How to Fix Social Security Poll Results: You’ve Got Opinions!

Category: Social Security

“See Presidential Positions (below)“.

August 15, 2024 — Thanks to everyone who voted in last week’s poll on the best way to fix Social Security. The good news is that you seem willing to make some sacrifices to make it happen, not just throw the burden onto someone else. Even if very few people in government are willing to suggest possible solutions (promising to save it without the way to do it is not a solution), you are! Here is a link to take the poll and see the many interesting Comments it provoked.

Poll Results

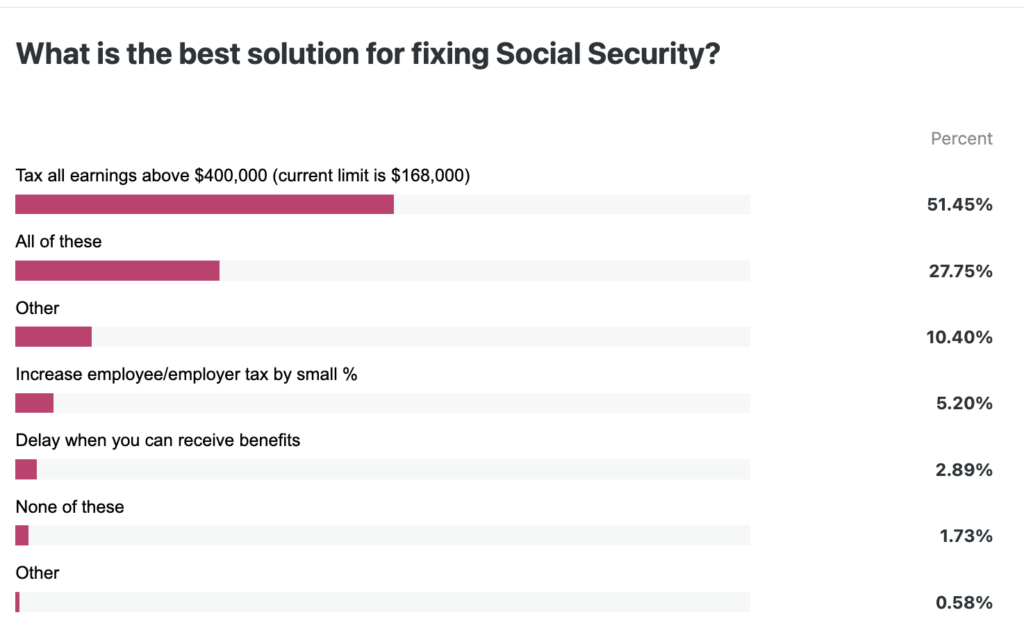

The #1 thing that the 170+ people who took our poll want is to expand the earned income that is taxable for Social Security. In 2024 that limit is $168,600. Over 51% of you voted to increase that so taxes are paid on all earnings over $400,000. That option would mean people earning from $168,600 to $400,000 would not pay more FICA taxes, but people over that would pay it on everything they earn. Although presumably not too many members of the Topretirements voters would be affected, the vote does reflect a common opinion, one that would provide a substantial amount (but not all) of the funds needed to avoid benefit cuts expected in 2035. See Reader Responses,

Next in line for votes was for “All of These Solutions”, which got 28% of the total. There is a certain selflessness here, since those solutions included increases in the tax percentage paid along with an increase in age limits, changes that could affect their pocketbooks.

The remaining choices in the poll showed little support compared to the two solutions outlined above. “Other” got 10% (one of those was “Privatize it or at least shift to the Thrift Savings Plan”.), “Increasing tax percentages by small amount” received 5% of the votes, and “Delaying age for benefits” garnered only 3% of the tally.

Unlike their elected officials, almost no one taking the survey (2%) thinks that none of those solutions would work. Bravo, Topretirements Members want to be part of the solution!

What our presidential candidates think – neither one has a plan

The Social Security Trustees predict that the combined SS Trust Funds will be exhausted by 2035. At that time only about 80% of promised benefits can be paid, using funds contributed by taxes from current workers. So what do our two presidential candidates think?

Donald Trump has said recently that he wants to save Social Security. In the past he has put out various, sometimes conflicting statements. One of those was calling Social Security a “Ponzi scheme”, and at other times promising to cut entitlement programs like SS and Medicare. Since his call to save Social Security he hasn’t presented any concrete ideas on how he might do that, other than cutting waste and fraud. Another of his recent campaign promises is that SS recipients wouldn’t have to pay taxes on their benefits. Unfortunately that would mostly benefit wealthier people, and would worsen the federal deficit. For the record, between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. Earn more than $34,000, up to 85% of your benefits may be taxable.

Kamala Harris has also promised to protect Social Security. It is assumed she supports the Biden proposal for people earning over $400,000 to pay SS taxes on all their earnings. On the other hand, she has indicated that she might increase benefits and change the annual COLA to provide more money to retirees. Those changes might actually worsen the SS deficit, unless other changes were enacted.

It will be interesting if either candidate comes out with a plan to fix SS, rather just making a statement that all will be OK. If you get the chance, please ask them about it! For a short explanation of the Social Security problem and possible solutions in simple terms, watch this video from PBS.

Comments? We would love to hear more about the solutions you think the country should take to fix the impending crisis on Social Security. Please use the Comments section below.

For further reading:

Topretirements Social Security Blog

Don’t Miss Out on Your Dream Retirement Spot

Free Weekly “Best Places” Newsletter – with Free Report

Comments

comments for this post are closed

Comments on "How to Fix Social Security Poll Results: You’ve Got Opinions!"

David says:

The tax has been 7.65% since at least the 1970's. Increase the tax to an even 8% and prevent other agencies from having their hand in the till.

Admin says:

Some experts believe that if there was a Social Security tax on all earnings, and not having the donut hole for earnings from $168,000 to $400,000, that alone could solve the problem.

Rufus says:

Regardless of who the President is and assuming he or she proposes a viable solution he or she will need co-operation from both houses of Congress. Congress is as much to blame for our situation as any President if not more.

Admin says:

I will be curious to see if either candidate could end up with a real plan beyond the platitudes.

Admin says:

Here is a fact I did not have straight. The taxes paid on Social Security benefits (on 85% of income over $34,000) do NOT go in the US Treasury Fund. Instead, they are deposited in the Social Security Trust Funds.

From the SSA: Where do taxes on Social Security go?

Social Security taxes that workers and employers pay are credited to the Social Security trust funds. The trust funds are defined by law as a way to set aside money that is earmarked for Social Security. A Board of Trustees oversees the trust funds.

Admin says:

With the election coming soon, perhaps the most important issue that affects retired people is how each candidate would address the urgent need to bolster the health of Social Security and Medicare. Here is how the New York Times summarizes the 2 candidates positions.

Both Harris and Trump say they would not cut Social Security or Medicare. Editor's note: Politically wise, easy and expedient to say, but how are they going to do it?

Trump's solutions: At one point he said he would be open to cutting entitlements (including SS and Medicare), but he seems to have backed off of that statement. He would like to end taxation of Social Security benefits. Most experts agree that would make SS run out of money earlier, and benefit higher earners more (since lower earners pay very few taxes anyway). He also would like to cut "waste" and aggressively combat fraud.

Harris's solutions: Raise taxes on people making more than $400,000 yr. Increase Medicare surtax to 5% from 3.8% for folks earning more than $400,000 yr. She supports the Inflation Reduction Act, which allows negotiation of drug prices between Medicare and pharmaceutical companies, and she would support increasing the speed of negotiations. At one time she supported increased benefits, but it is unclear if she still does.

Draw your own conclusions. The Topretirements opinion is that Trump's plans are so non-specific and unsound they will only hurt SS and Medicare, not fix the problem. Harris's plans make much more economic sense, but she probably hasn't gone far enough to solve the whole problem.