Best States for Property Taxes

Category: Financial and taxes in retirement

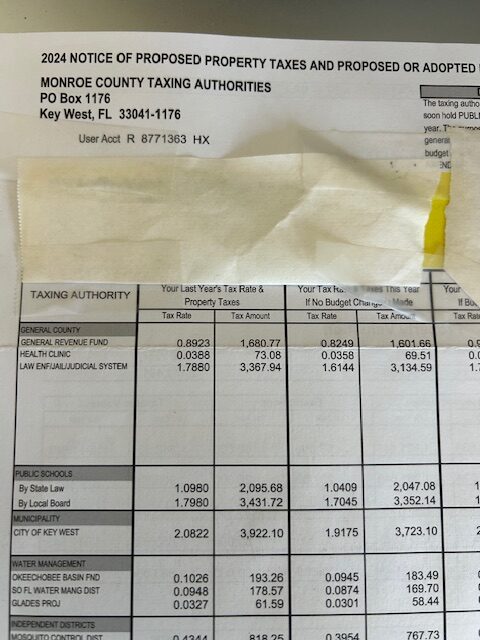

April 23, 2025 – More than state income taxes, those levied on your property can be one of the most problematic for retirees. That’s because they carry no direct relation to one’s ability to pay – you might have a valuable home,but little savings and income. Property taxes still have to be paid, although many states and municipalities have small discounts for seniors and low income people).

A report by property-data firm ATTOM analyzed taxes and home values in 2024. This is a summary, but there is much more detail in their report.

The States with the Lowest Property Taxes

Eight of the 10 states with the lowest effective tax rates for single-family homes were in the South and West of the country. Hawaii had the lowest rate (0.33 percent), followed by Idaho, Arizona, and Alabama all at (0.41 percent), and Delaware (0.43 percent).

Rounding out the 10 states with the lowest rates were Utah (0.45 percent), Tennessee (0.46 percent), West Virginia (0.47 percent), Nevada (0.48 percent), and Wyoming (0.49 percent).

And Those with the Highest

States in the Northeast have the highest property taxes in the country. Illinois, New Jersey, and Connecticut are the highest. Texas is also famous for having high property taxes. To some degree the high taxes come because the homes there are worth more, although the underlying rates are the primary problem. Advocates argue that higher taxes provide better services, and that is usually true.

See the full article for more detail and a map of the U.S. showing property taxes across the country.

Wirecutter’s Top Pick for Non-Alcoholic Apertif

Comments?

Comments on "Best States for Property Taxes"

John says:

Property taxes are definitely one of the top reasons why retirees move to a different state. If moving from a state with high property values they can not only save money on taxes, but probably buy a nicer residence with money left over. One of the best ideas states have to counter this flight is the Save our Homes type law in Florida, which caps tax increases on homesteade homes.