Are You Getting the Most Out of Your Social Security Statement

Category: Financial and taxes in retirement

February 16, 2016 — Even if you are not retired yet you have probably received several statements from the Social Security Agency over the years. That is because the Agency mails Statements to workers at ages 25, 30, 35, 40, 45, 50, 55, 60 and older. They go out three months prior to their birthday (but not if they receive Social Security benefits or have a my Social Security account).

The statement contains an amazing amount of helpful information. Unfortunately, that info is often ignored or misunderstood. In fact one survey found

that only one-third of workers close to retirement age who had been receiving statements for years could accurately estimate how much they would receive. We recommend that you be one of those who make good use of these facts and advice. Specifically, you can use that info in two important ways:

– To help you make a decision about when you will start taking your retirement benefits. The statement gives you an estimate of how much you receive in benefits at various ages: 62, normal retirement age (66 for most boomers), and 70.

– To get an idea of your future retirement finances, and adjust if necessary. You can do that by plugging your expected benefit into a budget, along with estimates for your other retirement income and expected living expenses.

Let’s take a look at the Statement

The sample below shows what someone might expect in benefits at various retirement ages. Obviously, the closer you get to those ages the more accurate the estimate will be. Note how much higher the age 70 benefit is. If you would like to be able to see your Statement online, as well as do other things, you can sign up at https://ssa.gov/myaccount/.

Here is a link to the full sample statement.

You can also produce your own estimate with the Social Security Benefit Estimator, or by using this one from consumerfinance.gov. Workers who do not want to wait for their scheduled mailing can request your Social Security Statement by following these instructions.

Here are some of the features of the Statement

– Your estimated benefits (see example above)

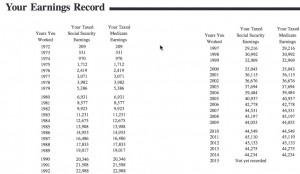

– Your earning history (a snapshot on your life!)

– How your benefits are estimated

– Facts about Social Security, such as how your benefits are calculated

– Sample benefit amounts by age (see below)

– What is the best option for you

– What happens when you work and take Social Security

– Retirement Age considerations

Bottom Line

Your Social Security benefits statement is useful to a successful retirement. Take advantage of yours when it comes in the mail, or go online and get it. If it looks like your retirement is not going to be comfortable, consider steps early to get better situated.

Comments? Have you been studying your Social Security benefit statement? If someone asked you how much you were going to receive at your target retirement age, could you give an accurate answer? Please share your thoughts in the Comments section below.

Comments on "Are You Getting the Most Out of Your Social Security Statement"

Louise says:

I don't see how anyone would have trouble understanding the statement. It is concise and give ages and amounts. Maybe those who don't know how much they will get are not ready to retire and are just not paying attention.

Billy says:

The statement assumes you will receive your last annual salary till retirement, rarely happens, retirees who haven't filed and don't work have to enter '0' for wages for future years benefits amounts.

Elaine C. says:

I remember the first time I saw my SS statement. It was a shock to see how little SS I would get at age 66, so I educated myself and got into a higher paying job to pull up the amount. It worked. I'll turn 66 in a handful of months, and will continue to work, although I am definitely going to work at a less stressful job and be in a more friendly living environment for myself as a senior. My days of being a solo rancher and working a 55-hour plus a week job are over. I am downsizing to a sustainable lifestyle.

ella says:

Elaine C., you go girl!

OldNassau says:

To complexify your decision about beginning SocSec benefits, consider

(1) if you are married, several options as to when you and your spouse begin, delay, or suspend benefits

(2) how will benefits change your income tax status - local(some cities), state (not, some, all benefits taxed depending on income), federal (ditto).

(3) Medicare premiums increase with total (not just taxable) income.

Terrie Douglas says:

When they calculate your benefit it is calculated based on the number of years (37?) worked salary, period. So doesn't matter if your salary is 0 or way less, as long as you have salary. They do actually take the highest salaried years, so again, it doesn't matter if you don't carry that high salary until retirement. Of course it will matter if you work for many many years at lower salaries.

I was concerned about that when I got laid off last year, but after reading how the benefit is calculated I am no longer concerned about getting a lesser benefit with greatly reduced earnings.

Dick L says:

Terrie, this is a very timely and concise report! I would only add that it is the top 35 years of your salaried years.