10 States That Attract the Most Retirees – Voting with Their Feet

Category: Best Retirement Towns and States

July 8, 2020 — It is a familiar question… what is the best state for retirement? There are many ways to answer that question, and in fact over the years we have tried several. There is the the lowest taxes viewpoint. Or, a comparison of other economic factors like cost of living. Alternative approaches include best climate, absence of natural hazards like hurricanes, geographic features like beaches and mountains, political climate, financial health of the state, medical care, etc.

Ultimately, identifying the best state for retirement is a very personal question. In the end it boils down to what is the best state for YOUR retirement. It is very possible that your best state is where you live now, if it meets your desires, since 80% or more retirees do not cross state lines after they retire.

The rubber meets the road approach comes from SmartAsset.com. Each year they analyze Census data to find out which states have the highest net immigration of people over 60 – states where more people move in than move out. Their list is presented below, which uses 2018 Census Data. Then, for sake of comparison, we also looked at the states that attract the most reader interest at Topretirements, based on views of our State Active Community Directories and mini-retirement guides.

Where people actually move

For several years running the top three spots on this list have not changed, with Florida, Arizona, and North Carolina experiencing the most positive net immigration. Florida had by far the most net immigration of people over 60 – over 69,000 retirees, double Arizona’s in the #2 spot and quadruple what third place North Carolina experienced. Two new states climbed onto the 2020 list, Tennessee and Delaware. Both states enjoy a favorable reputation as retirement destinations. Dropping off the list were Oregon and Alabama. Here is the SmartAsset list:

1. Florida

2. Arizona

3. North Carolina

4. Texas (was #6)

5. South Carolina (was #4)

6. Idaho (was #8)

7. GA (was #10)

8. Tennessee (new to the list)

9. Nevada (was #5)

10. Delaware (new)

Visitor Interest at Topretirements

Just for comparison sake, it is in interesting to see what our visitor logs had to say about the states our members are interested in exploring. We looked at data from the first six months of 2020.

In almost all cases our visitor logs agree with the net migration data from SmartAsset.com. Some small exceptions were Colorado and Oregon, which had more online interest than net migration, while Idaho and Nevada had positive net immigration but did not inspire so much online interest.

So why did these states gain over 60 population?

Here are some thoughts on why each state might have made the list (they are ranked in order of the most net immigration – links for each state go to our mini-retirement guide for each state).

Florida. There a lot of good reasons to retire in Florida: no income tax, no estate tax, its friendly Homestead Law, warm winters, plenty of nice places to live, etc. It has a very long coast on both the Atlantic and the Gulf of Mexico, plus countless lakes and rivers. There are big cities like Miami, Jacksonville, and Sarasota. Or charming small towns like Dunedin or Fernandina Beach. Pensacola had the second most online visitors at Topretirements for the first six months of 2020. Of course there are also people who don’t like the state, who tend to cite humidity, bugs and critters, summer heat, and overcrowding as their reasons. See “11 Iffy Reasons Not to Retire in Florida” and “The Most Walkable Towns in Florida” for different points of view. Cost of living is slightly below average.

Arizona. The Grand Canyon State also has warm winters in most of its regions, beautiful scenery, and a choice of affordable (and not so affordable) places to live. AZ is relatively tax-friendly – it doesn’t tax Social Security, has relatively low property taxes, and has the 36th highest Tax Burden from the Tax Foundation. Mesa, home to many active adult communities, was the city with the most positive net immigration per SmartAsset. Three cities in the Grand Canyon State were in the top 10 most popular places at Topretirements in 2020.

North Carolina. The Tar Heel state has a reputation as a relatively tax friendly place to retire. Although its tax burden was ranked 20th in 2012, that ranking has probably improved due to changes made in the past few years. There are some exemptions for retirement income. The State has an unusually wide range of geographic choices. You can live at the beach, an inland city or town, or in the mountains around Asheville, which is always one of the most popular places to retire.

South Carolina. The Palmetto State is also considered tax-friendly with a state and local tax burden ranking of 42. People over 65 get a $15,000 exemption on qualified retirement income. The State has slightly warmer winters, plus beaches and lakes, and there are many interesting places to retire – small cities like Greenville or towns like Beaufort (which was the #1 most popular retirement town on this site for the first half of 2020).

Texas. One of seven states with no income tax, its state and local burden is low, ranked #46 by the Tax Foundation. Cost of living is low, ranked #14. Texas has a range of places to retire from college towns like Austin to its Hill Country towns. There is a long coast on the Gulf as well.

Idaho. This up and coming state for retirement has a lot more to offer than its famous potatoes. For one, its outdoor recreation is hard to beat. Cost of living is relatively low (ranked 20th), as are property taxes (people over 65 get a significant break on their primary residence). Coeur d’Alene, on the shores of Lake Coeur d’Alene, attracts retirees and tourists because of its outstanding beauty and outdoor recreation.

Georgia. Warmer winters, lower cost of living (10th lowest by the MERIC Index), and lower taxes are some of the reasons why people over 65 are moving to the Peach State. College towns like Athens are a big draw.

Tennessee. New to the list this year, it also generated a lot of online interest at Topretirements. Interest and dividends are the only kinds of income taxed here, resulting in a very low State and Local Tax Burden. Cost of living is 11th lowest in the U.S. Crossville‘s popularity as a retirement destination has led to the development of several very large active adult communities here.

Nevada. It was not much of a surprise that the Silver State benefitted from net over 60 immigration. It has warm winters and a huge number of active adult communities with all kinds of amenities. Spring Valley held the #2 spot for the city with the most net immigration. It is one of only three states with positive net over 60 immigration that has no state income tax. Henderson had the distinction of being the U.S. city with the most net over 60 immigration last year. Cost of living is above average, ranked #38th by MERIC.

Delaware. The State has a great location with beaches and rural areas like the Delmarva Peninsula. Its tax burden is not the greatest (16th highest), but the combination of tax breaks for older citizens and very low property taxes make it attractive. The state is ranked 35th lowest for cost of living. Lewes is the fastest growing region of Delaware with many retirement communities located here and the surrounding area.

Interest in Retirement States at Topretirement

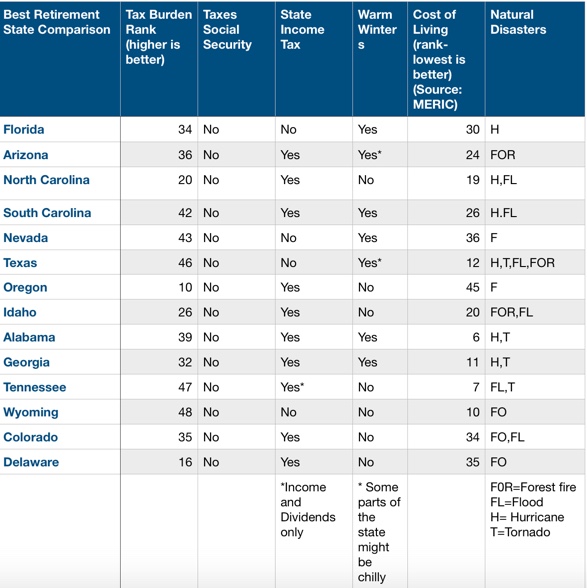

Chart of the Best States by attribute

The chart below attempts to show how these states stack up on factors like taxes, climate, natural disasters, etc. Some of the climate rankings might be slightly arbitrary, but hopefully the whole chart will give you a place to start your comparisons.

The best state for retirement is still a personal decision

It is useful to look at the states and towns where people actually retire because there have to be some good reasons why they are choosing them. But in the end, your own considerations might be more important.

Bottom line

Our advice is to carefully consider the factors that matter to you when choosing a retirement state. Then go there to visit and stay awhile, to see if your hunches were correct, before you do anything drastic like buying a home. The truth is, according to MarketWatch, most Americans don’t go anywhere in retirement: “Some 6% of those ages 55 to 59 moved anywhere between 2014 and 2015…. Among 65 to 69 year olds, just 4.5% moved during that year and of them, 10% moved to a different region. according to U.S. Census Survey data”, and only a tiny fraction of them relocated to a different region of the country.

An article from the New York Times,”The Best Places to Move in Retirement: They’re All Over the Map“, makes interesting reading on the sometimes silly and inconsistent choices that show on up on “Best Places to Retire” lists. It is a good article worth reading with a lot of background on best places to retire lists.

- For further reading:

- Where Retirees Are Moving 2019 Edition

- Where Retirees Are Moving 2020 – SmartAsset

- Worst States for Retirement 2018

- Most Tax Friendly States for Retirement

- Best States for Retirement – Most Popular

- https://coinfoundation.com/

Comments? What is your answer to the question, what is the best state for your retirement? Why is that? Is it where you live now? Please share your thoughts as to why in the Comments section below.

Comments on "10 States That Attract the Most Retirees – Voting with Their Feet"

JoannL says:

IMO - there should be another column in the chart for quality and access to healthcare.

Editor's comment: Thanks JoannL, I wish there was a good way to provide that. The problem is with this (and other factors like crime) is that is very hard to generalize when it comes to an entire state. There are some states with the very best medical care, but it tends to be concentrated in a few metropolitan areas. Almost every state has a university hospital that is probably top notch. The best approach is to make sure that you choose a place to live that has easy access to good medical care.

RichPB says:

While I understand that Ashville was mentioned as being in NCs mountains because it is a very popular retirement place, it's almost a shame that it represents 250 miles of mountains from NE to SW NC. (Asheville is about 1/3 of the way from the SW corner.). There are so many wonderful small towns and large towns and communities in that stretch and across the great breadth of the NC mountains. No question though, be sure first about your health care options -- access can be limited.

Pam says:

Re the healthcare question, perhaps you could look at each state's statistics for the doctor-to-patient ratio. For instance, Idaho is considered a "medically underserved" state. After living here few short years, two of my doctors have left the state, one promised I would be assigned to a doctor from the office pool of doctors but instead I had for a few years a nurse practitioner (who took good care of me) until I selected another office to have a doctor, but that doctor left the state, leaving me with "whomever can fit me in" from the pool of doctors. Although I am thankfully relatively healthy, we are in a global pandemic, and not having a personal doctor feels like floating in a healthcare boat with no oars. A state-by-state statistical list of doctor-to-patient ratios would be most helpful when considering moving, especially as we age and need more health services.

Jean says:

For hubs and me the best state for our retirement is Pennsylvania, specifically eastern Pa. The reasons why are: close to family and old friends across the river in NJ, more tax friendly for retirees, excellent healthcare, easy access to both Philly and NYC (by car or train), really good libraries, lots of ethnic restaurants, and easy to find great rye, pumpernickel, and crusty Italian breads (all made with only 3 or 4 simple ingredients - flour, yeast, salt and maybe caraway or sesame seeds). Added bonus, the only major climatic treat is snow and that melts. We sure would also like year round warm weather but after many visits to Fl (both coasts multiple times), and the Carolinas and Ga (coasts, lakes and mountains) and living in SC for a while we never found a place that offered those little things that we enjoy. There are many wonderful places to visit in the Southeast and we look forward to our snowbird trips in the winter and probably Fall or Spring trips to the Smokies.

Fionna says:

Jean,

My hub and I are considering leaving SC (where we initially retired) and moving to eastern PA for the same reasons you cited. Where in Bucks county did you retire to? I am currently looking in Bucks in addition to some other counties, but not much is on the market now. You are so right -- it's the small enjoyable things that make a difference!

Fionna

Jean says:

Fionna,

We are in Newtown. We rented a townhouse here for a year and contacted a realtor after about 6 months to start the find-a-house process. The market here is such that houses sell quickly so it's good to be nearby when house hunting. We also drove up to Bethlehem and seriously considered buying up there; there was a new 55+ just starting up that is just now starting to actually built and another community by the same builder looks lovely. Also, a b-i-l and s-i-l just bought a townhouse in Easton.

Bob says:

Tornadoes are not listed in Florida, yet they have more than any other state. Yes, it's a fact. They just are usually not the strong ones OK or KS get. So instead of wiping out a whole small town they wipe out a couple of blocks. Significant if you live on one of those. Florida also has the most lighting strikes of all the states. So listing hurricanes as its only natural problem is wrong.

Fionna says:

Thanks for the info. Jean. Newtown is a great area and we are also open to looking in the other places you mentioned, like Easton. We lived in Flemington NJ for 13 yrs. and know the area well. Your mention of crusty Italian bread makes my mouth water!

LMB says:

I live in S Florida. We do not get more tornadoes than Tenn or Ok. We do however have the most lighting strikes.

uncle al says:

whoo hoo ! we live on Long Island, NY and tornadoes are forecasted as a possibilty today with 3" of rain predicted ! so much for where ya live...

Flatearth6 says:

A lot of folks I knew in Delaware retired across the border in Pennsylvania - where pensions aren't taxed. HOWEVER, now that my father has recently passed away, we are dealing with an ungodly amount of paperwork for the state! All of his beneficiaries live in other states where they clearly define Inheritance Tax vs Estate Tax but PA lumps them together and taxes everything. They have made sure to get you coming and going! I don't know if this might make a difference in your living plans but I wanted to throw it out there - so you can be prepared.

Larry says:

Flatearth’s story about tax chickens coming home to roost in PA is a reminder that states must pay for their services somehow. Florida has no state income tax, for example, but SC and other states are more “tax friendly” for retirees.

Jennifer says:

If one goes to a state with no or low taxes, then expect no services when you need them the most.

Florida has a hefty property tax to make up for other taxes it does not have.

Editor's note: Actually, according to Tax-rates.org, Florida has the 22nd highest property taxes at 0.97% of home value. Texas, which has no state income tax, does have high property taxes and is ranked #3.