Our 10 Favorite Tools for Retirement

Category: Retirement Planning

March 2, 2024 — To do retirement right, you need all of the great tools you can get. In this article we have assembled our top 10 retirement tools for your consideration. As always, we would love to hear about any helps that you have – please share them in the Comments section below.

Social Security

1. SocialSecurity.gov. There is so much good and useful information at the Social Security site. You can find out what your benefits will be, when you can sign up, what your filing options are, etc. You can apply online. Of course you can always visit a Social Security office or call them, but start at the website and you will be amazed with what you can find.

Healthcare

2. Medicare.gov. Find out the facts about Part A, B, C, and D – and sign up for the option that fits you. Learn your options about Medigap (supplemental) insurance, or whether Medicare Advantage plans might be better for you. You can find and compare Part D drug plans. There is also a tool to find and compare different types of Medicare providers (like physicians, hospitals, nursing homes, and others).

Retirement Calculators

There are multiple calculators (almost all are free) that will help you predict if your retirement money is going to make it for the long term. With these calculators you plug in your age, retirement assets, and spending plans – then you get a prediction. One website we’ve seen, Caniretireyet.com, provides a short list and descriptions of their favorite calculators; it includes links to a good one from Fidelity as well as the Vanguard Nest Egg calculator discussed below. You might want to check it out. But here are our two favorite calculators:

3. SocialSecurity’s Retirement Estimator The Retirement Estimator gives estimates based on your actual Social Security earnings record. This is the place to start, as it will tell you with considerable certainty how much your monthly Social Security payment will be. Knowing that, you can go solve the rest of the “will I run out of money” equation, adding in pensions and income from your retirement savings and possible employment, how long you want the money to last, and then deducting what you think your expenses will be.

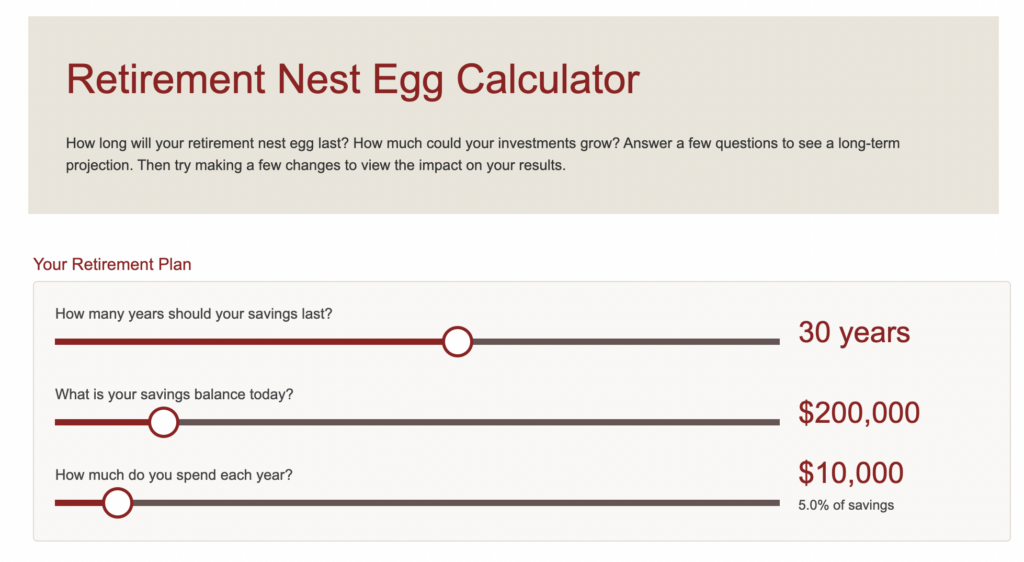

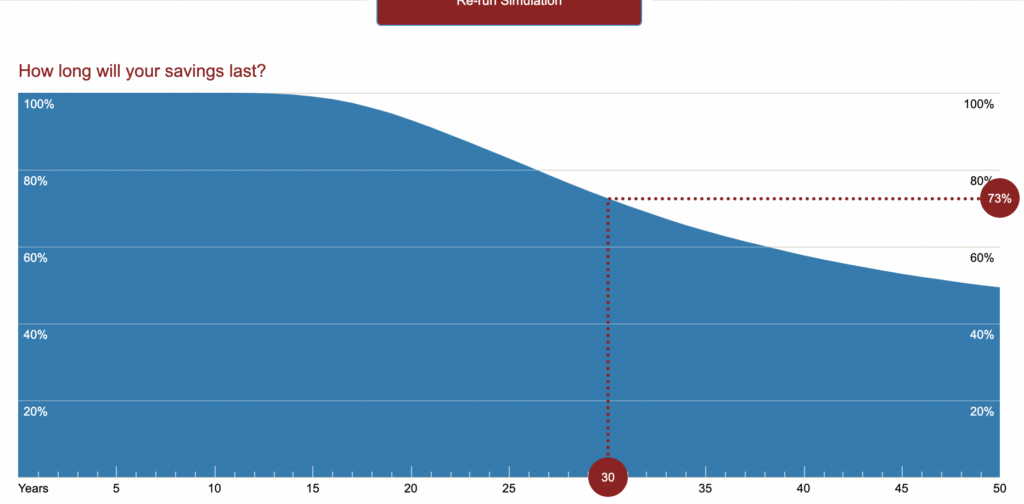

4. We like the Vanguard Nest Egg Calculator, which automatically does all of the calculations we just mentioned above. We used it with a couple of hypothetical assumptions to see what it said. The typical baby boomer has saved just over $200,000 for retirement, a nest egg that would provide $8000 year forever, assuming a constant 4% return. But if the couple in our example needed to take out $10,000/year to maintain their lifestyle and bolster their Social Security income, the Monte Carlo simulations predict what would happen. In this case our hypothetical couple would have a 73% chance of having their money last 30 years. That equates to a one in four chance that they would be living on Social Security alone after 30 years. (this projection assumes 50% of the savings are invested in stocks).

Where to Live

Here at Topretirements we have a helpful tool to help you figure out where to live, in addition to our main website and our free weekly newsletter.

5. The Community Explorer is the Topretirements tool. With this online tool you first select a State to explore. Then you can find communities that match your desires by drilling down by Lifestyle (biking, coastal, college town, etc.), almost 100 Amenities (golf course, marina, beach, equestrian, etc.), and Unit Type (single family, condos, townhomes, CCRC, etc.)

6. Best Cities for Successful Aging from the Milken Institute. As opposed to most “Best of…” lists, this one is based on lots of data and covers multiple categories. There is some great information here – the lists show the 381 best cities for successful aging for both large metros and smaller metros.

7. Kiplingers State by State Guide to Taxes for Retirees. There are a variety of places you can learn about taxes affecting retirees by state (including the State Guides at Topretirements.com). But the Kiplinger tool is unusually good. For example you can click on a state in its map and get a detailed summary of taxes on retirement income, property and purchases, as well as special tax breaks for seniors.

Helpful information about retirement

8. NextAvenue.org

Next Avenue is part of the PBS system, and it “invites readers to consider what is next, what lies just ahead and what will be revealed in their lives by exploring questions big and small”. Their articles, like “5 Social Security Gotchas” are short but practical. Their articles spark a lot of ideas which you later read about at Topretirements. We recommend NextAvenue and offer refer to them, even though they had steadfastedly refuse (so far!) to share any Topretirements features with their audience.

9. AARP.com. A lot of people have a bad feeling about the AARP because of all the products they try to sell, like insurance. But in our opinion the AARP does an excellent job of advocating for people of retirement age on issues like taxes, Social Security, and Healthcare. For example on the current tax reform bill in the Senate and House, they one of the few sources that offers factual information on how these bills will affect seniors (not well, is the answer!).

Honorable mention

Both the New York Times and the Wall Street Journal have “Retirement” sections that have thought-provoking and interesting articles – often about unusual lifestyles in retirement. You can subscribe to them online are on paper, or you can read them at the library. SquaredAwayBlog is another interesting resource.

One other tool from Topretirements is our “Baby Boomers Guide” a short eBook with checklists and quizzes that start your thinking process on all the aspects of retirement you need to consider.

What to Do in Retirement

10. RetiredBrains.com is a great resource for finding volunteer gigs. But don’t forget all the self-inventory tools that can help you find out what kinds of things you actually want to do in retirement. Our Blog section on “Work and Volunteering” can give you some great ideas you might not have thought of.

Comments? Please share your thoughts in the Comments section below. What tools have you used that you recommend we add to this list.

Comments on "Our 10 Favorite Tools for Retirement"

LS says:

For those retirees younger than age 65 or not otherwise eligible for Medicare, Healthcare.gov provides access to health insurance plans.

For those without prescription drug coverage, there are discount plans such as GoodRx and Singlecare.

There are also discount plans for vision and dental care for those without insurance. DentalPlans.com is one that shows many in my area for about $10-$13 per month.

Tom Konieczny says:

Why isn’t AMAC a favorite tool for retirement planning?

Admin says:

Never heard of AMAC before. Do you have some experience with them?

Admin says:

the tools at SSA.gov are really quite good. The most useful is the calculator to tell you how much your SS benefit will be under different claiming ages.