com community all this time. The people I have met online and their wisdom and comments since the site began in late 2006 have been amazing in so many ways. Thank you to everyone in the Topretirements community, you guys have been so

helpful to one another and to me!

On another note, back a few months ago we had some good Member suggestions on how to celebrate the site’s 10th anniversary. One of the best was to share stories from Members about their retirements. This article has links to 7 that came in – and feel free to contact us if you would like to share yours! Case Studies: How Robert and Jan Planned Their Retirement.

My Top 10 Pieces of Retirement Advice

None of this advice is radical or rocket science. To use a football metaphor, planning is all about blocking and tackling. But our brief coverage of these 10 points is only meant to get you started thinking – retirement planning is a big subject and worthy of careful exploration.

1. Start planning early.

Millennials are probably doing a better job of retirement planning than most of us baby boomers – maybe we thought we would never age. You can’t start planning too early for a couple of good reasons. The most critical financial factor to consider is the importance of compounding your savings for as many years as you can. If you delay too long it is hard to catch up. But non-financial issues need to be planned for too. The type of lifestyle and climate you want, how you will stay busy, who you will be near – these are important questions that take time to figure out for the best results.

2. Set goals and timelines.

As part of your planning process you need to set realistic targets for when you will retire (and when you will have enough money to do that).

You also need to set planning targets for the non-financial aspects of your retirement life. The worst thing you can do is retire and have no plan for the next chapter – where you’ll live, what you’ll do every day, what kind of medical facilities you might need, etc. And this piece of advice is just as critical – all that planning aside, you plan has to be flexible enough to be prepared for this reality: most baby boomers end up retiring years before they think they will.

3. Make a budget, and keep revising it.

Your budget process begins with listing your expected expenses in retirement and then matching them against all your sources of income. We are amazed at how many people don’t do this critical step, but you are courting disaster if you don’t. Until you know if you have enough money for the lifestyle you have planned, your plan is nothing. The earlier you make your budget, the more time you have to make adjustments if the numbers don’t add up. Don’t forget to factor in the Medical expense component either – a VERY big “If”. You might be healthy now, but almost every retiree eventually runs into medical expenses they never imagined.

Your financial picture will probably change over time – your investments do better or worse than you think, unexpected emergencies deplete them, etc. By doing an annual review of your budget you have a chance of adjusting before it is too late.

4. Don’t retire too early. The financial consequence of retiring too early is that you don’t have enough money for the long haul. Your average age expectancy might be in the late 70s, but lots of lots of people live into their 90s – or 100’s! Running out of money in your old age is a disaster, don’t let it happen to you. Money aside, a non-financial aspect of pulling the retirement trigger too soon is that you lose your purpose. If you like your job and don’t have a clear dream to follow, why be in a rush to trade that for a big unknown?

5. Delay taking Social Security as long as you possibly can.

Almost every financial expert we read advocates delaying taking Social Security benefits until at least Full Retirement Age – FRA (66 for most boomers and a few months later for younger folks), or even better, to age 70. Yes there are good reasons to take it earlier, chiefly because: your life expectancy is below average, or you don’t have enough to live on. But almost every expert urges you to delay as long as you can, with a caveat. That is, everyone’s situation is unique, and therefore you should discuss your options with a professional to make sure you make the right choice for you.

Taking your benefits at age 62 vs. 70 means you will be taking a huge financial haircut. Here is an example from Fidelity: a hypothetical person taking benefits at 62 might receive $1,200 a month. If she waits until her FRA to collect, she will receive 33% more, or $1,600 a month. If she waits until 70, her benefits will increase another 32%, to $2,112 a month. That’s over $900/month – for life! Her spouse benefits too. He would receive a higher spousal benefit based on her FRA benefit if that were higher than his own benefit. And if she dies first, her husband would receive the $2,112 for the rest of his life.

6. Take lots of scouting trips

Take advantage of your vacations and business trips to scout out where you might want to live in retirement. Take notes, visit communities, and talk with as many people as you can. Then when you actually retire, step up your visits based on your reading and previous experience. The more you know, the better the chances you will make a happy decision. Maybe you will decide to stay right where you are now, but at least you will have thought it through and explored the possibilities.

7. Rent before you buy.

We hear this over and over again: “If I had only rented first I would have known this was the wrong place for us.” Spending a few weeks or a month in a place is just not enough time to know all the factors that makes a place to retire right for you. But if you rent for a year or a season you will know. Buying and then selling and moving again is expensive and hard.

8. Downsize and get rid of stuff early

In our book one of the classic retirement mistakes is to hang on too long to the place you are living in now. Your existing home is probably bigger than you need, which means extra costs for everything – taxes, maintenance, utilities, etc. It is probably on two floors or has steps that will imprison you when you get older. Instead, you could be using that money to have fun and/or share with your children. Likewise getting rid of your stuff can be liberating. It takes up room, and if you wait too long, it will be a horrible burden for your heirs. Get rid of it now and enjoy the freedom.

9. Assume retirement is a long term proposition. Rich suggested in a Comment that we should remind our Members of “… the need to continue retirement planning for at least 10 years AFTER retirement. Even after you retire there will be changes in retirement expectations and plans.” How true Rich! Lets say you retire at age 62, your lifestyle will most likely be very active. But 20 years later you will probably be doing very different things. Your health or physical abilities might have declined, and the home or community that was perfect at age 62 is not right at all anymore. The key is to keep planning and stay flexible enough to adjust to whatever comes your way.

10. Retirement is a reset on life – seize the opportunity

This is our very favorite piece of advice to retirees. However your life has gone up to this point, good or not so good, here is a reset point. Sure, your body or your finances might not be in great shape, but there are always new possibilities. You can start a new career, learn a language, travel, volunteer, begin a new sport or lifestyle. But a reset is only possible if you consciously plan and choose it. If you passively let retirement wash over you, the opportunity is lost.

Bottom line

In preparing this article we realize we tackled this same “What We’ve Learned About Retirement” topic at our 6 year anniversary – there are some interesting differences but the core message remains the same. In fact over the years we have plowed the retirement field frequently – this is the 54th Blog article we’ve written on “Retirement Planning”! The good news is that although there are nuances and additional avenues to explore, the basic approach to planning retirement involves some basic common sense ideas available to anyone.

Comments? What other planning tips would you add or emphasize? Tell us what worked or didn’t work so well in the Comments section below.

Read some of our favorite member planning stories

Jay Michaels Retirement Tour

Sandy’s Active Adult Visits and Adventures

It Is Rocket Science: How This Space Engineer Planned His Retirement

Comments on "10 Years Later – What We’ve Learned About Retirement"

DeyErmand says:

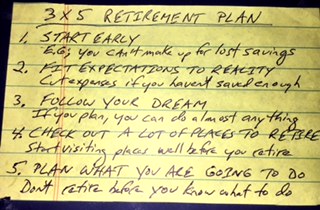

This is an excellent article. After ten years of hearing it all, living it every day, the author has supplied the readers with a great starting plan for planning retirement. I wish I would of had it 5 years ago!! I have jumped hoops to recoup to get on track by researching advice posted on this site. Number 5 on the 3X5 Retirement plan is the hardest for me. I like the advise don't retire until you know what you are going to be doing in retirement. It is more than a bucket list for me. Thanks

Rich says:

What a really great article! With such a few words and in a brief read you have captured almost everything Top Retirements is about. Retirement is an ever-evolving challenge for so many reasons. Looking back myself, the first five years were a phase that led through to the next ten. The realities of age began showing up late in that period, yet only this year have I re-discovered and hugely improved a lifelong interest and hobby. That continues and I expect to reap the enjoyment for years to come. So don't don't stop planning and looking ahead. Your future in retirement can hold much more than you might expect if you just follow the advice given and stick with it.

Timothy Bozoki says:

What a very to the point article. You didn't waster the reader's time with fluff, you got right to it and stated things very clearly. I'll hold onto this as a good reference and or memory jogger for those of us memory challenged people getting close to retirement.

Nancy Stone says:

Excellent article. I just want to highlight one aspect. Always be sure to over-budget for medical expenses. My husband and I did some good planning, and we're going to be okay despite the increase in our medical bills. But some of the more indulgent aspects of our plans, such as travel, will not be possible because medical bills are eating into our excellent savings. As it turns out, physically I will be far less able to travel than originally planned, so it doesn't really matter to us in the long run. But you never know how your story will play out and I certainly didn't plan on a rare cancer that requires many out-of-network doctors and medications that Medicare will not cover. Being healthy today is no guarantee of being healthy 5 years from now. I just wanted emphasize this because so many people, like us, under-budget for medical.

Mike says:

Item #5: Delay taking Social Security as long as you possibly can.

I think all the "experts" who say this are paid by the government to promote this. If you die before you can start SS, then the government wins and you get nothing. I am 62 years old and signed up for SS as soon as I was eligible. Why? Easy. Just do the math. If I waited just 4 years to full retirement age of 66 (vice 62), I would be over 82 years old before I BROKE EVEN with all the money I would have LOST by not taking SS at age 62. I paid into it all my life, I want to get something back before I die. My father passed away at 75, so my chances of making it to 82 are slim. Why not enjoy the money now? Plus, what if the SS system goes broke? That is another reason to take it now. As I said, just do the math....

Anne Jeltema says:

I give your article two thumps up. I've bee reading your emails and articles for quite a while now planning for retirement. You've featured many cities and states and listed the pro's and con's. Taxes, that's an interesting topic. What I've learned is that low taxes often means low, or no services, so choose your state and town carefully. As we near retirement, health care becomes something very important to us, so being near to a specialty hospitals could be really important, and deserves some research and consideration. You've provided us with a wealth of information to read and digest. We all want something different out of retirement, and there isn't any one single answer for any of us, but you've certainly given us the tools to choose what's best for us. I'm pretty much retired, with a 2 day a week job. My husband still works, so we're not quite retired, almost though. Thanks for all that you do.

Editor's note: Thanks to Anne and all the other commentators for the kind words. They mean a lot!

Anne, you raise a good point about availability of healthcare, which we should have worked into our 10 points. Many great places to retire do lack good quality, nearby healthcare options. So if you choose one of those places for other good reasons, at least consider the healthcare issue.

Darrell says:

I spent a great deal of time analyzing my expenses ... current and projected in retirement ... before I pulled the trigger. It was well worth the effort, and I certainly have recommended this to friends and family. Understanding where you spend your money now, and where you will spend your money in retirement is critical.

David Ecker says:

I read very frequently the comment that “I’m taking my Social Security as soon as I can. I won’t breakeven until I’m eighty-two and what are the chances of that?” Item 5 above reads, “Delay taking Social Security as long as you possibly can.” If you need the cash flow of Social Security, take it. If you do not need the cash flow and do not take it and you die before the “breakeven,” what do you really care? You’re dead. But if you live past the breakeven, as item 4 above reads, “Running out of money in your old age is a disaster.” And no, I don’t work for the government or the Social Security Administration.

Mike says:

Mr. Ecker,

Yes, you are right. If you die before taking any SS you are dead and what do you care? In my case, I would collect over $78,000 by age 66 if I started collecting SS at age 62 (which I did). If I die at age 66, I will have had $78,000 to enjoy beforehand. If I "delay taking as long as I can" and don't take it by age 66, then I get nothing.

This whole thing is a crap shoot. You are planning on living long enough to collect SS and the government is betting against you and hoping that you will not. In the end, your financial situation is the biggest factor. Even though I am financially comfortable, I elected to take SS early. My reason is the second biggest factor: health. I am already a two time cancer survivor and longevity is not on my side. Each person will have to weigh their own personal situation.

jim says:

I fully agree with delaying taking SS. Unless you have a terrible job or are very ill, work as long as you can. Every year past 62 increases your benefit by 8%.

Joanne Hice says:

We did a lot of your list of 10. I think the most important to us was #6. For 7 years we took scouting trips. I would find places to go on TopRetirements.com and off we would go. Some places we knew were not for us immediately. Some we really liked but they "just didn't feel right". About 5 years ago, I saw Green Valley AZ on here. I started reading everything I could about Green Valley. The more I read, the more I thought it sounded like where I wanted to be. Hubby wasn't as convinced, though. Finally I told him there were 11 golf courses, and he said he was ready to check it out. We flew out in July (during the monsoon season and summer heat). Coming from Texas, we noticed right away the low humidity. I could breathe and my legs weren't all swollen up. We drove all over town checking out stores, activities, etc. We talked to people to get their opinions on living in GV because everyone came from somewhere else. Every person we talked to loved it. By the end of the week, hubby was telling everyone who listened that we were moving to Green Valley. We gave ourselves a year to go through everything we owned, sell the house and make the move. We have now lived in Green Valley for a year and a half. We love it here and it was the right decision for us. There is so much to do and we are much more active than we ever were in Texas. Living is much cheaper which we hadn't expected so that was a surprise plus. And hubby belongs to a golf tournament so plays a couple of times every week. Thank you TopRetirements for leading me to our Utopia.

Gregory says:

John: I don't need to repeat other's praise for your site; both effort and content. Topretirement is my favorite read. Thanks!

Florence says:

It never ceases to amaze me how easy (it seems) it is for some people to decide where they want to live, and then just do it!!! We have narrowed down our choices, but that final decision, selling the house, leaving friends, (not so much our family which is scattered), leaves us in limbo. We know we have to move as our house is too large and taxes too high but the decisions seem overwhelming. HELP!!

Harrison says:

Excellent article! Excellent advice! You have put together one of the best summaries I have seen --- and I have read many top publications on retirement. Thanks for your work. And Florence, don't feel badly about taking your time to make a decision on moving. I have been retired for five years and my wife and I have the same issue. We enjoy visiting lots of retirement places around the country, especially the warm ones during the winter when it is cold here. But when we get back home, after a couple months away, we love our home and our relationships with friends and family here in Iowa. We also enjoy some great retirement activities right here at home. So for now, we are staying put and just getting the heck out of here for a month or two during the winter. I think we'll downsize eventually but we're not sure if that will be here or one of the other great places we have been to or heard about.

Kate S. says:

I agree with Florence. My kids live in very cold states. Moving near them wouldn't guarantee I'd be near family in retirement, since they're only in their 20s and starting careers. I come from a high-tax state (CT), so returning "home" isn't an option. I have a list of some things that I want like being within 2-3 hours of a large airport, good hospitals and libraries, and perhaps an Oster Learning Center. I've also decided to stay East of the Mississippi, and South of NY/Ohio. I use vacation time to visit possible retirement destinations. I took my kids to see two places that I liked. They spotted some things that I had missed, so both communities came off the list. (It was helpful to have somone else's opinions - I'm a widow.) It should be fun to have the whole country to research, but instead it's stressful. Too many choices! I'm eliminating places slowly, so I guess that's progress. I'm waiting for that moment of THIS IS THE PLACE - CAN'T WAIT TO MOVE!

Erik says:

Good advice, as usual! We successfully took advantage of several of your previous articles and tips prior to retiring and moving to personal retirement nirvana three years ago.

Some additional things that we learned include: start the retirement planning process ASAP--we got serious about financial planning for retirement about thirty years ago, started the "where" search about ten years prior to retiring and began the physical process of fixing up the house for sale, designing and building a new retirement home, downsizing, and moving about three year prior to pulling the ripcord. We should have started everything sooner--the physical part especially.

Another thing that we have learned since moving to our active adult community is too not wait too long to retire. Many of our older friends and neighbors have had numerous problems associated with their move, both health and mental--pulling up roots and moving is stressful. We were somewhat fortunate because we had to move several times during our careers for work-related reasons. Although these employer sponsored moves were much cheaper (employer subsidized), easier, and were tax-deductible, they did help us to learn how to more easily transition to our retirement destination. The folks that seem to have the hardest time adapting to a retirement move (including one neighbor who recently committed suicide) seem to have primarily lived in one area prior to retirement. If your roots are deep, your friends and family critical to your way of life, and you do not feel comfortable with different cultures and lifestyles--you may want to seriously consider alternatives to a major move for retirement. Some of these alternatives include snow-birding, move to a retirement community near where you live, etc.

One final bit of advice is to work with a local real-estate agent prior to visiting retirement communities. The local REA can provide a lot of information that is not easily available to typical retirement searchers, help you focus your search, and; more importantly, can help you tremendously when it comes down to negotiating the contract on your retirement abode. Many retirement community "tours" ask whether you are "represented" before they will show you their properties. Most of these innocuous forms include an exclusion to paying for a real estate agent in the future if you are not represented at the time of signing. Our REA helped us negotiate a significantly lower price for a custom-built retirement home. Also remember that the base price of a retirement home is often much lower that the price with the add-ons that you need and want. Don't sign a purchase contract until after you get the full price (and negotiate from there).

Good luck with your retirement quest!

Rich says:

Kate S, you don't say HOW you have done your exploring. For you and others with these concerns,I would suggest a car tour in/through the areas you might consider. That doesn't mean just a quick trip passing through. I mean driving from one place to another and staying there for a week to a month (perhaps depending on how much you like it). If you make the tours long enough (several months) it might also help you to break the ties. (I know that the opposite can also occur. We have toured extensively and each tour ends when we decide that we really want to be back home. Of course, that also suggests that we have succeeded in finding the right retirement place.

Sherwin Farr says:

To Joanne, about Green Valley. When I discovered the area I was excited. Because I wanted multiple golf courses, Ala Pinehurst, but without the humidity and winter weather. But when I looked up the water sustainability it was very disappointing for me, to be able to expect to sell my property in 20 years (if I bought) when I need to move to an assisted living facility. I will appreciate any information on why I should discount Internet info and choose Green Valley, AZ. Thanks

Editor's Note: Sherwin, there is a lot of information in various places on this site about Green Valley and Arizona. This article has 202 comments, for example. http://www.topretirements.com/blog/great-towns/retirement-101-arizona-new-mexico-and-utah.html/

Also, our review of Green Valley has basic info and many Forum posts, which you can see at the bottom of the review. http://www.topretirements.com/reviews/Arizona/Green_Valley.html

More comments are in the Forum http://www.topretirements.com/forum/f200/ARIZONA/Green_Valley.html

Kate S. says:

Rich: I'm still working, so staying somewhere for extended periods is not an option. At best, I can stay in an area for a weekend or a week. It's difficult to trade a cruise or vacation travel for a week of retirement research LOL. I have found that repeated trips to an area has helped me to see it differently. For ex., I visited a coastal Carolina area several times. First visit, I loved it and thought I had found my perfect destination. Second visit, I looked more critically at shopping, libraries etc. Third visit, I took my kids. They pointed to some issues with local hospitals and medical options that made me think twice. By then, I began to see an increasing number of homes for sale in the community that I was considering, and spoke to more local residents about the pros and cons of living in that area. I also got to see the impacts from this year's hurricane season. My perfect destination slowly became a good place to spend vacation time, but not somewhere that I'd want to live full-time. I guess that's the point of research, though. Ultimately, I'm pretty flexible and know that I'm capable of being happy anywhere. I'll end up liking my final choice, even if it isn't perfect. My problem is that there are too many choices!

JoannC says:

I have exactly Kate's problem - too many choices! Almost infinite, it seems. I thought I had a perfect plan and location for retirement but an unexpected delay forced me to stay in CA for an additional year after retirement - after I had already sold my house. The upside of the unexpected delay was that I spent some additional time on vacation in the location to which I had planned to move and decided it wasn't for me, so - major disaster averted. But now I'm back to too many choices. As an almost lifelong west-coaster, I have almost decided now that I want to remain on this coast, so that removed 47 states from consideration (I say almost because I still flirt with NV because of the absence of income tax and MA, despite the weather. And if anyone can provide further comments on the downside of a MA winter, please jump in and comment. I'm no stranger to rough winters having spent 4 of them in Russia and 2 of them in Canada, but even though I love 4 seasons, I hesitate to retire where I need to deal with snow and ice). Also hard to decide - a 55+ community or a suburb. The 55+ communities seem to be so self-contained and removed from the activities of other towns of reasonable size. If I or my dogs have a medical emergency, I don't want to be half an hour or more away from a good medical (or veterinary) facility, nor do I want to rely on the 55+ community for all my activities.

Kathleen Moore says:

I am having the same problem with too many choices. My retirement is 16 months off however I am reasearching now. I also believe you need to stay in the area for awhile. I'm in California now and the summers are extremely hot. California is also expensive. I'm narrowing my search to the Pacific Northwest and plan to purchase a trailer to live in while I'm searching. I will be selling my home first which is a concern. If anyone can give me any tips I would greatly appreciate it. Happy hunting.

Staci says:

Joanne C

Just wondering with so many northern states what is the appeal of MA?

Jan Cullinane says:

For Kathleen and Joanne C...

There is a term for "too many choices" - it's called "hyperchoice" - I also call it "analysis paralysis." When we are confronted with too many choices, we often end up doing nothing because it's too overwhelming, and if we DO try to check out every possibility, we end up feeling less satisfied with our choice.

What to do? Come up with three or four of what I call "non-negotiables" - things you MUST have in a new location. For example, for me it was walking distance to the Atlantic ocean, reasonable distance to airports, no winter, ability to ride my bike to the grocery store, and a newer master-planned community so it is easier to meet and make new friends. Doing that eliminated a TON of possibilities. Then, based on what I was willing to pay, I was able to find several places that would work. Have been living in the place I chose for about ten years now, and no regrets.

Anyway, just a suggestion that hopefully can help. Good luck!

Jan Cullinane, author, The Single Woman's Guide to Retirement (AARP/Wiley)

Ralphw says:

To JoannC we are from MA and I am also in real estate. For retirement purposes I feel property values coupled with high tax rates will force us to head out, probably south. Winters are challenging even if you are in a community that plows and shovels for you. Summers are great! If we had the means to afford two homes we would live in MA and winter in FL

Chris W. says:

Jan, may I ask where you ended up? It sounds ideal to me!

Laney says:

Excellent advice, Jan! I'd add that it's good to remember that no choice has to be forever. Since we can't know what we'll want or need in the future, I'm trying to focus on what I want now.

Karen says:

Jan, I'm curious, looking for the same things, where did you end up and why?

JoannC says:

Staci - you ask a good question to which I don't have a very good answer. Maybe it's the romanticism of revolutionary history (I've been fascinated with the American revolution since I was in elementary school). It's close to Europe (closer than CA) , has good universities for continuing education, good medical facilities, good vet facilities. But from any other standpoint, I couldn't begin to tell you why, other than perhaps it's on the east coast and I've spent most of my life on the west coast so it's something different. Maybe that's why it's just a flirtation and Ralphw's comment may cure me!

Jan - I totally agree with the list of non-negotiables, but even doing that, I come up with a huge list. One of my non-negotiables has resulted in eliminating a lot of 55+ communities which either don't allow fences or restrict their height. Because I have 2 small dogs and much of America is coyote country, the need to build a high fence tops my list. Most 55+ communities I've looked at don't allow this. I also just learned this morning that one of the 55+ communities I had been considering is close to a town where they appear to have a big gang problem. So today's news report may have just kicked that one off my list but it needs further research. Wish I were young enough to just run off and join the circus....

Staci says:

JoannC

Try to do some more investigating of more southerly Mid Atlantic locations. The weather is not quite as severe and in most cases the real estate taxes are lower. The entire area is rich in history and universities and cultural opportunities abound. I wouldn't worry too much about coyotes unless you're really out in a rural area. It's not as much as a problem here as out west.

Kathleen Moore says:

Thank you Jan. You have given me good words for thought. I will write my list of needs and wants and attempt to narrow my search. I am well aware there is not a perfect place so if I get 70% I'm doing well. I'm looking forward to the experience and the search. It's part of the fun. I'm already downsizing. Daunting but freeing too.

Thanks again, Kathy

One more thought, I know I want to be near water hopefully a view. One of my stumbling blocks is river, canal, lake or ocean? If any one can give me the good and bad I would really appreciate it. There are so many choices in the Pacific Northwest. I think I need to start there.

Stacey says:

I will be moving to Athens GA. It has 4 seasons but much milder than NY. It has an Osher Lifelong Learning Center, tons of culture and a beautiful environment. Just what I need.

Moderator Flo says:

JoannC

Try checking out this article on Mid Atlantic states

http://www.topretirements.com/blog/great-towns/dueling-retirement-states-series-update-va-md-nj-de.html/

Jan Cullinane says:

Chris W. I live in Hammock Beach - in Florida, in Flagler County, south of St. Augustine. Gated community, sidewalks, ride bike to grocery store, on the ocean, golf, tennis, pools, fitness center, etc. It's a Club environment (but you don't have to join the Club if you're not interested in the amenities). There is an HOA - I happen to like HOAs, but I know not everyone does. It is not a shopper's paradise if you're looking for higher-end stores very close by, so if that is on your "non-negotiable" list, this is not the place for you.

Chris W. says:

Thank you, Jan. I'm not a shopper, so this is even more appealing to me! I'll check it out, thanks again!

Juan says:

Jan, you have it right HOA and St. Augustine, Florida. This two of the many options that I have it drives me to think. I am in North Carolina, easy access to I-95. I am retired, my Spouse is not, the thing I know, she said no HOA's no St. Augustine. I have many friends tell me, get a new spouse, I said well after 33 years is kind of

difficult.

I ask what is in the middle of this situation?

I am retired from Army and happen to retired young.

Mary11 says:

I lived in the Clearwater area of Florida for 10 yrs and had to escape the humidity, thunderstorms every mid afternoon and the bugs! Have now lived in Sandiego and also the Pacific Northwest since then. Will be leaving Sandiego because of the budget and relocating to the oregon coast in the next few yrs. You can buy a condo facing the ocean for $100,000, a condo facing a river or lake for less than that or even a Manufactured home by the river with owning your own land for less than a condo. If you can handle the humidity go south but if you can't don't waste your time or expense.

JoannC says:

Staci and Moderator Flo - thanks for the suggestions. I looked at Virginia (Charlottesville and Williamsburg areas) a few years ago and will take another look. I can't remember quite why I took them off my list but they certainly tick all the boxes. (I do recall driving from Dulles to Williamsburg after a huge storm that took out trees and power lines. It seemed like the drive took forever but perhaps they have widened the road by now.)

Florence says:

The article above had some great ideas for those getting ready to retire. But here's a question for those who are already there. Looking at the suggestions above, if you could, would you have a "do-over"? Is there something on the list you didn't realize, underestimated, or misjudged? Please share your experiences with us novices!!

Bob Greenfield says:

What does HOA stand for?

Beth says:

So often I see mentioned that we should plan for medical expenses. My husband is 61 and I am 56. How do you even begin to determine what medical expenses will be, especially not knowing what the state of SS will be in another 5-10 years?

LS says:

This goes along with the downsizing process and getting rid of stuff. We live in an upscale neighborhood of 15 to 20 year old large suburban homes. I retired in 2015 and my wife will retire in 2018. We both had higher-level stressful and time-consuming positions. We also had 4 children and were constantly running here and there for all their activities. Between work and family obligations, we were always exhausted.

As we get ready to downsize into a less expensive and single level home, we look around and find that our current home is not ready to market. Many things are outdated or in need of repair. Before we can get rid of stuff, which we will surely need to do a lot of, we have to get everything fixed, re-painted, re-carpeted, roofed, etc. I've spent the last 18 months dealing with contractors and we're only about half way there. We are about finished with the kitchen remodel and we still have the remodel of the master bath to do. The lawn was in terrible shape and we had to have the front re-sodded.

What I would advise to those nearing retirement is to not only get rid of stuff, but to start getting your house ready to market long before you plan to downsize. If you have deferred maintenance and updating like us, you will find that you might be retiring to a contractor oversight manager like I did. As I reflect back on it, if one of us would have died prior to getting the house marketable, it would have been a tremendous burden on the surviving spouse to do this alone.

James Dylewski says:

SOCIAL SECURITY WAIT LOOK AT THE NUMBERS FROM YOUR EXAMPLE

AT 62 YOUR PERSON RECEIVES $1200/MONTH X 48 MONTHS = $57600

AT 66 $1600/MONTH A $400 DIFFERENCE WHEN YOU DIVIDE $57000 BY $400 = 144 MONTHS OR 12 LONG YEARS TO GET THE SAME BENEFIT, THEY ARE EVEN AT 78 YEARS OLD

WHAT IS THE AVERAGE AGE IN THE US ? Good news, America: We're living longer!

Life expectancy in the USA rose in 2012 to 78.8 years – a record high.

That was an increase of 0.1 year from 2011 when it was 78.7 years, according to a new report on mortality in the USA from the Centers for Disease Control and Prevention's National Center for Health

Louise says:

Bob Greenfield HOA stands for Home Owner Association. In certain communities monthly HOA fees are paid for certain amenities. Such as a clubhouse, swimming pool, grounds upkeep, exercise equipment, golf course and much more depending how exclusive the place is. The Villages in FL is an example of a place with HOA fees.

Staci says:

LS-

I'm in the same boat as you, we feel we have to "update" our home in order to get top dollar. What we keep wondering is though, "Why didn't we do this sooner, to enjoy some of the benefits"?

James- I read somewhere, perhaps the SS gov website, that whether you take early retirement, or wait until your full retirement age, the amount of payment received is the same.

Linda says:

Staci, don't believe everything you read somewhere on the web. You take a 20% (or so) cut in your monthly benefit if you take your Social Security at 62. The benefit increases each year you wait to claim it. It even increases every year you wait after your full retirement age, whatever that happens to be.

Jack says:

I also read " do not take SS too early or before FRA." I was 62 when I retired. My wife, a kindergarten teacher, 52. Our youngest daughter 14. I am a retired university academic. Because I had a child under the age of 18 we received an additional retirement check, almost to the full sum of my retirement check for the next 4 years. Put half into her college fund and half into our regular monthly budget. We lived fine and our daughter was able to go to the private university of her choice when she turned 18.

You cannot generalize as when to take SS because all cases are different.

areti11 says:

Well for me retiring at 62 or 66....only a difference of $66 monthly if I live to the age of 88. So it's 62 for me!

Jennifer says:

Jack you had a good experience with SS. I am a single woman, now 62 and I would not be able to survive on SS alone. I will not be getting a pension check which I assume you do receive plus your wife (may) still be working. I can see why you had no financial issues. Single people also get tired of working--but cannot retire early in many cases. I am/was a nurse and until the nineties we never had a retirement plan in place---for any employer that I had worked for. I now work for the Episcopal Church and the pay is lower--so is the stress--but the benefits are much better.

HEF says:

For those of you still trying to make decision on where to retire, I wanted to share our process. First of all - talk to each other! I have several friends who found out AFTER their husbands retired, that the men expected to live out their years in a log cabin on 75 acres in the middle of nowhere while the wives wanted to be in town with social things to do.

We started with a spreadsheet about 3 years ago. We knew we wanted to stay on the US east coast so we started our discussion in Florida and worked our way north. Knowing we wanted to be active, out of the suburbs and close to things to do, we picked out a few cities for our chart - adding and subtracting places as we did our research. I made columns for housing costs - comparing prices for a 3 bedroom/2 bathroom condo or house. Then, real estate taxes, sales tax, gas tax, inheritance tax, number of our church congregations, volunteer opportunities, educational opportunities, availability of CCRC (Continuing Care Community - our ultimate destination) , medical care & support for Parkinsons. Since the heat bothers both of us we decided to focus on going north and ended up deciding on Portland, Maine. We traveled there with notebooks in hand and spent a week visiting facilities, talking to people and scoping it out. I reached out to some online friends and we met up for lunch with two couples who were already retired there. We have another trip planned for this year. We have moved around a lot over the years so this is nothing new for us but the first time we get to make the decision all on our own. Can't wait!!

Make the spreadsheet with things YOU find important or like to do. www.city-data.com is a great source for demographic information.

Florence says:

Those are some great ideas!

Thanks

Linnea says:

HEF, I am starting to do my research, I still have 2 years to go. I really like your suggestion regarding a spreadsheet and what I'm looking for, plus costs. Thank you.

Bill Bradley says:

As I read about concerns of health care and high monthly

costs wanted to share..I am a single male soon to be 69 years young with a few medical issues and have signed

Up for different Medicare Supplement plans all that have various constrains and dollar differences in last 4 years.

Because I travel a lot I needed a plan where l could see any doctor anywhere when I needed one I live in Seattle and spend a lot of time in California and AZ and was constantly

Told not covered under my plan.

This year I got a plan from AARP United Health Care called the F plan or Cadillac plan where based on living in Seattle

I pay $ 204 monthly for complete healthcare. I can go anywhere, see any doctor, pay no deductibles for office visits to Brain surgery. Have a prescription plan offered by Walgreens for approx.70 monthly because l need narcotic pain medicine for bad arthritis.

Being senior citizen divorced and living alone I feel comfortable in knowing I am completely covered and even to work part time to pay 300 proxy. monthly it is still worth it. Found out about this from a friend who had $33,000 medical bills for knee replacement and paid "0" out of pocket.

Wanted to share.

Bill Bradley

ella says:

Thanks, Bill! Very good to know!

Louise says:

Bill, I think you are forgetting to mention Medicare B costs. We are in CT. My hub is going on Medicare March 1st and his costs are:

Medicare B = $121.80

AARP United Health Care Plan F = $241.50

AARP United Health Care RX = $ 67.30

Total = $430.60 a month (one person)

Hub had major surgery last year and was not on Medicare yet. We were pretty lucky but still have paid thousands out of our pocket and another $5,000 bill is being appealed so we don't know how that will turn out. Plan F is definitely a wonderful thing but will not be offered to new people after 2020 but those who have it can keep it. https://boomerbenefits.com/is-plan-f-going-away/

Louise says:

Update: I believe Medicare Part B will be $134 for 2017 when my hub starts and not the $121.80 I stated above. The book he was sent in December was a 2016 book with old pricing I believe!

Medicare B = $134.00

AARP United Health Care Plan F = $241.50

AARP United Health Care RX = $ 67.30

Total = $442.80 a month (one person)

https://www.medicare.gov/your-medicare-costs/part-b-costs/part-b-costs.html

toula1955 says:

I feel the medigap offerings with no monthly charges are good enough for my family. We don't have any special health issues so I'd rather save the money in the bank for when I might need to pay for them in the future. We can't afford to pay $400 per month for each of us.

Louise says:

Understandable that you may find $400 unaffordable. However, my hub's operation cost probably $85,000 if not more and much of it was covered by Anthem Blue Cross (ACA). My hub was 5 months away from being eligible for Medicare but the docs didn't really think waiting was a good idea. If we had Part F supplemental insurance along with Medicare he would have paid nothing. Saving a few hundred a month will never pay these astronomical medical bills. That is why we choose Plan F supplemental health insurance. The price for us for Plan F and the Rx plan will be double when I am eligible in 18 months. It is very scary to think we will have to spend around $886 a month for health insurance for two people. When we had our one and only mortgage it was $252 a month! That was 42 years ago and we thought it was scary at that time!

Jim C says:

toula1955, Major health problems can happen without warning so be careful not to be too underinsured. I thought I was in good health and then without warning had two separate heart attacks. Hospital cost was 100k for each incident. Luckily I had a Plan F supplemental that payed for everything.

MaryNB says:

Louise, that is exactly what I am paying plus dental. For anyone who thinks they are healthy enough without a Medicare supplement plan, BEWARE. We are all healthy until we are not. I am a cancer survivor and I am alive now because I could afford the best care. Don't think they will treat you if you can't afford it, because they will not.

MaryNB says:

Hef, I like the idea of Portland, Maine and think about it myself. Have you explored housing costs? I would be interested in renting at first. I have not checked out the taxes there yet. I plan several trips there in the Spring.

Louise says:

MaryNB You are absolutely correct. "We are all healthy until we are not".

When my hub retired we no longer had dental insurance. I searched around and found this plan that is not insurance but they negotiate with the dentists for lower prices on services. Went to dentist the other day and had a cleaning and xrays. It came to $137 but would have been $240 if we didn't have the dental plan. It is called Dentalplans.com. I think we pay around $150ish a year for it. Not sure if it is a good deal or not but so far is okay.

Also, since hub now has some medical issues and has never had any before, I am sold on Plan F which when combined with Medicare and Medicare Part B all bills will be covered including doctor visits copays. It is a bit of a bitter pill to swallow to spend so much for insurance. Be aware, Plan F will be phased out in 2020. If you have it you can stay on it and be Grandfathered. I will go on Medicare in 2018 and plan to go on Plan F too. With all this turmoil with Obamacare, wish I could get on Medicare now. Of course, the GOP plans to mess with SS and Medicare too.

Louise says:

I don't think many of us are educated on what Medicare involves. When I was younger I thought Medicare paid for all health services. Little did I know there is Medicare A, Medicare B, supplemental plans for prescription drugs and supplemental plans to cover the 20% Medicare doesn't cover. The supplemental plans are not too hard to digest but there is a lot of information. I have been studying this for way over a year and I bombarded Jim C. more than once on prices and this and that. He was very helpful...Thank you Jim! Keep in mind, depending on what State you live in, the supplemental plans have different prices. So if you have a brother or sister or friends in another State and they are giving you advice on what plans they have and costs, be aware that depending on what State you live in, the same plan could be much, much more.

Oh, and one more interesting thing. My hub's doctor wanted to send out tissue samples to be analyzed by this lab that does genetic testing. This testing will narrow down the specific treatment that should work for an individual. It helps the doctor determine the right treatment rather than go down dead ends. Plus, it will save the insurance companies money in the long run. Well, our insurance through Obamacare has denied the claim ($5,150). The genetic testing company is putting an appeal and may need to do several but expects the insurance company will pay. Anyway, the point of my story is that I found out by doing research and speaking to a representative at the genetic company that Medicare PAYS for this testing without all the problems we are experiencing! If they should keep denying the claim, we are stuck with that bill!

HEF says:

MaryNB - I have lots of info to share. Housing will be more expensive than where we are now with more taxes but we're planning for that. Sometimes - you get what you pay for :-) E-mail me directly at Myquest55@aol.com and we can talk further.

toula1955 says:

Well with us receiving less than $ 1600 per month I don't have many options. HOPEFULLY, medicaid will be around when that time comes.

Kate . says:

Re the costs of medical, dental etc. insurance, It's also a good idea to take care of as much as possible before retirement, if possible. I told my dentist that I wanted to maximize my insurance benefit each year while I'm still working. In January (in case I get laid off) we look at what can be done now under my dental insurance that will be a problem in the future. For ex., a tooth with a really large filling that is going to crack someday can be crowned now, using employer dental insurance. I've done the same thing with my doctor (colonoscopy, mammogram, stress test, etc.) It's expensive, but I figure that I'll enter retirement with health stuff updated and baseline test results that may help later. I think that a health care plan and maximizing use of employer benefits should be added to the checklist of things to consider before retirement.

I agree that I hope medicaid (and medicare) will be available when we retire! I'm not a fan of the AARP sales pitches, but they do serve a purpose as lobbyists for our population. And we need to be politically activie to protect our interests!

Jennifer says:

I wanted to start a thread on how everyone feels about AARP. I have found here that many of you do not care for AARP and their policies. I was considering joining as my Aunt says that they give lots of discounts, but now I am holding back until I investigate them further. They solicit very aggressively and I get mail from them frequently.

Louise says:

Jennifer, I am not pro or con on AARP however, I have the AARP version of the AAA motoring club. It seems to have all the benefits at a lower price. I have used it only once for a jump start and wasn't charged any extra. I also have AARP house and car insurance and an Umbrella plan through The Hartford. I previously had Allstate and had them for years and years. The prices were getting out of control so I contacted AARP and got a quote which lowered my costs around $800+ per year. Plus, I upgraded my insurance from what I had. Yes, I do receive offers for life insurance and annuities. What I am not interested in goes in the circular file. When hub retired I called them and lowered my car insurance price even further due to the low mileage we now put on the cars. I have no problems with AARP and will continue to stick with them. Hub is going on Medicare in March and will be on the AARP United Health care Plan F and the AARP United Health care Rx program. I never get any unsolicited phone calls from them and they have been very, very helpful. If something better came along, I wouldn't hesitate to change but for now, all is well.

Bill S. says:

Jennifer, consider AMAC.us, as an alternative to AARP. Wife & I joined AMAC (Assoc of Mature American Citizens) several years ago. It is only $16/yr for you and also covers your spouse for that one amount. They offer similar discount programs and access to endorsed insurance products. Considering their aggressive marketing, I've always been skeptical of AARP's mission and loyalties, but when they sold out seniors by going all in for support of ACA/Obamacare, that was it for me. Good luck!

DD says:

Oh my... I just did the math on 30 years cost of health insurance at $500 a month! It is more than my 401K total! It will take my IRA account too! That means I have to manage living on a Social security check and forget retiring somewhere warmer?I felt pretty good reading the article above, knowing I had started early preparing for retirement. But reading the posts on the medical expenses is a harsh reality. I should quit work, sale my house, move and live off of my 401K and IRA THEN retire at 65? UGH!!

Clyde says:

Medicare Advantage, which is the alternative to a Medicare supplement plan, often costs as little as $0 per month including significant drug benefits. I have an excellent Medicare Advantage plan for $26 a month through United Healthcare (not the AARP plan). I take three medications per day and the generics cost me nothing at all through the mail order pharmacy. The maximum out of pocket for the year is $6000. Once you hit that amount in your own costs, the rest is covered with no maximun. Fortunately, my annual out of pocket costs have not been more than $200-300, though I see my primary care physician about twice a year ($15 copay) and a specialist once or twice ($40 copay). It also covers two dental visits annually for full cleaning and an exam plus one set of xrays. I carefully reviewed about ten Medicare Advantage plans before choosing, as well as worked with an insurance agent. Medicare requires that agents receive a flat fee no matter which plan you get, so they have no incentive to push you to one or another. Picking the right Medicare plan is hard work, but worth every minute. If you don't spend a lot of time at it, it can come back to haunt you.

As to AARP supporting ACA/Obamacare, if this is the case, it makes very little difference to most seniors. Anyone 65 or over is ineligible for Obamacare, because they then have Medicare available. I was on Obamacare for a year before I reached 65, and it worked quite well for me.

Clyde says:

Also as to insurance agents helping you with Medicare, they cannot charge you for those services. They get paid through the flat fee for each Medicare policy they sign up. And you pay no more premium than anyone else, whether you go through an agent or not. If an agent tries to charge you a fee for their services, steer clear.

Rich says:

Read Louise's comment above -- I completely agree. I have never received a "sales pitch" from AARP -- just the "junk" mail which occasionally actually has something good. The "medigap" insurance offerings beat every other option I've checked. My mother had the same insurance for all her years before her death at 89. Her last 10 years or so I had to manage her affairs and found the insurance to be fair, consistent, reliable and affordable.

Caps says:

We haven't heard of "medigap," heretofore.

Who qualifies?

Thanks

Louisew says:

https://www.medicare.gov/supplement-other-insurance/medigap/whats-medigap.html

Louise says:

https://www.medicare.gov/supplement-other-insurance/medigap/whats-medigap.html

Jennifer says:

Clyde, specifically which United Healthcare plan do you have? Does Medicare Advantage replace Medicare or is it a supplement to it? Would I need to still sign up for Medicare if I wanted a Medicare advantage plan? These are questions that those of us nearing retirement, but not quite there yet, would need to know. Many thanks!,

Stacey says:

Jennifer, I just retired and got an Advantage plan. However you still must pay for Medicare. I pay $134 per month for Medicare and $66 per month for the advantage plan which brings it to a total of $200 per month. I'm in NYC. Hope this helps

Florence says:

In PA an advantage plans includes Medicare, any supplement and can include prescriptions. It is administered by Health insurance companies Aetna, united health care, etc. You have to use doctors within that "network" and there may not be coverage out of state. People choose it because it simplifies coverage by having one payment and by having all the same health insurance carrier.

Clyde says:

Jennifer, I have United Healthcare Complete Plan 2 (HMO) in Connecticut. After Plan A, which every Medicare recipient pays and is usually automatically deducted from your Social Security, you can get further coverage, which most people do, through Plan B, also known as Medicare supplemental. Medigap is another name for the supplemental. As an alternative instead of Medigap, there is Medicare Advantage (called Plan C), It can be much less expensive than Medigap, but is usually an HMO or PPO. It can be used in most parts of the U.S. for emergencies, but is mostly used in your

Clyde says:

(continued) local region for almost all services through an HMO. I've found the HMO is fairly extensive in terms of providers and hospitals. It's best to learn more at the medicare.gov website or from a good book on the subject of Medicare.

Jennifer says:

Thanks Clyde, I have a friend who uses Kaiser Permanente as his Medicare Advantage Plan and he is very happy with it. I did some research and the physicians seem to be very good, but you may not see the same one every time.

Jim says:

All good advice, but I will add:

* Be doubly sure that your spouse (if you have one) is exactly on the same page as yourself. I thought I was sure that we were. I retired on August 1st of 2016, and my wife on October 1st 2016. We had been looking at properties in Florida, narrowing down where we wanted to live. We have been spending 3-4 weeks a year for many years in Florida, and had selected a house to rent for a couple of months while we seriously looked at condos in the area. When it came time to finalize the rental, my wife told me that she doesn't want to move now, and really doesn't know if she will ever want to move. So basically, I retired from a good paying job that I really liked and working with people that I loved to retire and stay here. I had to find a part time job to keep my sanity, and luckily I found one that I really like, although it pays a fraction of what I was making. Money isn't an issue, as the folks at our investment firm said we had enough money to last into our 90's, but this has really driven a wedge between us and I find myself growing more bitter as every week passes.

Jennifer says:

Hi Jim:

Florida is not for everyone but there are southern states that have lovely weather year round--say southern Georgia without the bugs and large variety of snakes and large alligators that seem to inhabit Florida. Ask your wife why she does not like Florida and I bet it is the heat and humidity she would face in the summer. Georgia still has that, but maybe she can meet you half way if introduced to another locale other than Florida.

Louise says:

Jim, so sorry to hear your plans derailed. Is there any chance your wife is going through a depression from retiring? Or maybe she needs some time to decompress from all her years of working? She is only retired 3 months, maybe it is too soon to just pack up and move. Can you try baby steps and go for several vacations, a month at a time, to FL to get your/her feet wet? Could it be due to children/grandchildren friends, family? There are many factors in not wanting to move.

Maybe you could suggest renting your house for a year and move to FL as a 'trial' and if she still doesn't want to stay there after a year, you will move back. Or maybe you could be snow birds so you have the best of both worlds. You would be happy for 6 months and she would be happy for 6 months. Or, maybe she really doesn't like FL but might be up to some place else like AZ or CA.

If it is due to children/grand kids maybe you could promise you will fly back to see them for a few weeks several times a year or pay for tickets so they can join your in FL for a vacation. When the grand kids get old enough, they could spend the summers with you in FL. Try to find out what the stumbling block is that has changed her mind.

Sandie says:

Maybe "stay put" should be a retirement option if you can afford it. After several years searching for that perfect place, DH and I have realized that staying in central Virginia, where we have spent most of our lives, is probably the best place for us. Granted the cost of living, availabilty of health care and things we like to do is acceptable. Folks who are contemplating a move to save on living costs might want to factor in the expense of moving back if things do not work out.

Bill Bradley says:

Thanks for update Louise.

Medicare A and B are,taken out of monthly SS payment

SO I tend to forget about it

Went to Doctors yesterday and it was nice not to worry about deductibles, lab bills in mail etc .

In Seattle my plan F cost 204 month and cost is different based on where you live.

Remember if your supplement plan is not hat good when on Medicare you can walk into any emergency room and see doctors and specialist for $65 . I have seen many many illegals use emergency room for their complete family as though it was a doctor's office

Louise says:

Bill, My hub went through surgery last year and it was very scary to see him go through major surgery and then to see the bills on the Anthem membership website and waiting and wondering if they would be paid. We had to pay thousands on top of our Obamacare premiums, copays and copays at doctor offices, $50 each time. Plus, copays at the drug store. Hub was only 5 months away from Medicare and that was a bummer! So when investigating all the supplement plans, we chose plan F. It pays for all copays except prescriptions. For peace of mind, we are going with Plan F. We may never have another year with medical expenses like this year or maybe we will have a worse year. But we won't be tossing and turning worrying. Right now we are waiting on a bill ($5,150) for genetic testing that guides the doctors on appropriate further treatment. Right now Anthem is denying the claim! We have an appeal in right now. The doc seems to believe it will be paid and we may have to appeal several times or more. BUT, if hub was on Medicare, they actually pay for this test! Go figure!

In CT Plan F is $241.50!

Yes, in 2007 I worked in a hospital and they never turned anyone away, illegal or homeless. The hospitals have to charge more for everything to make up the difference for the non paying patients. Glad they can treat those who have no money but some how we taxpayers and patients with insurance end up footing the bills.

Bubbajog says:

I definitely believe "staying put" is the option the vast majority of retiree's choose.

Kate . says:

I have put "staying put" on my list of possibilities. I have been trying to decide between moving towards a coastal community (love the beach, and see myself with a book on the sand every day), a 55+ community (despite being an introvert who has worked very long hours for the last 40 years, I see myself making new friends and enjoying community amenities), or moving back north to be near my kids (a practical choice for mutual family support, but colder and would cost about $400 a month more in higher taxes).

As I browse the real estate sites, I've realized that I could have to pay more for less housing if I move to a new home. Alternatively, I could buy an older home and start all over with painting, window treatments, replacement of water heater/furnace/roof, etc. I'd have to pay movers and a real estate agent if I move. Alternatively, I could apply the realtor and mover fees to updating my my current home. The positives are that I'm in an area with good weather (SC near Charlotte), have a 3,000 ft newer home with a 1st floor master that is relatively economical (taxes under $2K, and utilities, HOA and yard service are about $450 mo). Negatives are that I'm an eight hour drive from kids, my neighborhood is not age-restricted, and I'm not on the beach or in a 55+ community. When I stop working 12 hour days, I'll have to try to build a social life of some kind wherever I end up. Anyway, that realtor and moving cost would pay for lots of upgrades....so staying put has to be an option.

Jim C says:

Here in Georgia our Plan F monthly costs are $170.00 for myself and $152.00 for my wife. Because of the medical problems we both had last year I am very thankful to have the Plan F.

Stacey says:

Jim are those amounts in addition to the $134 for Medicare? I'll eventually move to GA so am interested in the plans there

DD says:

Jim, I am sorry about your unexpected change of plans. However, I do not think you made a good choice returning to work after retiring. Give your wife some time and do some of the other things you both had planned in retirement. Or was moving your only retirement plan? You likely chose your current home because you liked many aspects of the house or community. If your current community meets your needs as a retiree, there's no reason to pick up and move to another one. This maybe the reason your wife changed her mind, along with the fact you barely gave her time to adjust from working to retirement. The option of being Snow birds would be your best choice right now.

Louise says:

Is Jim C and Jim on this thread the same person or do we have two Jims?

BeckyN says:

To Jim whose wife changed her mind on moving. I am starting my 4th week of retirement. The 1st was going to many appointments I had been delaying or rescheduling until I was not working (because I was working 12 hours or more per day in my last month). Then 2nd was leaving the cold CT climate and spending a week on a Florida beach. My 3rd was sitting in my comfy recliner (and PJs) in a funk, watching TV or snoozing but mostly thinking about what was now my reality and my future. Now in my 4th week I finally decided to unpack my suitcase, wash clothes and get back to living. All those feelings in just a month, and I know I have many more to experience as my retirement evolves, We plan to move 6/1 back to a place I originally did not want to go. But I have had almost 6 months now to adjust to that news and now I am looking forward to getting on to that next phase. Please give your wife some time. Everyone deals with this new stage in their life at a different pace. Communication is always the best. Talk to her, ask what she is feeling and most of all listen, listen, listen. You might just discover why she now does not want to move and seek her help in finding a compromise.

Jim C says:

Louise, There are two Jim's. I am Jim C and live in Georgia.

Stacey, For 2017 The amount deducted from SS for Medicare is $109.00. An additional $55.00 a month is deducted from SS for Part D prescription drugs. And As Mentioned above, I pay $170.00 a month for supplemental Plan F. This is not deducted from SS but debits my checking account on the first of the month.

Louise says:

Thanks Jim C, I remember you live in GA! You have been very helpful with SS/Medicare/Part D/Part F information and I appreciate it very much! My hub starts on his Medicare/Part D/Part F journey starting March. I am still on Obamacare and will have to call Access Health CT mid month to update them on hubs new status and I will remain on Obamacare. At least until they roll out the new, improved, cheaper and BETTER plan. Hahaha, hope that happens but doubtful. Just trying to squeak by till I get on Medicare mid 2018.

Jim, do you have an opportunity to buy those wonderful GA peaches at roadside stands and other vegetables too? We have vegetable stands around here but things are pretty expensive. One of my fondest memories is years ago when hub and I went to FL we stopped at a place that sold grapefruits and oranges plus they made their own OJ. Those ruby red grapefruits were so sweet and delicious and the OJ was like nothing I had ever drank in my life! Some friends we visited in FL, who lived there, had gallon jugs of OJ in their freezer. They never wanted to run out!

Jim C says:

Louise, Not much of that in North Georgia/Atlanta metro but in central and southern Georgia you see lots of citrus on farm stands along the road.

Staci says:

Just wondering--

What was something you anticipated about retirement that worked out differently than you expected---both positively and negatively. Thanks for sharing.

DaveJ says:

I skimmed through many of the comments and one item jumped out at me - shame on me if I missed it - and that is NO ONE mentioned whether or not they had talked to a financial adviser before making a decision on when to retire, SS, medical choices, taxes and the list goes on., Folks, for most of us we have one shot to get it right. Poll after poll after poll taken by people who have retired state the number one mistake was taking SS to early. You don't need to be wealthy to talk to an adviser, in fact I may be so bold as to say the less you have the more you need to talk to an adviser. Men - like it or not we are likely to leave this world before our spouse and if we have been the major breadwinner our SS check will be the largest which our spouse will receive when we pass BUT she will lose hers. In other words the income my wife receives is going to take a hit after I pass and I want to make sure I do everything to my ability in providing for her. The longer I wait the more she gets, simple as that. I don't give a hoot about the break even point, however I care a lot about her comfort now AND when I am gone.

LS says:

Just a word of caution on financial advisers. Several years before I retired, my wife signed us up for a free consultation with a financial adviser at Chase Bank. He was very nice and gathered much financial data from us and did some charts and graphs and projections for us. However, there is no free lunch. He turned out to be a commissioned salesman who was urging us to transfer our 401k savings plans to him to invest in Chase's high load mutual funds. He pestered us for some time but I wasn't interested in doing that. If you are going to consult a financial planner, I recommend using a fee-based one where you pay a set fee for his/her advice. Pay attention to the fees for any fund you invest in. These can eat up any gain you make on the investment.

Another thing to do before retirement is to consult a lawyer to prepare a will, medical directive and power of attorney if you haven't already done so. Also be sure that all of your designation of beneficiary forms are up to date for any financial accounts, life insurance, etc. Make sure that your cars, boats, RVs, etc., are titled jointly so there are no problems when one of you die.

Clyde says:

A good choice for a financial advisor could be one who charges on a fee-for-services basis only. With these advisors, you only pay for time used based on a previously agreed-upon rate, usually hourly. These types of advisors agree to receive no commissions or other compensation for any investments or products recommended, so they only have your best interests in mind. I have used such an advisor from the Garrett Financial Services group and found her to be very effective; I have had no relationship with Garrett except as a client. There are many other reputable fee-for-services advisors out there.

Carol Dugan says:

As someone did mention, don't forget that AARP does a lot of lobbying on our behalf in Washington. Something we need now more than ever. The membership is worth the price and helps them accomplish our goals. Lots of different thoughts on ACA of course. But Medicare and SSN need vocal advocates right where it might do some good.

MaryNB says:

I was burned twice by financial advisors and lost a lot of money! I have no idea where it went, but it left me totally broke for awhile. I will not go to another one!

Trout Chaser says:

Folks, pay attention, you need to employ a fee only financial advisor/planner who explicitly operates under Fiduciary Rules. That means in all cases, they must put the interests of the client first. Any financial advisor, not under fiduciary rules, can legally skim your accounts ( known as asset management fees ) and you will not know it unless you read all the fine print of everything in your account. That's right, the fees are invisible unless your know where to look in the prospectus. These fees are on top of the fee the advisor charges, like "I'll manage your assets for 1% per year". Any advisor, not under fiduciary rules has a huge conflict of interest. It operates like this : I could put you in our firm managed "Super Duper Fund" which has a management fee of 1.25% and pays me to sell it and then pays me 0.25% per year. Or I could put you in a Vanguard Index fund for 0.16% annual management fee and pays me nothing. Which do you thing he'll recommend? Under Fiduciary Rules, the advisor MUST recommend the Vanguard/index fund approach because it's in your best interest!

Lynne says:

Great discussion regarding financial advisors! And perfect timing for me. I am just learning about them, and have been working with Fidelity. My consultant gets a salary, no commission. Does that mean he is working in my best interests? I know NOTHING about this stuff, and I cannot afford to play fast and loose with that money. Thanks in advance for any comments.

Florence says:

Trout Chaser and Lynne

I know an Executive Order was issued yesterday changing Fiduciary Rules. You may want to check that what Trout Chaser posted is still, hopefully, in place.

SandyZ says:

I believe that Trump just signed an "order" doing away with the Fiduciary rules for financial advisors. Does anyone know how that will work? Lynne, we also have used Fidelity, but if you get tangled up in their managed account, you will pay at least 1% annually in management fees.

Jim C says:

As a general rule I would stay away from large brokerage firms and banks. Vanguard , Fidelity and Charles Schwab are low cost alternatives. In addition you can find fee only certified financial planners on line in your area. Dave Ramsey's web site would be one source fo a fee only CFP.

Rich says:

SandyZ, you are correct. All should read and follow Trout Chaser advice above.

http://www.forbes.com/sites/ashleaebeling/2017/02/03/trumps-official-memo-ordering-dol-to-review-the-fiduciary-rule-meant-to-protect-investors/#6a616acd4fe0

Billy says:

Vanguard, Fidelity and Schwab are the largest brokerage firms. They are some of the only ones I would invest with because of their size. Fidelity's advisors are educators at their branch offices. The management and investing decisions are made in Boston. Their managed accounts charge .92%, the total fee, I was told, without an exit charge. Something I am considering for part of a portfolio. If you don't know enough to do it yourself or don't want to, this sounds like a good option.If fiduciary rules are lifted financial planners still have the option to guide under them as Fidelity does and has been for a long time as well as others I'm sure.

Bubbajog says:

I have been with Fidelity over 15 years with taxable, IRA, and 401K accounts. Fidelity provides the individual investor with excellent information and education opportunities. If you are going to invest in equities; you need to educate yourself.

Kate . says:

I agre with Bubbajog that there's no excuse for not educating yourself. There's a wealth of free financial info available now, including on sites such as Fidelity.

I am contacted constantly by financial planners, both independent ones (especially those free or low-cost seminars, which are today's version of cold-calling to try to identify possible clients with assets) and ones associated with Fidelity and Merrill Lynch where I have assets. My bank is also constantly trying to get me to use their "wealth managers" for no-fee financial planning. All of the brokerage houses and banks have financial software, that spits out fancy-looking financial plans (in some cases or free). I work with someone who was recently stung by purchasing financial planning that was supposedly worth a lot of money at a charity auction. He spent time with the "certified" financial planner. He then rec'd a proposal for changing all of his investments, including the ones he was very pleased with, and buying some financial products that were questionable at best, including life insurance and annuity products. He's a widower, and doesn't need life insurance! When he declined to invest with the financial planner, the financial planner then billed him for time spent in excess of the hour donated to the charity to write the financial plan pitching the unsuitable products

I am jaundiced about financial planners from stories like this one, and what I saw when my husband was one for many years (remember Shearson Lehman and EF Hutton?). Some of the biggest "producers" in his offices had no financial background other than the sales training they received through their brokerage or a college degree in business or finance. The biggest "producer" was a former used car salesman who just had a really smooth pitch. They would have a call in the morning from the main office to tell them what to "market" that day, including particular stocks or products, things to tell clients about market trends, etc. None of them did their own research.

While we've seen progress on disclosures of incentives offered directly to brokers by funds or other financial products, we don't see the internal bonuses that are awarded by the brokerage firms themselves. We don't know, for example, if the brokerage firm is offering a bonus to brokers with the greatest number of trades in a month (which could obviously encourage flipping client's stocks unnecessarily) or to the broker who opens the greatest number of new accounts.