Retirement Confidence Hits All-Time High – Despite Covid

Category: Financial and taxes in retirement

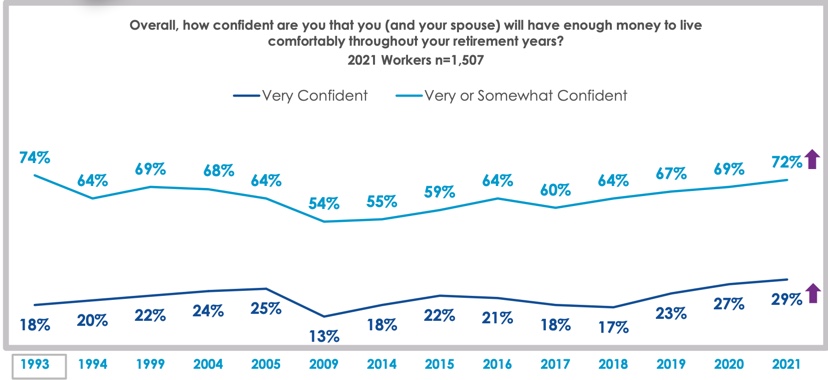

May 24, 2021 — The Employee Benefits Research Institute (EBRI) has released the results from its annual retirement confidence survey – and they are pretty good! Back in 2014, 55% of all workers said they were “confident they would have enough money to retire confidently”. This year, 72% of all workers say they are that confident, and 80% of retirees agree (in 2014 only 67% were that confident). The survey also had some other extremely interesting findings that we have detailed below.

Covid and confidence

One would have thought that a year of being in the Covid pandemic would have negatively affected how retirees feel about their retirements. Instead, 72% feel about the same level of confidence, and only 19% feel “slightly less confident”. How much the heady stock market has had an effect on this confidence is unknown, although we would venture it has been positive.

About one third of overall workers say the pandemic has affected their ability to save for retirement. One in five workers saw their pay or working hours negatively affected by the pandemic.

Of the 23% of retirees who feel less confident in total, most of them seem to be those with major debt problems, savings under $10,000, never saved for retirement, and those with poor health. However when it comes to debt, only 8% of retirees think they have a serious problem with it, while 26% think they have a minor problem.

Financial advice

Where would you guess most workers go for retirement planning advice? Our guess wasn’t the right answer. About 35% of people rely on family and friends, 35% do their own research online or with other sources, and 27% use a financial planner. About 22% rely on their employer. Some 36% of retirees say they have a financial planner.

Retiring earlier than planned

One of the more startling findings in the study is in when people retire. About half of them say they retired earlier than planned (46% vs. 48% who retired about when they expected). This is a result we have seen in many surveys – workers on average think they will retire much later than they actually do. Often it is an unexpected health issue or layoff that triggers the retirement. These problems tend to come out of the blue, and when they do they have a negative effect on retirement finances. EBRI found that half of workers believe they will gradually transition into retirement. However, 7 in 10 retirees report they had a full-time stop. Although almost three quarters say they will work in retirement, less than half do any kind of paid work.

Retirement lifestyle – good news for most folks

Some 71% of retirees say their retirement is either about what they expected or slightly better. That represents a slight dip from the 2020 survey results. Fewer said it was much better (10%) than much worse (19%). Again, there was a slightly more positive experience in 2021 vs. 2020.

Even more figures

The full report makes for interesting reading. There are the results for spending expectations in retirement, use of retirement savings, confidence in Medicare and Social Security. You can see the full report here.

Comments? How is your confidence in a comfortable retirement? Are you spending about what you thought? Did you retire when you thought you would? Please share your experiences in the Comments section below.

For further reading:

You Are Retiring, the Kids Are in College – And You’re Broke

Comments on "Retirement Confidence Hits All-Time High – Despite Covid"

RichPB says:

Fascinating. We retired three years early at 55 due what had become bad work environments for both. But though we retired on a shoestring, we had planned and saved. Retirement was a little difficult financially as expected, but got better over time and from the beginning we both felt it was a good decision and retirement was better than expected. We are fortunate that our efforts were successful.

I've always felt that in large part, people can make their own luck. Low income does not have to be a lifetime condition. Crime is seldom a successful way out.