Applying for Social Security Online: Our Experience

Category: Financial and taxes in retirement

May 16, 2018 — (Updated July and October with more experience). Back in March I received a letter from the Social Security Administration – “It is time for you to register for your retirement benefit!” I was impressed with their timing and efficiency, since my 70th birthday will be this August. Nicely done. This article will chronicle my experiences in registering for my Social Security retirement benefit online – lessons learned that hopefully will help others when it comes time to claim their benefits.

My decision was to wait until age 70 to claim. Fortunately we have been able to afford to live without that benefit so far. That blessing, coupled with very good genes (my parents’ average age before departing this earth was 97), made it seem like a good bet to wait until 70. That way I could capture the 8% increase a year for delaying from age 66, and then enjoy that extra money for a long time past the breakeven point in my late 70s (and my wife after I pass). Time will tell if that was a good move or not.

Registering for Social Security retirement benefits

My plan and hope was to register online, and not have to spend time on the phone or waiting in a SS office for help. In most cases, once your application is submitted electronically, you’re done. There are no forms to sign and usually no documentation is required. Social Security will process your application and contact you if any further information is needed. Our experience was that registering can be done and relatively easily. However, there are some pitfalls and things to look out for along the way.

Step 1. Go to SSA.gov

If you go to “Apply for Retirement Benefits” the process is rather simple. You have to be at least 61 years and 9 months old to apply, and you can’t apply for your benefits more than 4 months before you want them to start. If you don’t have Medicare but are within 3 months of age 65, you can use this application to apply for both Medicare and Social Security. To start the process you will need to create a username and password. You will be given a reentry number, which will allow you to come back and complete your application at a later time. You are going to want to keep that and your username and password in a safe place (not your computer).

Step 2. Gather required information

The SSA site is going to ask you for some information, so it is best to assemble it now. For example you’ll need to be able to answer questions about any marriages and divorces, if you have applied for Medicare or Social Security before, facts about your children (in some cases), U.S. military service, employment and self-employment in recent years, your bank account routing and account numbers, as well as some other details. Here is a Checklist of what you will need.

Step 3: Fill out the application

All of the questions on the online application are straightforward, but there are a few that might take you by surprise. Mostly it is a question of having the information on hand, such as where and when you were married, and your spouse’s Social Security number.

Step 4: Fill in the blanks – about the ex

When it comes to surprise questions, I wasn’t prepared to provide information about my previous marriage and ex-wife. That series starts with a question if you had been married to someone else for 10 years or more. In my case that was Yes. Did that marriage end in divorce? So then the questions continued – is that ex-spouse still alive (yes), where and when you were married, and was it done by clergy or public official. The Social Security number of the spouse is needed, as well her birthdate. Not to mention having to know the date and place the marriage was dissolved. In my case it took a little research and time to get all that info.

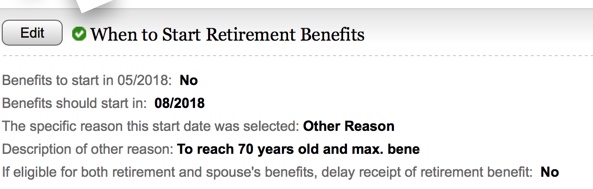

Step 5: Important: When do you want to start your benefits

This is an important question worth careful consideration. The longer you delay (up to the month you turn 70), the higher your benefit. There is no benefit for waiting beyond that month.

Step 6: Do you want to delay receipt of your retirement benefit?

You may have the option to delay receipt of your retirement benefits, if you are eligible for both your own retirement benefits and a spouse’s benefit (your spouse is collecting now). In that case you may choose to receive only the spouse’s benefit now and delay receiving your own retirement benefit (the Restricted Benefit is not available to people born on or after Jan. 2, 1954).

If you are eligible for delaying your own benefit it is in most cases a no-brainer to do that. That’s because either way you are going to get a benefit now. But, if your earning record is at least as high as your spouse’s, and can live with a potentially smaller spousal benefit for a few years, there is a good chance your own benefit will be much higher at age 70 (it grows at 8% a year each year from age 66).

Step 7, the last section – Additional Comments

Here is your chance to add comments. Many people recommend using this section to reiterate your preferences – for example when you want to start your benefits and that you want to take advantage of the Restricted Benefit.

You can put your application on ice

Before you start out the application process you were given a re-entry number. That way if you complete only part of the application you can come back in any time and resume where you left off (or you can start over again).

Problems: Website access, and, beware the incomplete section

My experience with the online process turned up two problems that others might run into.

First, the SS website is overloaded. Many times when I tried to go back to my application to fill in missing data, all I got were repeated error messages – “We cannot help you at this time”. I finally was able to get through at 7:30AM – so if you have problems getting through try off-peak hours.

I was frustrated in my attempt to “sign” and submit the completed application. There just didn’t seem to be any place to do that. I went forward in the process, only to be told I was only saving the application to be completed in the future. I went backward, but that didn’t help either. Finally, just before I resigned myself to calling the SS office, I realized that perhaps there was an incomplete section. Sure enough, I had not filled out the section asking if I had ever had another name or SSAN. Once that was completed, the button to “Sign and Submit” magically appeared.

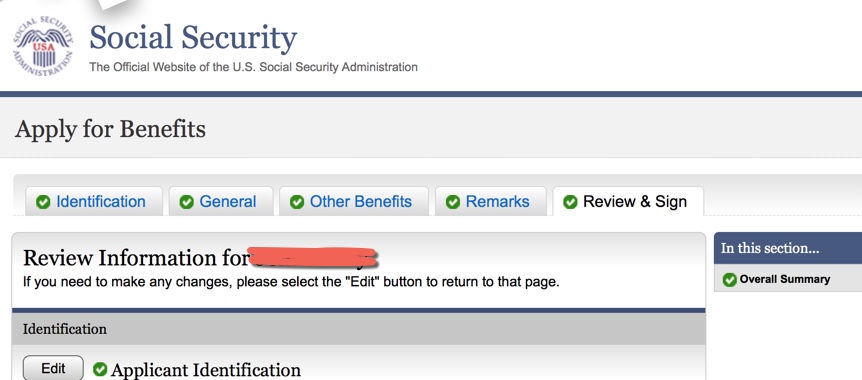

Review and Submit

Check over your application and make sure the information you have submitted is correct. An error could cause a delay in you getting your benefit, not to mention having to answer questions from the SS office. Once you do submit you will come to a page that tells you have done just that, and that will be followed up with an email. In our case a few days later we got a call and email from a Social Security case worker, who wanted to get some followup information. After a bout of telephone tag my case worker left a message. He wanted to let me know that I had the option to claim retroactively going back 3 months, which would mean I would get a nice lump sum payment as well as start collecting right away. Though tempting, my decision was that having waited this long, I might as well wait 3 more months and get the maximum. I based that decision mostly on what I hope is the much longer than average life expectancy I have, as well as does my (5 years) younger spouse. Next step – let’s see if the correct amount arrives in my bank account in August!

Bottom line

Based on my experience I would definitely recommend going the online application route. It was relatively quick, and the ability to amend the application over time before submitting it was a plus (we can only imagine how frustrating it would be to go to the SS office and realize we did not have all of the info needed to complete the application). If, however, you are not sure about when you want to start taking your benefits, if the Restricted Benefit is a good idea for you, or other questions, you might want to call or visit your Social Security office. Just be careful, we have heard stories that suggested that not every SS case worker has a great understanding of how the system works and what is best for you.

July Update – Not quite there yet!

Since I filed my application in mid May I have been waiting to see what would happen with it. I did receive a letter from SS saying my application had been received, but no more info. Several times I went back to MySocialSecurityto try to see the status of the application. But every time I went in I got the same message dated May 14: “Application pending”

A call to Social Security

Since the same message had been displaying for 2 months, I decided I needed to call SS and inquire. My goal, which was to have the application completed and start receiving my first check in August when I turn 70, seemed tenuous.

So I called them up (1-800-772-1213) to find out. Here is how that went:

– I called on a Monday afternoon. It took 50 minutes on hold to get a (helpful) rep. The automated process didn’t quite work because I couldn’t quite put my finger on Filing Number. Make sure that when you apply you keep that number handy!

– The rep asked some qualifying questions to make sure it was really me, and that was pretty routine

– After being put on hold another 5 minutes or so, rep informed me everything was fine with my application and I should be getting a letter by the end of the month.

– Here is the big surprise I learned from the rep- don’t expect your first check the month you want to start! Rather, your first benefit month is the first whole month after you claim (I claimed for early August on my birthday). In my case that means the benefit starts the next month, in September. But don’t spend that September check, because SS pays in arrears. In October I am supposed to get my first check (direct deposit), which will be for Sept. So that was a bit of a shock. Now I am hoping the money arrives in my account as promised!

October update

Turns out earlier information from the SS office was incorrect. We received our first deposit on September 12, a month earlier than we were led to believe. So the saga ends, happily.

More bottom line

SS could do a better job of advising when your first payment will be made. The website could provide more information about the status of an application, and what the next steps will be. Phoning SS is slow, but you can get answers, although not always correct.

Comments? Have you gone through the process of applying for Social Security? If so was it online, over the phone, or in person? Any difficulties or surprises along the way? Were you happy, or not, with the experience? Please share your thoughts in the Comments section below.

For further reading:

What You Don’t Know About Social Security Could Hurt You

Social Security Quiz

Comments on "Applying for Social Security Online: Our Experience"

Dick Gorman says:

I will soon be turning 64, but want to be as fully prepared as possible when I interact with social security. Knowing that social security will "Provide enough information so that claimants can make informed choices, but do not give advice,",(GN 00203.004 Taking The Claim), I would ask The Community to please respond to my question.

As my full retirement age is 66, I have been paying into ss for the past 10 years,(Former state employee, and retired for the past 4 years), any benefits I may receive will be offset by the WEP/GOP acts. Should I wait until age 70 before filing or do so at 66. I am fortunate enough to be receiving a state pension.

Jennifer says:

I , too, found it easy to apply for my benefits online. I did get a call from the Missouri SSA office to confirm a few details and to go over a few things such as when to begin my benefits. I found they were much more informative and accurate than my local offices here in Washington, DC. My benefits began on March 28, and so far so good. I did have to take early benefits, due to job elimination. I will be 64 in September and have not yet been hired fulltime. I am working part-time and enjoying that albeit the income restrictions at my age with Social Security. I was able to choose a seasonal part-time job that I have come to love and when it ends at the end of June, I have already been hired for another part-time position with a great office owned by some lovely people. It puts me back in the medical world, and I can stay as long as I wish to work. My Social security benefits certainly help me to survive and I am glad for the relatively easy process and friendly information I was given from SSA.

Sandie says:

I applied by phone. The woman I dealt with was so helpful, efficient, and polite that I worried she would be fired if the SS adminstration found out about her. When my husband applied a few years later, he contacted her and had a similar experience.

A month or so after the initial contact, I received a thick envelope in the mail that was a transcript of the conversation, the last page of which contained words to the effect that the wad of pages complied with the paperwork reduction act.

Kay says:

I was told I had to apply in person, as I was applying for survivor benefits on my ex-husband's record. Turns out I could have dropped off documents and completed the application over the phone, but I felt better taking care of it face to face. They did ask lots of questions that I did not expect like 'Where was he living before he died', 'What city did he die in', 'Did he remarry'. These are not always something an ex would know.

They also printed out 'my application' for me in narrative form, lots of text, lots of paper. They said they do not keep a printed copy, only the online information. I had read in 'Get What's Yours: the Secret to Maxing Out Your Social Security' to note in the comments section of the form to exclude my own retirement benefits. As there was no form and so no comments section, I kept saying over and over again that I did not want this to be an application for my own retirement benefits. I was glad to see in the printed narrative I received, there was a statement to that effect. Not sure if that was 'standard' for a survivor 'application' or if it was because of my comments.

Pat Reynolds says:

Easy peasy. Since I was very busy closing up my office, packing to relocate, and closing on my house, I did it part one night and part another. No problems getting on at 1 a.m. No calls, just a notice online when processed and approved

mary says:

My own SS Benefit is much smaller than my husbands. I want to collect my husbands SS. To do do I needed to produce a certifiedmarriage certificate to the office or a consulate.

Dick says:

Wise choice to file for benefits online and work from where you have all of your info handy. Like you I filed 3 months before my 70th birthday, however I did not receive a letter or phone call from SS. Instead I went to the local office and filed or should I say attempted to.

It was a real hassle. Not only did they mess up my benefit start date but I did not receive my benefit amount that was estimated on my yearly SS benefit sheet. It only took about 3 visits, 6 phone calls and 8 months to get them to set my correct amount to receive. Whew! Their worker and her managers even said what they first allotted me was a decent amount for my wages over the years. In other words these locals were trying to cut me out of my earned benefit. I still can't believe this goes on so check and recheck what they are doing when you file for your benefits.

Sue M says:

Federal withholding taxes aren’t automatically taken out. You have to file IRS Form W-4V. Select the percentage of your monthly benefit that you want withheld from the available choices: 7 percent, 10 percent, 15 percent or 25 percent. Then sign the form and return it to your local Social Security office by mail or in person

Joanne Ragwar says:

Dick Gorman: I am also a state employee who retired at age 61 from Massachusetts but I have also worked as a nurse for 30+ years in the private sector. I did not always make enough to to bypass the windfall elimination but have nearly 25 years where I did make more than the minimum. I am currently working full time as a nurse and hope to continue till age 70--but might not be able to go that long. You should work as long as you can because each year you make more than the minimum to avoid WEP, which is about $23K, you will earn more in social security dollars.

Tom says:

I applied online too. A few days later I got an email from SS asking me to call the woman who was processing my application. I called and she asked me a few questions and to FAX her my last years W2 form, a copy of my SS card, and my latest pay stub. That was it. No birth certificate needed. Two months later I got my first payment. I was amazed at how easy and efficient the process was.

Admin says:

Update from your Editor:

After a bout of telephone tag my case worker left a message. He wanted to let me know that I had the option to claim retroactively going back 3 months, which would mean I would get a nice lump sum payment as well as start collecting right away. Though tempting, I left a message back that my decision was that having waited this long, I might as well wait 3 more months and get the maximum. I based that decision mostly on what I hope is the much longer than average life expectancy I have, as well as that of my (5 years) younger spouse.

Dick Gorman says:

Thank you Joanne.

JeffH says:

Sue M used the pre-2018 withholding percentages. I believe they were changed to 7, 10, 12 and 22. Our withholding was originally set at 15% 3 years ago. After our post-2017 tax filing advisor meeting, he suggested we lower them to either 10 or 12 by submitting new W-4V forms. We have not done so as yet, but plan to following a meeting at our local SSA office.